What is Changing in PJM’s Proposal?

Jun 16, 2015

The Federal Energy Regulatory Commission required several significant changes in PJM's Capacity Performance proposal.

The Federal Energy Regulatory Commission required several significant changes in PJM’s Capacity Performance proposal. PJM must make the changes in a compliance filing due in 30 days.

- Review of Sell Offers: The commission approved PJM’s proposed mechanism for reviewing and rejecting sell offers but required it to remove the phrase “to the satisfaction of the Office of the Interconnection” from Attachment DD, saying it was “too ambiguous and allows PJM too much discretion.” (¶92)

- Good Faith Representation: The commission rejected PJM’s proposal that resources submitting Capacity Performance offers make a good faith representation that it has, or will make, necessary investments to ensure it has the capability to provide energy when called upon. Knowingly false representations would have been subject to penalties. The commission said it did not believe the representation “would provide any added value in incenting resource performance.” It also said the scope of the requirement was “inappropriately vague” and could create a barrier to entry for new resources. (¶94-5)

- External Resources: FERC said PJM must add a requirement that an external generation capacity resource must demonstrate that it meets – or will meet by the start of the delivery year – the criteria for an exception to the Capacity Import Limit in order to offer as a Capacity Performance resource. (¶97)

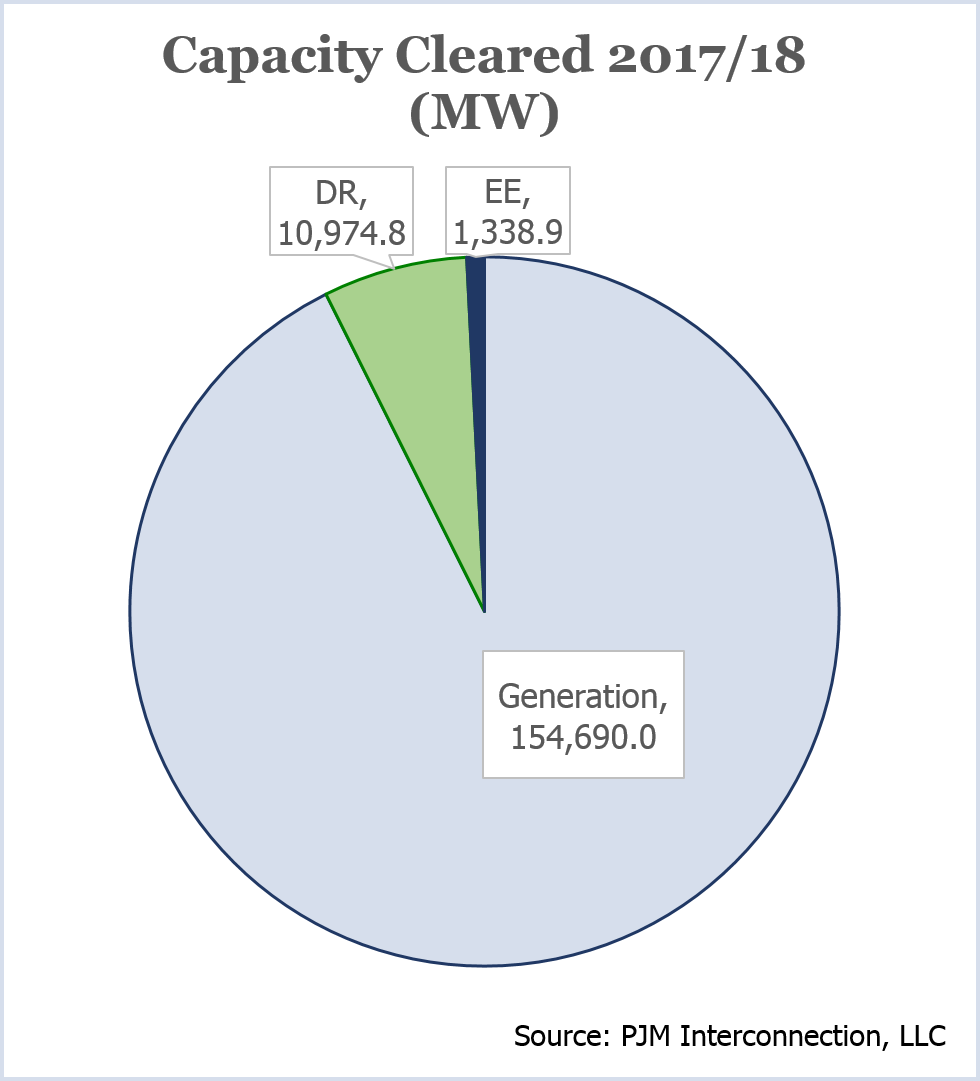

- Demand Resources, Energy Efficiency, Storage, Intermittent Resources: PJM must clarify that capacity storage resources, intermittent resources, energy efficiency resources and demand resources may submit stand-alone Capacity Performance sell offers in a megawatt quantity consistent with their average expected output during peak-hour periods. (¶100)

- Environmentally Limited Resources: PJM must clarify that it will permit aggregated offers from environmentally limited resources. (¶101)

- Aggregation Across Locational Deliverability Areas: FERC rejected PJM’s proposal to allow resources in different locational deliverability areas to submit aggregated offers, saying the RTO had not demonstrated why Capacity Emergency Transfer Limits should not be taken into account. “We are not persuaded that aggregation will be feasible across locational deliverability areas in all circumstances or would be able to provide the required resource adequacy during emergency conditions,” the commission said. In addition, it said the proposal was inconsistent with the Capacity Performance design, noting that several Capacity Performance rate parameters (non-performance charge rate, performance bonus payment rate, stop-loss limits, and default offer caps) are LDA-specific. (¶103)

- Monthly Stop-Loss: The commission agreed with PJM’s request to withdraw its original proposal that the monthly stop-loss limit on penalties equal 0.5 times annual net CONE, which the RTO said would allow under-performance without consequence once a resource has reached the limit, equivalent to 15 performance assessment hours in a month. PJM acknowledged in its response to FERC’s March 31 deficiency letter that most performance assessment hours are likely to occur during a few peak months of the year. The commission said the monthly stop-loss limit would “severely dilute” PJM’s performance incentives. (¶165)

- Non-Performance Charges: FERC required two clarifications to the language in proposed section 10A(d) of the Tariff “to avoid ambiguity or misinterpretation.” It said the proposed wording, “limitations specified by such seller in the resource operating parameters,” could be misinterpreted to mean only those operating parameter limitations that are less flexible than a resource’s pre-determined parameter-limited schedule. That, it said, could allow less flexible resources to avoid non-performance charges more often than more flexible resources. “We find that a clarification is warranted to make clear what parameter limitations are at issue in this provision.”

- It also required PJM to make clear that if a capacity resource is not scheduled by PJM due to any operating parameter limitations submitted in the resource’s offer, any undelivered megawatts will be counted as a performance shortfall. The same penalty would apply to a resource that was not scheduled because its market-based offer was higher than its cost-based offer. (¶167-173)

- Net Energy Imports: FERC required a clarification to avoid any ambiguity regarding how PJM will assess the performance of external resources, saying it agreed with the Market Monitor that the RTO’s proposal does not specify how PJM will assess performance for energy imports and when emergency action hours only occur within individual zones or sub-zones. “If an emergency action is limited to a zone or sub-zone region, transmission into the affected region is likely restricted, so including a system-wide measure of net energy imports would likely distort the balancing ratio,” the commission said. It also agreed with Panda Power Funds and the Coalition of Generators and Project Finance Resources (Essential Power, Lakewood Cogeneration, Moxie Freedom, CPV Power Development, NextEra Energy, Invenergy Thermal Development and Brookfield Energy Marketing) that, as proposed, the balancing ratio could exceed 1, causing capacity resources’ expected performance during a performance assessment hour to exceed their full cleared unforced capacity quantity.

- It required PJM to submit revisions clarifying: the definition of net energy imports; how it will apply the performance assessment calculation to external resources with and without a capacity commitment when an emergency action is triggered PJM-wide; and that a capacity resource’s expected performance for any performance assessment hour shall not exceed 100% of its cleared UCAP quantity. (¶175-178)

- Fixed Resource Requirement Entities: FERC said PJM’s penalties rate could unduly penalize Fixed Resource Requirement (FRR) entities because the physical penalty option lacks an hourly charge rate relative to the additional capacity per megawatt of non-performance. It required that PJM propose a penalty rate for the physical payment option in terms of additional capacity per megawatt-hour of non-performance. It also required the RTO to allow FRRs to choose between the physical non-performance assessment option and the financial non-performance assessment option at the start of the delivery year, rather than when the FRR submits its first capacity plan. “We find that this delay will allow a Fixed Resource Requirement entity to make its decision on the best information available.” FERC also said PJM may apply the Capacity Performance rules to FRR entities only after the conclusion of the FRR plans to which they are currently obligated. (¶208-212)

- Exemption for Planned Generation Resources: FERC rejected PJM’s proposal to exempt planned generation capacity resources from the capacity market must-offer requirement until they become operational. “We are not persuaded by PJM’s concerns that continuing to apply the must-offer requirement to planned resources that have cleared at least one RPM auction would act as a barrier to entry. In addition, we are concerned that by clearing an RPM auction with a planned resource but not following through on its construction in a timely manner, a seller could effectively withhold capacity and deter a new entrant from taking its place,” the commission said. It noted that PJM’s current rules allow resources not expected to become operational as planned to seek an exception to the must-offer requirement. (¶ 353-356)

- Credit Requirements: FERC agreed with PJM that the risk of non-performance is higher for resources that do not exist at the time a seller submits an offer but said its proposal did not acknowledge changes in the risk as a resource transitions through the stages of development. It required PJM to modify the proposed credit requirements for planned resources and financed resources, as recommended by Panda Power Funds, to allow the security requirement to be reduced as the project nears its in-service date. FERC also required PJM to revise its credit requirements to recognize LDA-specific net CONE values in determining a market seller’s auction credit rate. (¶382-383)

- Operating Parameters: The commission rejected, in part, PJM’s proposed revisions to rules on operating parameters. FERC said PJM’s existing rules allow capacity resources to submit energy market offers with inflexible operating parameters that do not reflect their actual capabilities. As a result, generators could offer excessive minimum run times, resulting in unjust make-whole payments at ratepayers’ expense, the commission said. But it called PJM’s proposed changes “overly restrictive,” saying the RTO’s proposals for capping the minimum start-up and notification times for all resources and for capping the minimum down time of storage resources did not take into account unit-specific constraints.

- It also found fault with PJM’s proposal that offers reflect only physical constraints, saying it barred resources from reflecting in their offers contractual limits, such as gas pipeline requirements that generators take uniform delivery throughout the day, which could result in longer minimum run times. The commission said including such constraints in a supply offer is reasonable and not an exercise of market power, as PJM had contended in proposing that resources that do so be denied make-whole payments. “We see no reason to treat costs associated with resource physical constraints differently than costs associated with other types of actual constraints,” the commission said.

- It ordered PJM to revise the rules to allow make-whole payments based on “actual constraints.” However, the commission rejected arguments that a resource’s inability to perform due to such limitations should be excused when calculating capacity payments. “The revisions that we direct here ensure that resources are appropriately compensated for their operation in the energy market; they do not excuse a resource from failing to fulfill its capacity obligation,” the commission said. “Providing such an exemption from non-performance charges would blunt the incentives for providing energy and reserves during the hours when they are most needed. … Accordingly, it is reasonable for a resource that fails to perform because of parameter limitations to receive less net capacity revenue than a performing resource.” (¶437-440)

- Maximum Emergency Offers: The commission said PJM had failed to make a case that its current rules regarding maximum emergency offers are unjust and unreasonable, rejecting its proposed changes. PJM said the rules allow a generation capacity resource to submit an uneconomic offer price, removing itself from the day-ahead energy market until PJM has declared a maximum emergency. FERC acknowledged that the rules may allow a capacity resource to avoid honoring its capacity commitment. “However, we conclude that proper application of non-performance charges, rather than revision of the maximum emergency offer designation, is the appropriate method of eliminating this concern,” the commission said. PJM’s proposal could unintentionally reduce the number of resources available during emergency conditions if the resource’s alternative action is to take a forced outage, FERC said. “There is, therefore, value in allowing a Capacity Performance resource to offer capacity on an emergency-only basis when it is subject to environmental limitations, fuel limitations, or temporary emergency conditions, or when it can provide its capacity on a temporary basis only.” (¶476-479)