CAISO is seeking FERC approval to scrap its process for taking on new interconnection applications this year as it works through the “unprecedented volume” of requests submitted for the previous interconnection study period.

CAISO’s tariff requires it to open a new window for interconnection requests each year on April 1. But in a Feb. 8 filing with the commission, the ISO asked permission to forgo the process for 2024 to give it more time to study existing requests representing more than 350 GW of capacity — about seven times greater than CAISO’s peak load.

“Adding new interconnection requests at this time would exacerbate current challenges and delay studies further,” the filing stated. “Forgoing the 2024 window is a just and reasonable solution to prioritize the huge volume of existing interconnection requests on time.”

Like other RTOs and ISOs, CAISO uses a “cluster” approach to dealing with interconnection requests whereby multiple resources are studied together to assess their impact on the existing grid and determine the need for transmission upgrades.

For each cluster of resources, the two-year process consists of a Phase I interconnection study that determines what interconnection facilities and reliability and delivery upgrades will be needed by each potential interconnection customer. A Phase II study refines the cost estimates in the first study “based upon changes in queue and deliverability allocation results,” according to CAISO.

“Because the most common change in queue is an interconnection customer’s withdrawal, both the Phase II interconnection study and the annual reassessment typically remove no longer needed upgrades from interconnection customers’ studies and cost responsibilities, reducing costs,” the ISO noted in its filing.

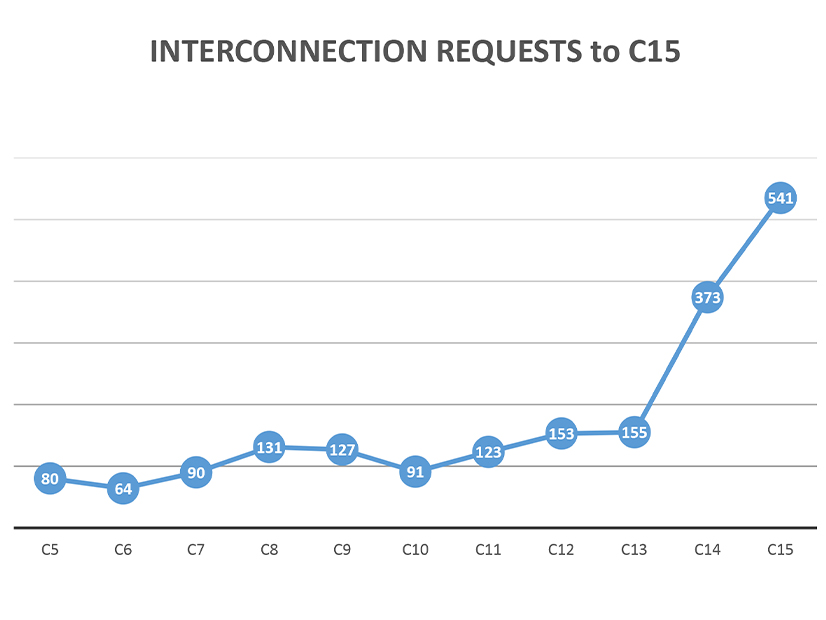

In the Cluster 14 window of 2021, the number of CAISO interconnection requests skyrocketed to 373, up 241% over the previous — record-setting — cluster. To manage the volume, the ISO was forced to cancel its 2022 interconnection window.

And on top of the sheer growth in volume, the ISO also saw that just 40% of resources dropped out of the queue after completion of the Phase I study, compared with a typical drop-out rate of 60%, which the ISO attributed to financial strength in the industry.

In 2023, Cluster 15 set yet another record, reaching 541 interconnection requests.

“Even accounting for the year without a cluster application window, Cluster 15’s extreme volume represents the low bar to submit an interconnection request and the high level of financial opportunity in generation development,” CAISO wrote in its filing. “Developers submitted these interconnection requests understanding they would face an extended study process and longer construction timelines. In [an] accurate but self-fulfilling prophecy, developers also submitted multiple interconnection requests because the CAISO would be unlikely to be able to open another interconnection request window in 2024.”

CAISO last year proposed to forgo the 2024 interconnection window when it began its Interconnection Process Enhancements stakeholder initiative, but deferred to stakeholder wishes to hold off on that move.

“Since then, stakeholders and the CAISO have focused their efforts on necessary reforms to enable meaningful study of cluster 15. The CAISO subsequently reproposed deferring the 2024 interconnection request window. No developer, transmission owner or other stakeholder opposed the proposal,” the ISO noted in its filing.

CAISO has asked FERC to approve the change effective March 31.