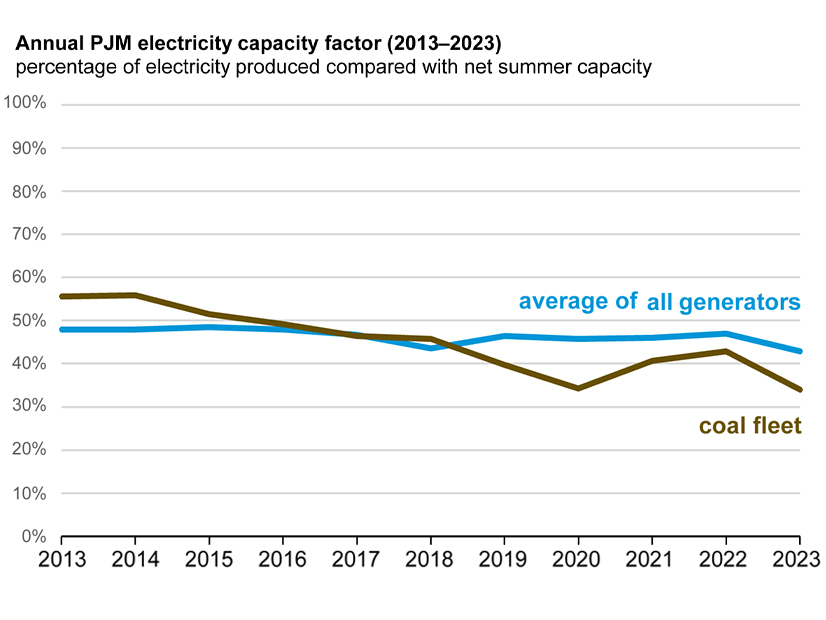

Analysis from the U.S. Energy Information Administration finds that the average runtime for PJM coal-fired generators has declined sharply over the past decade because of increasing fuel and start-up costs.

The agency’s June 17 “Today in Energy” report said the RTO’s coal-fired power plants ran at an average of 34% of their maximum output in 2023, down from 56% in 2013.

That resource class made up 14% of generation available to PJM and 18% of capacity last year, compared with 44% and 38% a year earlier. About 34 GW of coal generation retired over that period, and an additional 2 GW was shifted to other fuel sources. EIA attributed much of the change to competition from the growth of efficient combined cycle gas generation.

The strain of repeat starts and stops can increase maintenance costs for thermal generators designed to operate at a constant rate, meaning that when PJM is selecting the lowest-cost resources for dispatch in the energy market, it’s often uneconomic to start an offline coal plant.

“Coal-fired generating units are generally designed for steady-state operation, and they operate with the fewest problems when they run all the time,” EIA wrote. “Restarts can be costly because large thermal plants can experience problems caused by repeated start-ups and shutdowns, increasing maintenance costs. The restart cost can be a key factor in determining plant operating strategy. … Because those restart costs increase their market offer, coal plants, when competing against other sources, may not be selected to operate.”

The changing economics hit independent power producers particularly hard, with 24 GW of IPP-owned coal generation deactivating over the past decade, leaving 17.6 GW on the grid. IPPs lack the cost recovery mechanisms that allow regulated utilities to mitigate financial risk for their generators, EIA said.

In an email to RTO Insider, PJM’s Dan Lockwood said the findings appear to be in line with a white paper the RTO published last year, which found that retirements of thermal generators could outpace the development of new resources through 2030. (See PJM Chief: Retirements Need to Slow Down.)

“As PJM pointed out in its ‘Energy Transition in PJM: Resource Retirements, Replacements & Risks’ study issued early last year, a confluence of conditions — including state and federal policy requirements; industry and corporate goals requiring clean energy; reduced costs and/or subsidies for clean resources; stringent environmental standards; age-related maintenance costs; and diminished energy revenues — are leading to an overall decline in the use of thermal resources, including an increase in coal unit retirements,” Lockwood wrote.