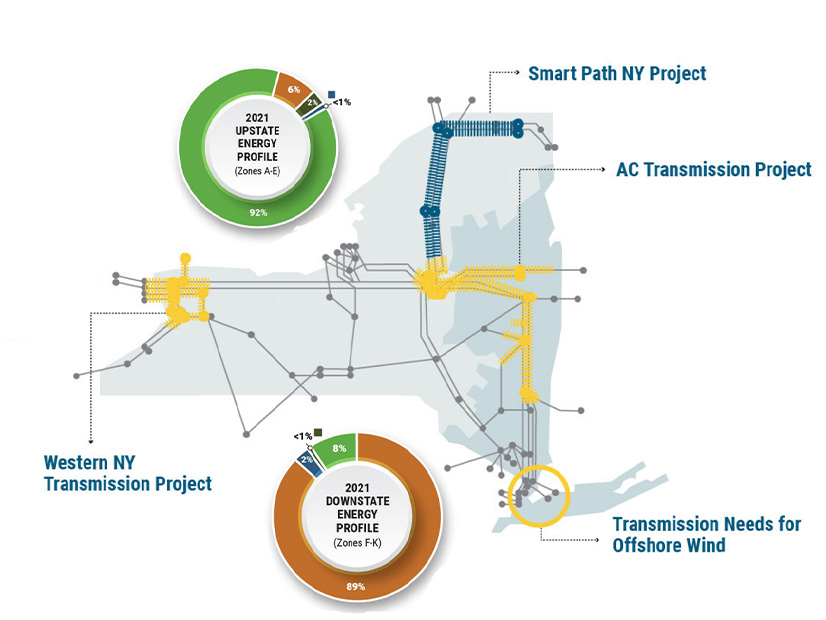

FERC on Friday partially approved new rates from Niagara Mohawk for its portions of the AC Transmission Public Policy Transmission Project, which is designed to increase transfer capability across central east New York.

To pay for its share of the project (LS Power and the New York Power Authority are building most of it), the National Grid subsidiary proposed to include a new rate in its transmission service charge, called Rate Schedule 20.

The project, which is expected to be completed later this year, includes changes to some of Niagara Mohawk’s facilities. The firm plans to spend between $38 to $55 million upgrading a substation and reconductoring some transmission.

FERC accepted the firm’s cost-allocation proposal, which is in accordance with the 25/75 method used in NYISO where 75% of the costs go to zones that directly benefit from such lines and the last 25% is allocated across the entire market.

The much larger, $1.2 billion project mostly involves new infrastructure, but utilities retain the right to add any upgrades to their systems required by such projects. While FERC already had found that utilities had that right back in 2019, the NYISO tariff did not include language to implement generally, so the developers executed the “Segment A” agreement with Niagara Mohawk to make the required upgrades.

The cost-allocation method is in line with what FERC has approved for public policy lines, but the commission said the rest of the proposal has not been shown to be just and reasonable and set the matter for hearing procedures to gather more information.

The charges Niagara Mohawk proposed went into effect Aug. 5 but are subject to change and refunds based on the outcome of the hearings.

The utility said its proposed charges would lead to the same returns on all its other transmission investments under its transmission service charge (TSC). But since its Segment A charges were on top of those, the revenue from it would be credited to the standard TSC to avoid double counting.

FERC sent a deficiency letter to the utility seeking answers on its proposal, including whether ratepayers would continue to pay a return on investment once the facilities are fully depreciated.

Niagara Mohawk said its carry charge uses average systemwide cost ratemaking, and that leads to ratepayers paying a return as calculated over its useful life. The method is not precise, but the utility said tracking and calculating the costs of specific low-capital assets (like the $38 million it would spend on Segment A) can be administratively burdensome and lead to higher costs for ratepayers.

In the order Friday, FERC still questioned why the carrying charge included retirement obligations, which generally are not permissible in transmission rates. The utility said it would make another filing removing the retirement fees, but FERC said it was not clear whether that approach was appropriate.

The fact that the small segments Niagara Mohawk is building will be recovered using an average of its entire transmission base means that Segment A will never fully depreciate for rate purposes, and the utility failed to show it would ensure its costs are recovered in a systematic and rational manner.

While FERC set the matter for hearing, it encouraged a settlement and will wait to pick an administrative law judge for 45 days to give a chance for settlement talks to occur.