By Ted Caddell

A Florida power trader under investigation for market manipulation over up-to-congestion trades says the transactions were lawful and that an “unfair” investigation by the Federal Energy Regulatory Commission has ruined his business. He asked for a review of his case by the full commission (IN15-5).

According to FERC’s Office of Enforcement, Stephen Tsingas and his firm, City Power Marketing, made $1.2 million in July 2010 through “fraudulent” and risk-free round-trip UTC trades placed solely to collect line-loss rebates. The allegation is almost identical to what FERC made in the pending case against Rich and Kevin Gates and their Powhatan Energy Fund.

Tsingas’ April 7 filing is in response to the demand by FERC Enforcement that it show why he and City Power shouldn’t return the profits and pay $15 million in fines.

Tsingas’ defense is similar to that of the Gates brothers: He argues that when the trades were undertaken there was no direct prohibition of them. When PJM’s Independent Market Monitor raised objections to the transactions, Tsingas says, he and City Power discontinued them.

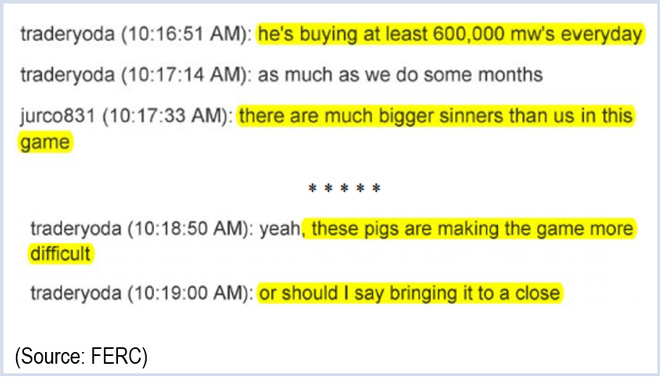

Tsingas also denied an allegation that he concealed documents during the investigation. Tsingas and his attorneys say a series of instant messages that FERC purports to show collusion are taken out of context.

Tsingas’ legal team — which includes Todd Mullins, a former branch chief in the Office of Enforcement’s Division of Investigations — says the investigation effectively put City Power out of business.

“Staff’s investigation of this handful of trades has destroyed CPM,” they wrote. “Once a company with eight employees and gross revenues exceeding $8 million annually, CPM now only has one employee — Mr. Tsingas.

“The stress of an investigation that has lasted almost five years, along with the enormous expenses incurred as a result, have ruined the company even before any tribunal — judicial or administrative — has had the opportunity to determine the merits of staff’s accusations.”

The crux of the defense is that to be prosecuted for manipulation, there must be a showing of “fraud or deceit.” Tsingas claims that when the trades were undertaken there had not yet been a determination that the trades were anything but legal transactions that may have taken advantage of a market weakness.

“There was no false information injected into the marketplace,” Tsingas’ lawyers wrote. “There was no artificial price formation. There was no violation of the [commission’s] Anti-Manipulation Rule. CPM traders were simply responding to the predictable incentives created by the market.

“The commission cannot and should not turn into a violation every case in which [a] participant trades in a manner consistent with the rules as then written and involving no falsity just because the trader may have had a motive for the trade that was not what the commission … had in mind,” they argued.