The D.C. Circuit Court of Appeals on Friday remanded FERC’s approval of the Southeast Energy Exchange Market (SEEM) back to the commission for additional proceedings.

The three-judge panel agreed that FERC was wrong to deny initial requests for rehearing of the approval because of the dates on which they were filed, but Judge Neomi Rao split with her two colleagues in a partial dissent and agreed with the commission’s reasoning on two of the specific rules that came before the court.

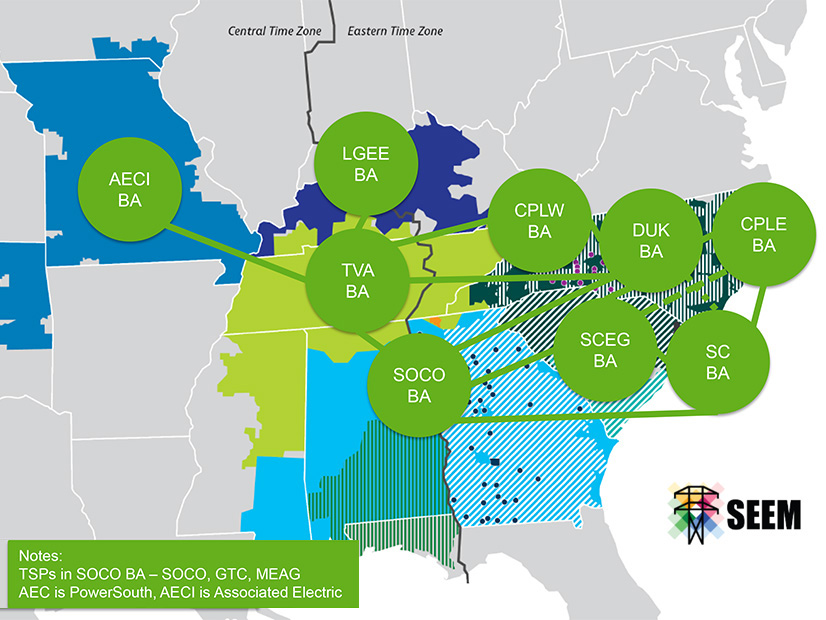

SEEM members include Associated Electric Cooperative, Duke Energy, Southern Co., Tennessee Valley Authority and others in the Southeast. The market has an algorithm to match excess supply with free transmission every 15 minutes, enabling more frequent transactions among its members. It ran into opposition from parties who argued it was anti-competitive compared to the Western Energy Imbalance Market, let alone a full ISO/RTO.

FERC was unable to agree on whether to approve the SEEM proposal, splitting 2-2, which allowed the SEEM tariff to go into effect automatically. Now it returns to another iteration of the commission with four votes, though with acting Chair Willie Phillips instead of former Chair Richard Glick. (See SEEM to Move Ahead, Minus FERC Approval.)

The case presented a test of a recent change to the Federal Power Act that made such split decisions reviewable by the courts. One issue was whether parties had submitted their required rehearing requests to the commission on time. FERC argued that it had to rule on the case by Oct. 10, 2021, which started the 30-day countdown for rehearing that would end Nov. 9.

However, Oct. 10, 2021, was a Sunday, and it was followed by Columbus Day on Oct. 11, when FERC was shut down. Thirty days after was Veterans Day, which meant FERC was closed again. Advanced Energy United and other parties sought rehearing in filings submitted Nov. 12.

The court ruled in 1989 that deadline dates exclude Saturdays, Sundays and federal holidays, which made Nov. 12 the due date for rehearing requests.

“Accordingly, the commission erred in finding the petition for rehearing of the deadlock order untimely below, and the related orders finding as such are therefore vacated,” the court said.

FERC will have to deal with the rehearing requests’ merits on remand, the court said.

While FERC was split on the order approving SEEM, it was able to vote out a related order on the market’s nonfirm energy exchange transmission service (NFEETS); it also rejected requests for rehearing of that order. The court was able to weigh the merits of those requests. (See FERC Again Rejects Efforts to Overturn SEEM.)

SEEM requires that entities transacting in it have a source and sink inside its footprint, which goes against FERC’s pro forma open-access transmission tariff from Order 888. The old bilateral market was different from the pro forma tariff as well, but the new SEEM rules excluded 65 existing bilateral trading partners that cannot participate in the new market.

SEEM’s backers argued that the geographic limits were needed to implement the 15-minute trades, but the court noted that they could have designed the system differently to more efficiently handle such requests.

“The creation of a new service that — by its design — excludes existing market participants evokes the discriminatory practices against third-party competitors by monopoly utilities that prompted the commission’s adoption of Order No. 888,” the majority said.

It ruled that FERC failed to offer a good enough explanation on how the rules are better than the pro forma tariff and that it will have to explain that better, or explore rule changes, on remand.

Opponents argued that under Order 888, NFEETS made SEEM a loose power pool, which is required to be open to nonmembers. Order 888 qualifies loose power pools as arrangements between more than two utilities where they offer discounted power, specifically mentioning “non-pancaked” rates as a discount.

SEEM charges only one transmission rate for power to cross all of its members’ systems, so the majority found that FERC failed to adequately explain why it was not a loose power pool.

Rao dissented on the NFEETS issue, finding that SEEM’s backers had compelling technical reasons to limit participation to entities within its footprint and that FERC correctly determined it was not a loose power pool.

“NFEETS does not limit access to any currently existing service,” Rao wrote. “Rather, it provides an entirely new service that facilitates valuable short-term energy transactions, resulting in substantial cost savings across the Southeast. The tariff revisions are thus strictly preferable to the existing tariffs.”

She also agreed with FERC that SEEM did not qualify as a loose power pool because it creates the opportunity for new transactions; it does not “in any sense result in a discounted or special rate from existing arrangements.”

“SEEM provides a valuable service by establishing a new market for utilities in the Southeast to engage in short-term energy transactions,” Rao said. “FERC reasonably approved the no-cost transmission service necessary to implement SEEM.”