FERC approved transmission rate incentives for New York Transco’s Propel NY Energy project, but it ordered settlement proceedings on its proposed base return on equity of 10.7% (ER24-232).

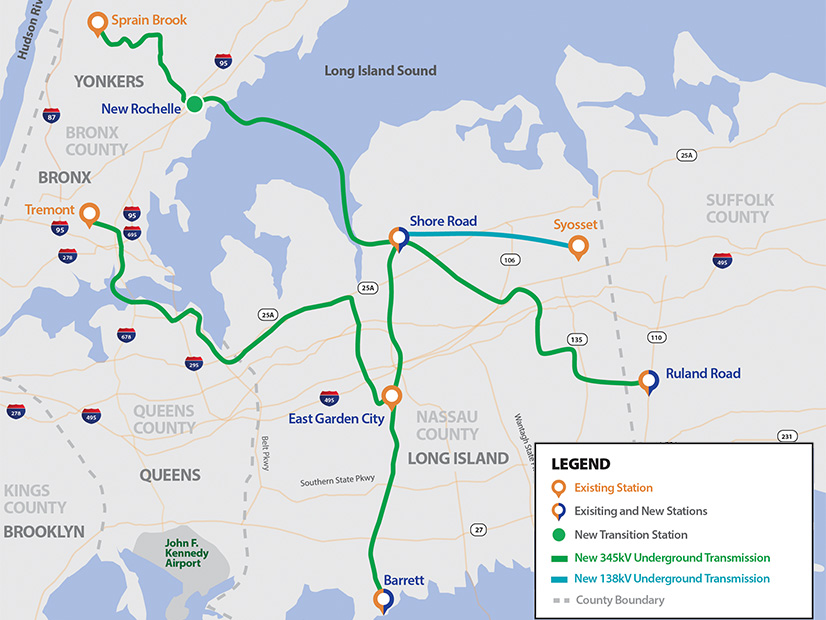

Propel NY, a $2.7 billion 345-kV joint project between NY Transco and the New York Power Authority, was selected in NYISO’s public policy transmission needs (PPTN) assessment to deliver at least 3,000 MW from offshore wind farms near the Long Island coast. (See “Long Island PPTN,” NYISO Previews New York City Transmission Needs Assessment.)

New York Transco is owned by Consolidated Edison Transmission, Grid NY, Iberdrola USA Networks New York Transco and Central Hudson Electric Transmission. In October, the company asked FERC to include Propel NY in the ISO’s Rate Schedule 13 tariff, which governs how developers recover costs, and to allocate project costs based on a statewide volumetric load-ratio share.

The company also proposed a cost containment mechanism to essentially bar it from recovering the first 20% of any cost overruns.

FERC’s Dec. 26 order approved NY Transco’s request for 100% coverage for abandoned plant and construction work in progress (CWIP), and a 50-basis-point RTO participation adder.

But the commission reduced the ROE risk incentive to 75 basis points from 150 and suspended the proposed base ROE of 10.7% pending the settlement procedures, saying it could not resolve differing methodologies and proxy groups based on the record before it.

Complaints

The state Public Service Commission, the City of New York and Multiple Intervenors, representing large industrial, commercial and institutional energy consumers, opposed the proposed base ROE, cost containment, RTO participation adder and risk incentive.

They criticized the 10.7% ROE as inflated, and they argued that NY Transco failed to demonstrate any special project risks.

The commission’s ruling noted that it had not granted an ROE risk incentive greater than 50 basis points since its 2012 policy statement on incentives. But it acknowledged that Propel NY “involves new, high-voltage, completely underground and submarine electric transmission cables that will involve nearly 90 miles of excavation for underground cable in urban areas, underwater crossings and the need to directionally drill for 6,000 feet, as well as the construction of four transmission substations located in densely populated areas.”

“We find that the greater risks and challenges associated with those characteristics of the project warrant an increase in the level of ROE risk incentive compared to those earlier cases,” the commission said. “However, New York Transco has not justified an ROE risk incentive of 150 basis points, which we find would be excessive in these circumstances.”

Commissioner Mark Christie dissented, saying “the incentives granted in this order go beyond the commission’s practices and what should be accepted.”

Irrespective of the ultimate ROE calculation, Christie said, NY Transco’s requested incentives would be “egregiously unfair to New York consumers.”

He further contended that since Propel NY was selected through NYISO’s PPTN for its “relatively low procurement, permitting, and construction risks,” the claim for extensive incentives to mitigate these already-assessed risks should be rejected.