By Suzanne Herel

The Federal Energy Regulatory Commission last week denied a challenge to PJM’s capacity import limit, rejecting rehearing requests by American Municipal Power, the Northern Illinois Municipal Power Agency and the Illinois Municipal Energy Agency (IMEA) (ER14-503-002).

PJM sought the limit after imports nearly doubled in the May 2013 Base Residual Auction, leading some to question their deliverability.

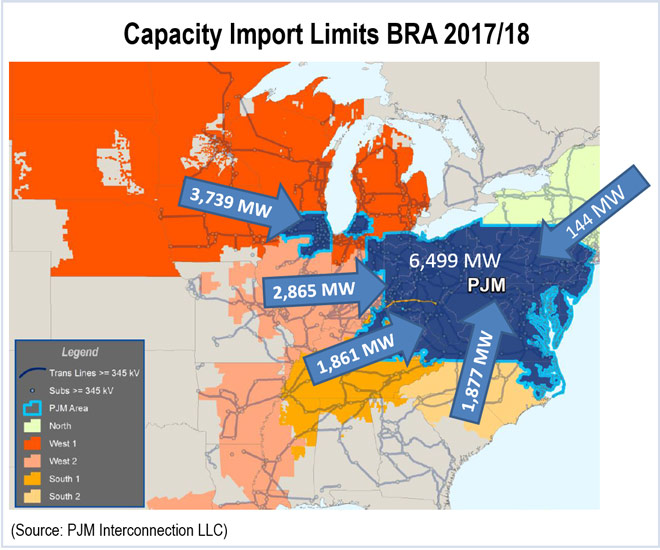

The new rules, which FERC approved in April, created five export zones with a combined limit of 6,499 MW for the 2014 BRA. Cleared generation imports dropped to 4,526 MW in 2014, a reduction of almost 40% from 2013. (See Capacity Prices Jump Following Rule Changes.)

In requesting a rehearing, IMEA said there was no substantial evidence supporting the requirement that external generation resources be pseudo-tied to PJM to qualify for an exemption to the import limit. It also argued that the revisions discriminate against load-serving entities that own generation resources outside of PJM.

FERC said that PJM established that a pseudo-tie is needed to address the risk of curtailment, noting that firm transmission into PJM was curtailed under 151 transmission loading relief-5 events between January 2009 and July 2013. “The risk of a TLR-5 event interrupting the transmission of energy necessary in an emergency situation is a sufficient basis to justify the capacity import limit, since such a risk demonstrates that resources external to PJM may not be equal to internal resources in satisfying a capacity requirement,” FERC said.

It rejected IMEA’s discrimination claim, saying the import limits are analogous to capacity emergency transfer limits, which apply to internal generation.

FERC also rejected the allegation by AMP and Northern Illinois that it had approved the limit without a proper analysis of its effect on competition in PJM’s capacity market.

“We find that an over-commitment of external resources in the Base Residual Auction would run a deliverability risk and distort the Base Residual Auction process by displacing resources that are deliverable,” FERC said. “… Systematic commitment of external resources at levels that cannot be reliably delivered will add resources to the supply curve in the auction and tend to reduce the clearing price below the level offered by resources that are actually deliverable to PJM.”