Several MISO stakeholders took exception to the RTO’s proposal before FERC to cap the volume of interconnection requests it accepts annually.

ORLANDO, Fla. — Several MISO stakeholders took exception to the RTO’s proposal before FERC to cap the volume of interconnection requests it accepts annually.

MISO made two filings with FERC last month to establish an annual megawatt cap on projects, enforce stricter proof of land use, enact automatic and escalating monetary penalties for withdrawals, and increase milestone fees for its generator interconnection queue (ER24-340 and ER24-341). (See MISO’s More Stringent Interconnection Queue Rules Go Before FERC.)

DTE Energy said a queue cycle cap would be “unprecedented” and argued it won’t address “the root cause of MISO’s inability to timely process interconnection requests.”

DTE said it’s not the number of projects overall, but the percentage of speculative projects in the queue that’s the problem. Developers have resorted to “over-saturating the interconnection queue with projects as an insurance strategy to secure a position” because of long wait times in the queue, DTE argued. DTE supported the other aspects of MISO’s queue rule changes.

MISO has said there are only so many potential generation projects it can simultaneously consider in interconnection studies while still achieving accurate results. (See MISO Relaxes Proposal on Stricter Queue Ruleset.)

But the Coalition of Midwest Power Producers argued MISO wants to impose a megawatt cap “without articulating how a lower volume will ensure accelerated queue processing.” The coalition said MISO didn’t detail “unique processes or additional computing power to resolve the volume and study pace issues that have been the albatross of the MISO queue process.”

NextEra Energy agreed MISO didn’t provide evidence to show a cap will “remedy or mitigate the factors leading to its unwieldy, inefficient and untimely interconnection queue.” It said the cap will stymie competition and create barriers to entry for smaller generation developers.

Ameren said it thought the cap “is a blunt tool that is not fully thought out and may result in unjust outcomes.”

Xcel Energy, on the other hand, said MISO has sufficiently explained a megawatt cap is key to alleviating the overstuffed queue. Entergy agreed the sheer size of the interconnection queue is interfering with “realistic” study results and not giving developers a clear picture of whether they should proceed with generation projects.

The Organization of MISO States also threw its support behind the cap, saying a “backstop mechanism is needed — at least temporarily — to ensure MISO can produce realistic network upgrade studies based on a smaller, more manageable queue size.”

“MISO’s queue is oversaturated with projects that are vying to identify the cheapest locations to interconnect, causing MISO to choose to effectively shut down its interconnection queue,” OMS told FERC.

MISO’s current generator interconnection queue contains more than 1,300 projects at nearly 230 GW — nearly double MISO’s summertime peak demand.

“It is not reasonable to expect MISO to continue to try and work through this level of requests in its queue process,” Xcel said.

In a joint protest, the American Clean Power Association, the American Council on Renewable Energy, the Solar Energy Industries Association and Clean Grid Alliance argued that limiting projects annually is diametrically opposed to the rapid transition of clean energy resources. They said it’s only natural MISO’s queue has expanded rapidly in recent years.

“If accepted, the cap proposal would create perverse incentives that will create havoc, increase uncertainty and discriminate against the very clean-energy resources that the region needs,” the clean energy groups contended.

Alliant Energy argued MISO’s proposal to cap queue cycles is an odd choice when the grid operator has been telling stakeholders new capacity additions are crucial. Alliant referenced OMS’ most recent resource adequacy survey showing the footprint runs the risk of a 9-GW capacity shortfall by 2028.

MISO Leadership Hopeful for ‘More Confident, Less Speculative’ Projects

At MISO Board Week in Orlando, Executive Director of Resource Planning Scott Wright said even though there are some complaints, stakeholders’ comments reveal “a broad consensus that the staggering queue line was unsustainable.”

Wright said an annual megawatt cap on projects, an automatic penalty scheduled for withdrawal and increased milestone fees will encourage a “more confident, less speculative” class of projects to enter the queue.

“Many of the projects in the queue are highly speculative despite our past rule changes to use a ‘first-ready, first-served’ approach,” he said. Wright also said MISO’s existing withdrawal process are too “low-consequence.”

Wright added that the “staggering” number of queue projects is developers’ “rational” response to more favorable economic conditions for renewable energy development. He said it’s natural MISO found itself having to tighten requirements, so its historically “high-quality” queue isn’t compromised.

Wright said since the last Board Week in September, members have announced more retirement plans, with Michigan adopting a clean energy pledge by 2040.

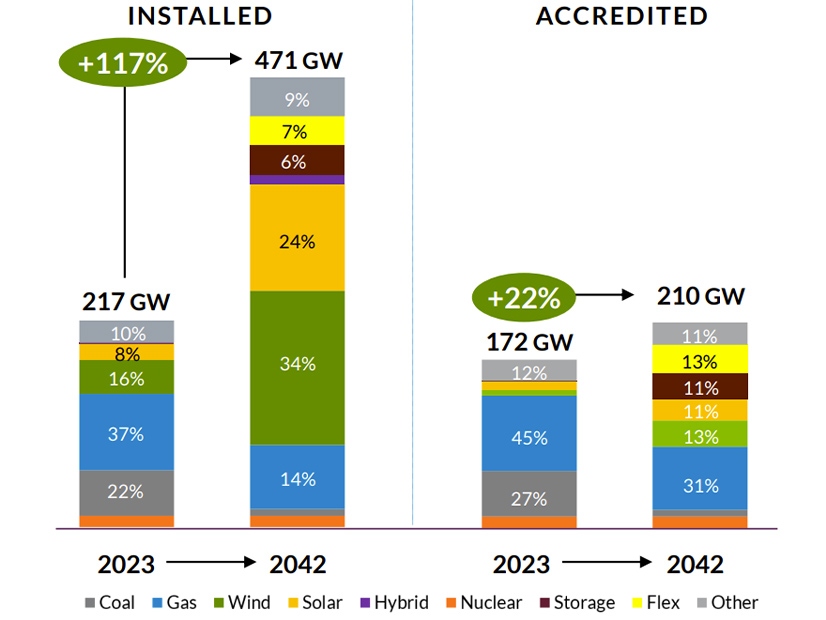

MISO predicts it will add about 250 GW in installed capacity over the next 20 years, but it will only amount to a 38-GW increase to MISOS’s current 172 GW in accredited capacity.

50 GW in Greenlit and Unfinished Projects Haven’t Budged

Wright added that the prospective projects in the queue still face inflation and supply chain headwinds. MISO’s large number of approved but unbuilt generation projects hasn’t budged since the summer. (See MISO: Reliability Risk Upped by 49 GW in Approved but Unbuilt Generation.)

Today, 50 GW across 316 projects are awaiting construction, with 50% of those developers saying wait times will average 650 days until commercial operation. Most of the on-hold projects are solar generation, accounting for 32 GW.

By year’s end, Wright said that amount could grow to nearly 60 in approved but unbuilt generation projects.

Vice President of System Planning Aubrey Johnson said nationally, 260 GW in generation projects have signed interconnection agreements in the organized markets and yet remain unconstructed. Johnson said that side of the issue deserves more awareness in conversations about the country’s interconnection woes, when usually, inadequate transmission planning is emphasized.

“This is something that needs national attention. It’s something that we call attention to at every turn,” Johnson said.