By Rich Heidorn Jr.

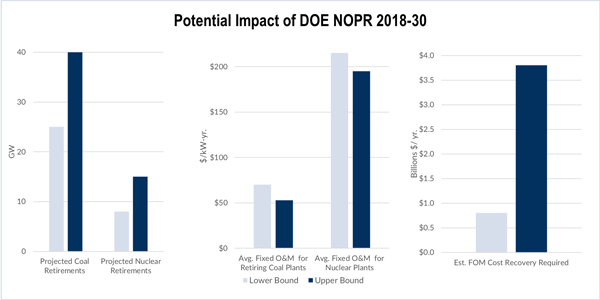

The U.S. Department of Energy’s proposed rescue plan for at-risk coal and nuclear plants could cost ratepayers $800 million to $3.8 billion annually through 2030, ICF analysts said Wednesday.

The analysts said the wide range is the result of considerable uncertainty about how FERC might implement the Notice of Proposed Rulemaking issued by Energy Secretary Rick Perry last week. The NOPR directed FERC to ensure that nuclear and coal generation in deregulated states with 90-days on-site fuel supply receive “full recovery” of their costs.

Legal analysts have said FERC could reject Perry’s directive. (See FERC’s Independence to be Tested by DOE NOPR.)

But ICF senior vice president Judah Rose said during a webinar Wednesday that he sees “a significant possibility” that FERC will take some action to address the secretary’s “resilience” concerns, especially in the wake of Hurricanes Harvey, Maria and Irma.

“DOE has rarely, if ever, exercised its authority vis-a-vis FERC in this manner. It is even more rare to act with such very tight deadlines — i.e. 60 days, and with such broad regional coverage — it applies to any ISO or RTO with an energy market (day-ahead and real-time) and any plant not subject to state rate of return regulation,” Rose and ICF principal George Katsigiannakis wrote in a blog post. “In the past, most NOPRs originated from FERC directly. Thus, past experience is not necessarily a good guide regarding handicapping the likelihood of implementation. Also, the political environment is without obvious precedent.”

The “lower bound” annual cost of $800 million ($6.6 billion net present value (NPV) at a 7% discount rate) assumes high natural gas prices, normal energy demand, and that units’ fixed operations and maintenance costs are partially recovered in the market.

The “upper bound” cost of $3.8 billion ($31 billion NPV) is based on an expectation of low gas prices and low energy demand with a minimum offer price rule for all regulated units.

The “lower bound” assumes high natural gas prices, normal energy demand, and that units’ fixed operations and maintenance costs are partially recovered in the market. The “upper bound” is based on an expectation of low gas prices and low energy demand with a minimum offer price rule for all regulated units. | ICF

Among the uncertainties, Rose said, is whether FERC seeks to provide cost recovery through energy prices, as proposed in the NOPR, or through capacity prices “because the service is to some degree more akin to a capacity service.”

One particularly important question is whether the rules will include mitigation of buy-side or sell-side market power, an issue not mentioned in the NOPR. If a large share of the generation fleet is subject to rate of service regulation, the analysts said, it could delay retirements and lower supply bids, reducing energy and capacity revenues for remaining units.

If coal plants have bid below costs in the past, prices could increase, but if mitigation is not pursued vigorously, market prices could decrease.

Impact on Gas, Renewables

By reducing coal and nuclear retirements, said ICF Managing Director Michael Sloan, the rule would likely reduce the development of new natural gas-fired capacity by 20 to 40 GW, leading to a reduction of gas demand of as much as 5 Bcfd by 2030, causing gas prices to drop by 4 to 7%.

One uncertainty: whether gas plants with firm pipeline contracts or access to underground storage or local production could qualify for cost recovery.

Renewable generation would be less impacted by the capacity market but could be affected by other FERC actions on price formation, such as restrictions on negative pricing.

The analysts said the NOPR also raised these questions:

- Will the rules permit expansions at existing units or reopening of mothballed units? If expansions are allowed, how many megawatts?

- Who will set the rate of return and what will be the amortization period?

- Why is the NOPR restricted to RTOs and merchant plants? Given FERC’s role in ensuring reliability, “What showing, if any, do rate-of-return states have to show that they have the correct procedures in place to achieve resilience? Will this ultimately apply to all jurisdictional transmission providers?”

“This NOPR could have a major impact on the industry and markets, and could be a huge game changer for baseload plants. Timing is unclear along with most of the details. The only certainty is the uncertainty that this will create in the marketplace as the rule is developed and the details debated,” said the analysts, who questioned whether upcoming capacity auctions in ISO-NE (January 2018) and PJM (May 2018) and monthly auctions in NYISO will be delayed.