FERC on Oct. 20 approved SunZia Transmission’s Open Access Transmission Tariff, which governs how the 550-mile HVDC line will offer new customers firm and non-firm point-to-point service (ER23-2146).

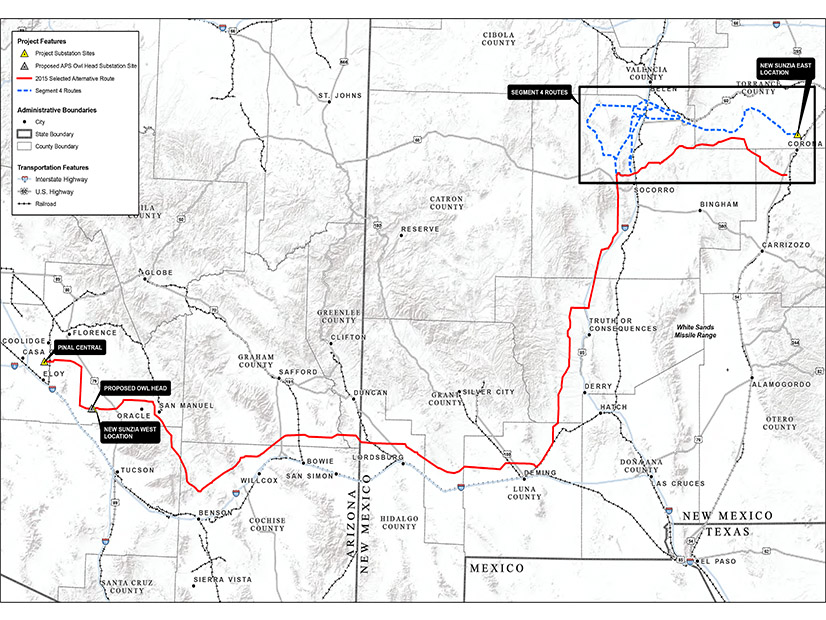

Pattern Energy is developing the transmission line, which is designed to ship renewable power from New Mexico to Arizona. Pattern is also an anchor-shipper on the line, developing several renewable projects in New Mexico.

SunZia has developed a monthly transmission rate of $8.18/kW, and it has based its annual, weekly, daily and hourly rates on that price.

The tariff includes interconnection rules for renewables that want to connect to SunZia, requiring customers to fund all incremental costs that are required to provide them service. In the event SunZia has to be taken out of service for a month or longer, the new interconnection customer will have to pay it back for the loss of any transmission revenue or any income it would have earned from the investment and production tax credits.

FERC found the tariff, including the generator interconnection procedures, to be just and reasonable and not unduly discriminatory or preferential.

SunZia’s existing full capacity is subscribed to SunZia Wind (another Pattern subsidiary), but the tariff will be used for future transmission customers. The practice of basing all of its rates on the previously approved $8.18/kW monthly rate is consistent with FERC precedent, the commission said.

The merchant project also laid out plans to update its rates periodically, which is similar to mechanisms other merchant projects have, the commission said. The updates will let SunZia reflect changes in conditions or expenses.

FERC had issued a deficiency notice on the language requiring new interconnection customers to cover SunZia’s losses from any outages that last more than a month, but it ended up accepting it.

“SunZia Transmission explains that, as a merchant transmission developer of an HVDC line, it faces considerable financial risks,” FERC said. “Further, SunZia asserts that an outage would eliminate SunZia Transmission’s ability to provide any service for the duration of the outage.”

FERC has previously recognized that an anchor customer can assist merchant developers in meeting financial challenges unique to merchant development.

In this case, the financial futures of both the SunZia transmission line and the related SunZia Wind projects depend on each other and require certainty that losses from connecting a new customer would be recovered, FERC said.

“SunZia Transmission depends on monthly transmission service charge payments made by SunZia Wind to pay for its costs and to make debt service payments, and SunZia Wind depends on the continued availability of the transmission system to deliver energy in order to pay the transmission service charge and pay its own lenders,” FERC said.

The firm would have to submit a filing to FERC to recover any costs under those provisions, so without commission approval, it would not be able to collect payments from interconnection customers to cover losses from an extended outage.