By William Opalka

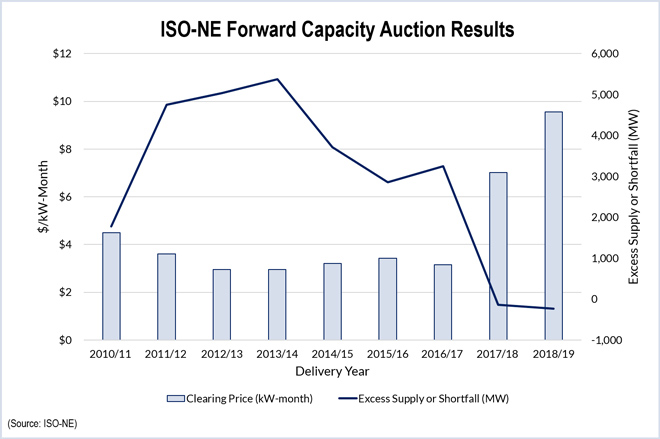

ISO-NE’s ninth Forward Capacity Auction saw prices increase by about one-third as 1,400 MW of new resources cleared to replace retiring coal plants.

While the RTO exceeded its six-state requirement of 34,189 MW by more than 500 MW, the Southeastern Massachusetts-Rhode Island zone failed to meet its obligation.

Monday’s auction was held to meet demand for the capacity commitment period from June 1, 2018, to May 31, 2019.

A preliminary estimate of the total cost is about $4 billion, compared to the 2014 auction that resulted in a total cost of about $3 billion.

The 24,447 MW of new and existing capacity resources that cleared the auction outside of SEMA/RI will be paid $9.55/kW-month. In FCA 8, most resources cleared at $7.025/kW-month.

The increase was expected. (See ISO-NE Opens FCA 9 amid Expectations of High Prices.)

New Capacity

The auction results included 1,400 MW of new capacity to help make up the shortage of generation created by the announced or pending retirements of more than 3,000 MW. New resources include three power plants — two in Connecticut and one in Southeastern Massachusetts — and 367 MW of new demand-side resources.

The resources include a 725-MW combined-cycle resource in Oxford, Conn., under development by Competitive Power Ventures. Two 45-MW combustion turbines in Wallingford, Conn., and a 195-MW CT in Medway, Mass., also cleared.

The auction started with 5,432 MW of new resources qualified to compete, according to the RTO.

“The capacity market is working as designed. The price signals from last year’s auction helped spur investment in new resources, including more than 1,000 MW of new generating capacity, which will help address the region’s resource shortage and meet peak demand in 2018-2019,” ISO-NE CEO Gordon van Welie said in a statement.

He credited the Pay-for-Performance incentive that rewards the best performing resources — an innovation being used for the first time in FCA 9 — a sloped demand curve, a seven-year price lock-in for new resources and the ability to defer a capacity obligation for one year under extraordinary circumstances.

The region was divided into four zones: Connecticut; Northeast Massachusetts/Greater Boston (NEMA/Boston); Rest of Pool (ROP); and a new zone, Southeast Massachusetts/Rhode Island (SEMA/RI).

Shortfall

In SEMA/RI — home of the 1,517-MW Brayton Point generating station, which is set to close in 2017 — 7,241 MW qualified, falling short of the 7,479 MW needed to meet the zone’s local sourcing requirement.

The shortfall meant the zone was not opened to bidding. Instead, administrative pricing rules were triggered: 353 MW of new resources will receive the auction starting price of $17.73/kW-month, while the 6,888 MW of existing resources will receive $11.08/kW-month, which is based on the net cost to build a new resource.