By Robert Mullin

Berkshire Hathaway Energy is contesting FERC’s June decision to revoke the ability of the company’s subsidiaries to sell power at market-based rates in four neighboring balancing authority areas in the West.

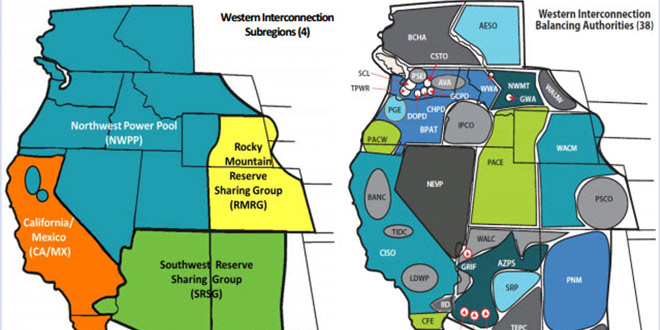

The commission’s June 9 order prohibited Berkshire-owned utilities PacifiCorp and NV Energy — as well as 19 other affiliates — from offering power at market rates in the PacifiCorp East (PACE), PacifiCorp West (PACW), Idaho Power and NorthWestern areas based on concerns about horizontal market power. (See Berkshire Market-Based Rate Sales Restricted in 4 BAAs.)

In a request for rehearing and clarification filed July 11, Berkshire argued that the commission failed to make a “definitive finding” that the company possesses market power in the four regions before revoking market-based rate authority, as required under FERC Order 697 (ER10-2475).

“[The commission] did not provide sound reasoning, nor did it show a path to how it arrived at its decision,” the company said. “But, nonetheless, the commission moved ahead and revoked market-based rate authority and imposed cost-based rates.”

‘Moving Target’

Berkshire contended that it was denied due process after FERC failed to notify the company of the commission’s “newly announced standards for determining market power” ahead of the company’s initial “change in status” filing — standards it said the commission “articulated for the first time” in the June 9 ruling.

The company’s utilities “have repeatedly demonstrated their willingness to comply with any guidance that the commission has provided,” Berkshire said. “They should not be penalized for failing to hit a constantly moving target.”

Berkshire also sought clarification on whether its affiliates can use their own “case-specific” cost-based rates for sales in the four areas, or must rely on the commission’s default cost-based rates — requesting rehearing if it is the latter.

The June ruling stemmed from Berkshire’s 2013 acquisition of NV Energy, which put Warren Buffett’s conglomerate in control of 19 GW of generating capacity in the West — enough capacity to fail the “pivotal supplier” and “wholesale market share” indicative screens for market power in the four areas.

Delivered Price Test

Generation owners that fail the screens can disprove the presumption of market power by performing a more thorough delivered price test (DPT). The DPT factors in the native load commitments and generating capacity of all suppliers in a region in order to determine each supplier’s “available economic capacity” over 10 different seasons and load conditions.

The commission ruled that the DPT analysis submitted by the Berkshire companies was insufficient to rebut the presumption of market power, having failed to include “inputs, assumptions and facts appropriate to the unique characteristics of each balancing authority area when studying that particular area.”

The ruling pointed to an instance in which Berkshire’s analysis erroneously listed Idaho Power as a competing supplier during periods when that utility would “likely not” be positioned to provide competition.

Berkshire countered the finding that its tests were unreliable, saying that each of its 57 “unique” DPT analyses “was prepared in accordance with the commission’s previously announced requirements and each was similar in form and substance to” analyses the commission had previously approved.

FERC identified five alleged deficiencies in the tests, the company said.

“On that basis [the commission] concluded that ‘we are unable to validate the results of the [Berkshire companies’] DPT analysis and are unable to rely on the DPT analysis,’” Berkshire said.

Berkshire also questioned the commission’s use of its own “undisclosed analyses using alternative assumptions or data that yielded different results than those provided by” the company, saying that the commission failed to include the results of those analyses in the proceeding.

The company further contended that the “purported deficiencies” in the DPTs were the “sole basis” for the commission revoking market-based rate authority, rather than any alternative analyses or evidence submitted by intervenors or the commission itself.

“By its own admission, the commission’s decision was not ‘based on the results of the DPTs’ and does not purport to have made any finding based on the DPT results or any other substantial evidence that the [Berkshire companies] have market power in any of the mitigated markets,” the company said.