By Chris O’Malley and Rich Heidorn Jr.

SPP could meet the Environmental Protection Agency’s 30% carbon dioxide reduction target by 2030 through a $45/ton carbon adder and 7.8 GW of additional generation, most of it wind, according to a report issued last week by the RTO.

The analysis, the RTO’s second on the potential impacts of EPA’s Clean Power Plan, estimates the cost of those measures at $2.9 billion per year, not including additional transmission or gas pipelines that will be needed.

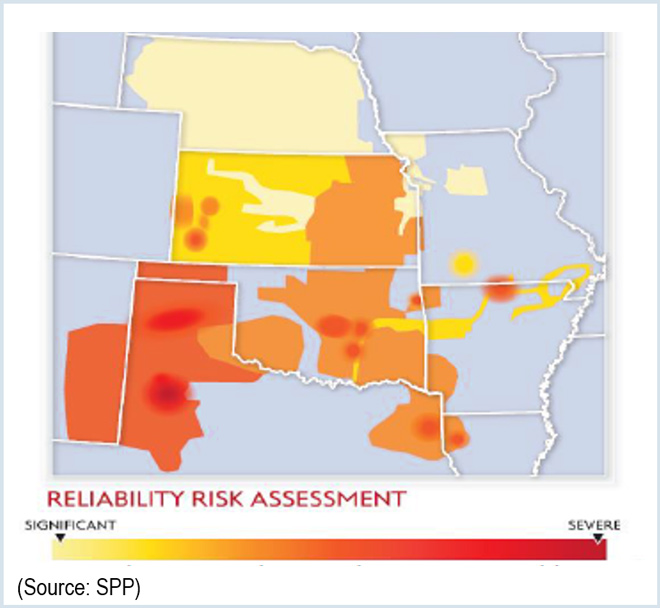

SPP’s first study, released in October, concluded that EPA’s implementation timeline — particularly its 2020 interim goals — did not allow enough time to build needed generation and transmission to replace coal plant retirements and deliver wind power to population centers. It predicted SPP’s transmission system could face severe overloads, increasing the potential for cascading outages.

“This second analysis does not alter our earlier conclusion that additional infrastructure — and time — is needed to meet the CPP’s proposed CO2 emission goals,” Lanny Nickell, vice president of engineering, said in a statement.

During a series of technical conferences convened by the Federal Energy Regulatory Commission, and at meetings with state regulators, EPA officials suggested the final rule due this summer may relax the 2020 goals, which have been widely criticized as unworkable. (See EPA on Carbon Rule: We’re Listening.)

Methodology

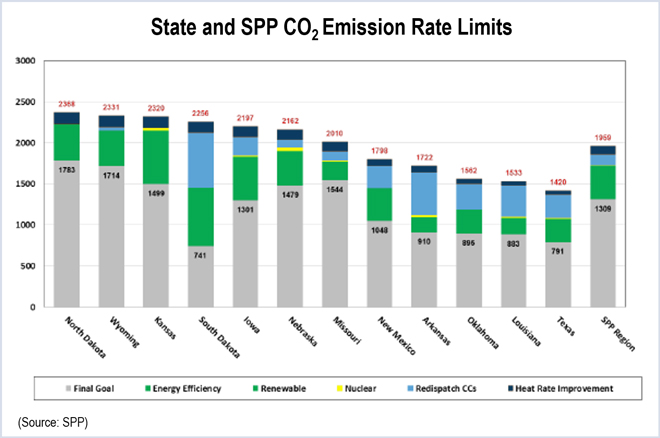

SPP said its analysis found that the region could meet the EPA goal with a carbon adder — essentially a tax on a unit’s carbon emissions — of $60/ton of carbon emissions. But it said an adder cost of $30-$45 per ton would be most cost-effective.

The report’s conclusions are based on a $45/ton adder and the addition of 5.6 GW of wind and 1.2 GW of natural gas generation above that currently planned.

The $2.9 billion in annual costs is the result of $600 million in increased annual energy costs and $13.3 billion in capital spending. The study did not evaluate infrastructure needs and thus did not include costs of transmission or gas pipeline that would be needed.

The study assumed a 70% capacity factor for combined-cycle gas generators and 47% for new wind. The added wind generation would allow that resource to meet 25% of the non-coincident peak-load obligations in the region. SPP’s minimum 12% capacity margin was preserved in each load zone.

Unduly Pessimistic

The tone of SPP’s second analysis is less gloomy than that of the first, which warned of the possibility of rolling blackouts. But critics said the new report is still unduly pessimistic.

The American Wind Energy Association said SPP’s analysis overestimates compliance costs because it “arbitrarily” limited the region’s options.

Michael Goggin, AWEA’s senior director of research, said SPP’s assumption for the cost of new wind generation is about 40% higher than current wind in the region, a nearly $1 billion difference. “Those costs would be even lower if SPP accounted for how wind energy costs continue to fall drastically, dropping by more than 50% over the last five years,” he wrote in a blog post.

Goggin said SPP’s analysis also did not include energy efficiency as a compliance option and assumed almost no new gas generation would be built.

“SPP’s study essentially examines what would happen if the region tried to comply with one arm tied behind its back,” he said. “If the region had been allowed to fully utilize its abundant and low-cost resources of wind, natural gas, and energy efficiency, the cost of achieving the Clean Power Plan would have been far lower.”

SPP acknowledged it did not analyze each of the EPA’s proposed “building blocks.” Unlike the RTO’s Integrated Transmission Plan, the study also did not consider economic interchange with other regions. The RTO said it made this choice to minimize “the uncertainty associated with trying to determine how SPP’s neighbors will operate under their own compliance with the CPP.”

Stakeholders in SPP and MISO told a FERC technical conference last month they are developing the framework for a cap-and-trade interstate trading platform for carbon. (See MISO, SPP Stakeholders Developing Trading Plan to Comply with EPA Carbon Rules).

Indicative, Not Definitive

In an interview, Nickell said the AWEA critique failed to “recognize that the study was meant to be indicative as opposed to definitive.” Nickell said some potential compliance options were excluded to provide an apples-to-apples comparison for a third, state-by-state analysis, which is expected in early June.

“This isn’t the only way to solve the problem,” he acknowledged. “Clearly [energy efficiency] could reduce costs. It’s a matter of what could be done.”

While the study assumes only 1.2 GW of incremental gas-fired generation, that is in addition to 22 GW of new gas capacity already planned, he added.

Retirements

SPP’s scenario assumed about 2.2 GW of coal retirements “incremental to those retirements already planned,” based on those generators running below a 30% capacity factor after adding a $45/ton adder.

“This assumption may be conservative considering that SPP’s analysis indicates nearly all existing coal-fired generation in the region would operate above 80% capacity factor without a carbon cost adder but approximately 12,200 MW of coal-fired generation would operate below 80% capacity factor with a $45/ton cost adder.”

The analysis does not take into account transmission constraints or interchange with adjacent pools, SPP said.

AWEA also criticized the report’s claim that 13.9 GW of coal is “at risk” of retirement.

“SPP gets to the extremely unrealistic 13.9 GW number by considering coal plants ‘at risk’ for retirement if they fall below an 80% capacity factor. An 80% capacity factor is an extremely high and unrealistic threshold for considering a plant at risk of retirement; in fact, the national average coal plant capacity factor is currently 60%. Almost all of SPP’s ‘at risk’ coal plants would actually just be operating at average capacity factors.”

From Crisis to Inevitability

Late last year, SPP and MISO warned of a reliability crisis if the Clean Power Plan isn’t eased to account for up to 134 GW of generation retirements by 2020, most of them coal-fired units. (See MISO, SPP: EPA Clean Power Plan Threatens Reliability.)

SPP’s first study assumed new generation was added without additional transmission infrastructure. The model showed that portions of the system in the Texas panhandle, western Kansas and northern Arkansas “were so severely overloaded that cascading outages and voltage collapse would occur and would result in violations of [North American Electric Reliability Corp.] reliability standards,” SPP CEO Nick Brown said in his comments to EPA.

But the initial alarm about the Clean Power Plan has given way to compliance strategy contemplation. In addition to the third study that will analyze the cost of state-by-state compliance, the RTO is beginning work on a transmission planning study. That analysis is targeted for January 2017, Nickell said.