By William Opalka

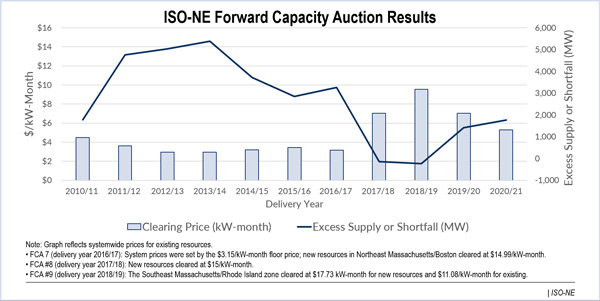

Prices dropped by one-quarter to $5.30/kW-month in ISO-NE’s capacity auction Monday, the lowest clearing prices since the RTO eliminated its price floor after the 2013 auction.

Forward Capacity Auction 11 easily surpassed the 34,075 MW of resources needed for the 2020/21 capacity commitment period, with a total of 35, 835 MW. Unlike in recent auctions, the RTO said, no new large power plants qualified, nor did any large power plants announce their retirements beforehand. However, 640 MW of new energy efficiency and demand response resources cleared, the equivalent of a new generating plant.

Three new power plants cleared in FCA 10 last year, which had a clearing price of $7.03/kW-month. That followed two consecutive record-breaking years, topped by the record $9.55/kW-month in 2015. (See Prices Down 26% in ISO-NE Capacity Auction.)

Falling prices are “the result of competition to provide plenty of the capacity that we need in New England,” Robert Ethier, vice president of market operations at ISO-NE, said at a news briefing Thursday.

Although the auction did not have large, significant new resources, “we did have a lot of smaller, other resources clear in the auction,” Ethier added.

The clearing price will be paid to all resources in all three capacity zones in New England and 1,035 MW of imports from New York and Quebec. Imports from New Brunswick, totaling 200 MW, will receive $3.38/kW-month. That price is lower because of excess capacity available over a 200-MW tie line.

The total cost this year is about $2.4 billion, down from last year’s $3 billion and 2015’s $4 billion.

Ethier said the lower prices allowed ISO-NE to acquire more than the minimum target to give it flexibility and to enhance reliability. Almost 40,500 MW — 34,505 MW of existing capacity and 150 new resources totaling 5,958 MW — qualified. (See ISO-NE Capacity Requirement Shows Flat Demand, More Solar.)

Several oil-fired units dropped out of the auction, “well under 200 MW” in the aggregate, officials said, but they remain available in the energy market. “We have not yet received any retirement notices from them,” said Stephen Rourke, vice president of system planning.

The new efficiency and DR resources bring the total available to more than 3,200 MW, or about 9% of the total capacity market.

In addition, demand reductions from the RTO’s forecast of behind-the-meter solar PV growth reduced the capacity target by 720 MW.

Six megawatts of new wind and 5 MW of new solar resources cleared the auction, bringing their totals to 137 MW and 66 MW, respectively.

ISO-NE said it will file the results with FERC at the end of the month, hoping for acceptance that traditionally occurs in June. The commission is operating without a quorum and would not be able to approve FCA 11 results on time if they are contested.

“We’ve thought about it, but it’s not a big concern, yet,” Ethier said.