California’s “leadership in electrification” will be a key driver of Pacific Gas and Electric’s expected customer growth in the coming years, CEO Patti Poppe said Feb. 22 during the utility’s fourth-quarter and year-end earnings call.

PG&E is forecasting annual load growth of 1 to 3% through 2028, based in large part on expectations for increased electrification and continuing uptake of electric vehicles among its customers, according to slides accompanying the call.

The utility also foresees strong growth in demand from commercial customers, with service applications from new data centers increasing threefold last year over the previous four years.

“As we look at the five-year forward load-growth forecasts, the back end of that forecast will reflect the additional data center demand,” Poppe said. “And look, I think we all can agree that the only thing that’s happening with data centers is they need more of them.”

PG&E estimates $62 billion in capital expenditures over 2024-2028, with the spending supporting “strategic capital investments in electrification, energization, undergrounding and wildfire mitigation,” according to a footnote in the slides. That represents a 20% increase over the utility’s outlook for the 2023-2027 period and translates into a 9.5% compound annual growth rate (CAGR) for its rate base.

The company also foresees opportunities for an additional $5 billion in spending over the next five years on transportation electrification infrastructure, transmission upgrades, incremental business connections, hydroelectric facilities and storage, and information technology and automation.

Despite the anticipated sharp growth in spending, Poppe said the company expects to hold customer rate increases to 2 to 4% annually based on new cost-saving measures and the ability to spread costs over the growing load base.

Poppe attributed the cost-saving to the utility’s adoption of a “lean operating system,” which last year drove a 5.5% reduction in nonfuel operations and maintenance costs after a 10% CAGR in those expenses during the previous five years.

“As a reminder, several years of doing whatever was necessary to respond to back-to-back crises pushed our capital-to-expense ratio far below the industry average,” she said. “This is where we have a wealth of opportunity and a long runway to drive efficiencies with sustainable savings benefiting both our customers and our investors.”

Poppe also touted PG&E’s improving record related to wildfire ignitions.

The utility has been found responsible for its equipment sparking some of the most destructive fires in California’s history, including the deadly 2018 Camp Fire, which burned down most of the rural town of Paradise and killed 85 people. (See Cal Fire Pins Deadly Camp Fire on PGE.)

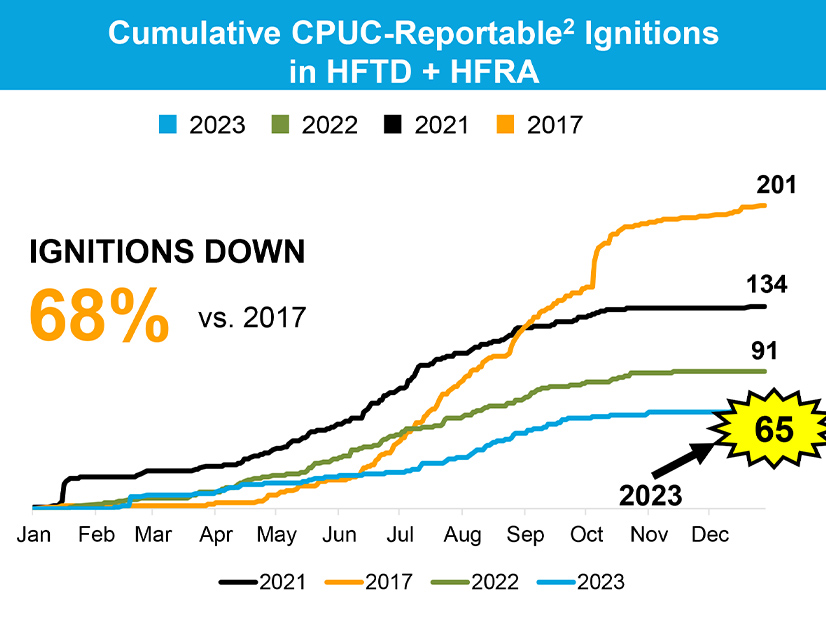

PG&E started no “catastrophic” fires in its service territory last year, while tallying 68 reportable ignitions, compared with 91 in 2022, 134 in 2021 and 201 in 2017. Based on the scoring methodology established by the California Public Utilities Commission, the utility’s wildfire risk fell by 94%.

“While we’re extremely pleased with these results, our team certainly isn’t stopping here. We see further opportunities to drive overall wildfire risk reduction beyond the 94% achieved in 2023 as we continue with additional system hardening and deployment of new technologies,” Poppe said.

PG&E last year undergrounded 364 miles of distribution lines at a cost of just under $3 million per mile, bettering targets of 350 miles at $3.3 million per mile. Poppe said the work will help prevent public safety power shutoffs and other outages for 15,000 customers in areas of high fire risk.

The utility expects to underground around 250 miles of lines this year, part of a plan to bury 10,000 miles of lines — or about 8% of its distribution system, Poppe noted.

Pacific Generation a ‘Great Transaction’

PG&E is still awaiting the CPUC’s decision on the proposed spinoff and sale of a minority stake in Pacific Generation, a standalone subsidiary that would control 5.6 GW of generating capacity, including more than 1.3 GW of battery and pumped storage. FERC last year approved the plan, which would raise an estimated $3.4 billion for PG&E. (See FERC Approves PG&E’s Proposal to Spin off Generation.)

“We think this a great transaction for customers,” PG&E CFO Carolyn Burke said, adding that the advantageous financing costs stemming from the spinoff will also improve the utility’s balance sheet and lower overall costs for utility customers.

Both Burke and Poppe emphasized during the call that PG&E would not be seeking to raise money from equity markets this year because the company’s current stock price makes other financing options more “favorable.”

PG&E reported earnings sat at the top end of previous estimates. The company made $2.242 billion last year ($1.05/share), compared with $1.8 billion ($0.85/share) in 2022. Fourth-quarter earnings per share jumped to 84 cents from 24 cents a year earlier.