The NYISO Business Issues Committee on Jan. 17 voted to recommend that the Management Committee approve proposed tariff revisions that would provide all fast-start resources with their physical schedules for the day-ahead market (DAM) to avoid scheduling them below their minimum generation levels.

The changes stem from FERC orders requiring NYISO to modify how it reflects and prices fast-start resources in its energy markets for more accurate representation of their contributions. (See FERC Orders Fast-start Rules for PJM, NYISO.) Although NYISO implemented the required changes, it realized that they inadvertently extended DAM eligibility to some units that are now receiving ideal schedules below their minimum generation level, potentially causing operational inefficiencies or market imbalances. (See “Enhanced Fast-Start Pricing,” NYISO OKs Changes on Hybrid, Fast Start Resources, TCCs.)

In the DAM, the “ideal schedule” refers to a planned dispatch based on model or system predictions, whereas the physical schedule represents units’ actual operational outputs, reflecting real-time electricity production.

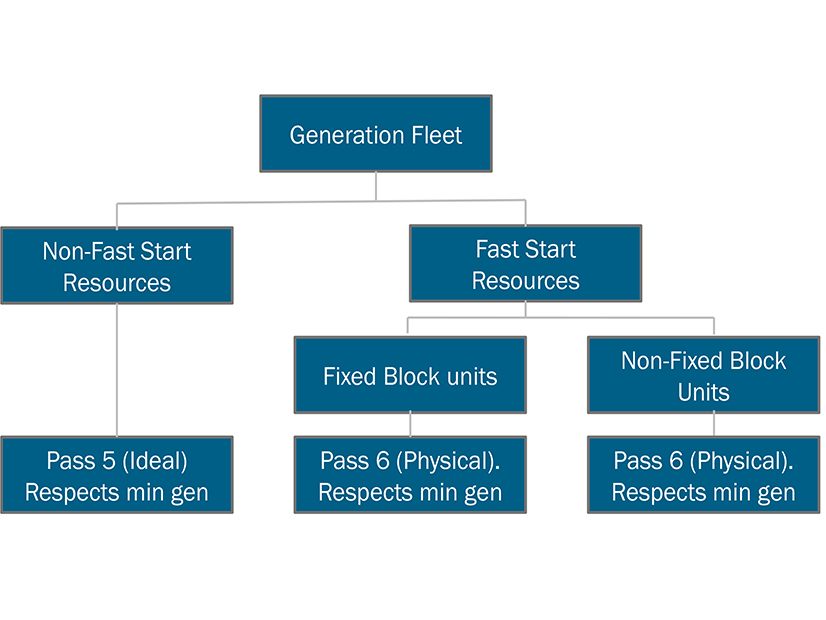

Andres Flores, NYISO market design specialist, explained to the BIC that fast-start resources are divided into fixed-block and non-fixed-block units. Fixed-block units currently receive their physical schedules, but non-fixed block units are given their ideal schedule, which allows a unit’s minimum operating limit to be relaxed to zero.

This led to a problem where some non-fixed-block units in the DAM are given ideal schedules that may result in them being scheduled below their minimum generation level. Allowing these units to receive their physical schedule in the DAM would ensure their minimum generation levels are respected.

In response to questions, NYISO said that the proposed changes would not affect the FERC-required pricing logic adjustments already in place, nor would they require major software updates.

Assuming approval from the MC, the revisions are expected to be filed with FERC in March.

December Market Operations

Nicole Bouchez, NYISO’s senior principal economist, presented the December market operations report to the BIC, highlighting how the month’s average locational-based marginal price (LBMP) was $33.67/MWh, lower than November’s $34.90/MWh and significantly below December 2022’s $110.17/MWh. (See “November Market Operations,” NYISO BIC Stakeholders OK Modeling, Market Design.)

Bouchez also noted that December’s natural gas prices also decreased, falling from $2.21/MMBtu in November to $2.11/MMBtu. That also marked an 83.7% year-over-year decrease in natural gas prices.

She attributed the declines to the significant drop in natural gas prices, adding how this is “not surprising, given how warm our December was.”