VALLEY FORGE, Pa. — Illinois’ climate goals could cost other states in PJM and MISO tens of millions in transmission upgrades over the next two decades as coal and natural gas power plants are forced to retire, PJM said last week.

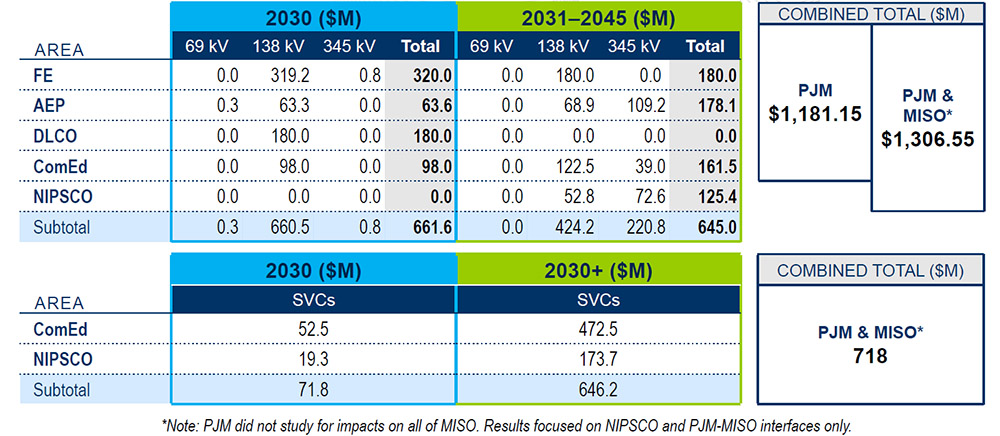

PJM’s Illinois Generation Retirement Study found that the state’s Climate and Equitable Jobs Act (CEJA) could require $700 million in transmission upgrades through 2030 and an additional $1.3 billion by 2045 in the Commonwealth Edison (NASDAQ:EXC), FirstEnergy (NYSE:FE), Duquesne Light Co. and American Electric Power (NASDAQ:AEP) zones in PJM, and the Northern Indiana Public Service Co. (NIPSCO) (NYSE:NI) zone in MISO.

CEJA, which Gov. J.D. Pritzker signed in September 2021, requires Illinois to eliminate carbon emissions from its electricity sector, with coal and natural gas generators shuttered or converted to zero-emission resources by 2045.

PJM predicts the retirement of almost 12,000 MW of generation by 2030 and nearly 23,000 MW by 2045. The RTO’s study identified plants scheduled to retire or that are likely to retire under CEJA based on publicly available emissions data and published heat rates. The RTO said it confirmed its findings with plant operators.

It also looked at potential replacement generation based on the 200,000 MW in its interconnection queue, 95% of which is solar, wind or hybrids including renewables and storage.

‘Initial Snapshot’

PJM said the study is a “very initial snapshot” of CEJA’s impact and that it is not proposing projects for the Regional Transmission Expansion Plan (RTEP) based on it.

“The cost estimates identified in this study will not actually be charged to consumers today,” PJM said. “As the system evolves with retirements and additions, we will have a better sense of the necessary transmission that will be needed to alleviate any reliability violations.”

PJM’s David Egan, who presented the study results to the Planning Committee on Aug. 9, said transmission upgrade costs could be reduced if the new generation is connected in favorable locations near recently deactivated plants. But upgrades might need to be accelerated if existing generators retire earlier than modeled, he said.

Asked about the potential impact of the incentives for carbon capture in the Inflation Reduction Act, which is awaiting President Biden’s signature, Egan said, “As these mandates or laws change, we will be modifying our studies.” (See related story, House Passes IRA, Sends to Biden’s Desk.)

MISO Impact

PJM said it will combine its study with an analysis MISO is expected to complete late this year or early next to determine optimized interregional projects that could cut costs.

“Our study report is emphasizing that both PJM and MISO recognize the need to collaborate on case assumptions and work together on solutions when appropriate,” said PJM’s Dan Lockwood.

“We anticipate MISO will identify additional impacts and costs,” Egan said.

The study does not include MISO’s long-range transmission plan’s (LRTP) Tranche 1 projects or its additional LRTP study work in the Illinois area.

PJM focused its efforts on MISO facilities along the RTOs’ seam and reviewed results with NIPSCO, the MISO transmission owner facing the biggest impact.

Not Included

PJM did not attempt to estimate early retirements because of current CEJA operational limits on natural gas-fired generation. It also did not include new renewable generation expected to be added to the system under CEJA’s incentives. In support of the bill, the Illinois Commerce Commission in July released its first draft of the Renewable Energy Access Plan (REAP) to improve transmission capacity to support increased renewables.

Costs for reliability-must-run contracts for units that PJM may ask to operate beyond their desired deactivation dates also were not included in the study.

State Impacts

“This puts Ohio in a very precarious position of having to pay for the decisions of another state,” said Mike Haugh, of the Ohio Consumers’ Counsel.

Greg Poulos, executive director of the Consumer Advocates of the PJM States, said he hoped the RTO would look for “opportunities to reduce these costs.”

PJM encouraged stakeholders to attend their CEJA workshop on Aug. 22 to learn more about the law and how it would affect their current or future investments.

Thermal Violations

PJM also identified upgrades that would be needed to comply with the thermal, reactive, stability and short-circuit requirements of NERC standard TPL-001-4.1.

Upgrades for thermal violations are estimated at $1.3 billion (64% of the total), almost evenly split between the 2030 and 2031-2045 study periods. About 15% of the total is for ComEd.

Because not much new generation is projected for Illinois, the study predicts increased East-to-West imports will cause “numerous, significant” thermal reliability violations in both the 2030 and 2031-2045 scenarios, PJM said.

The study said 69 upgrades to PJM’s 138-kV system are responsible for 82% of the thermal upgrade costs, with 16 345-kV upgrades accounting for the remainder.

Voltage Issues

Fixing voltage violations is estimated at $718 million (36%). “Unlike thermal violations, which tend to be more linearly aligned with megawatt impacts, voltage violations are nonlinear,” PJM said.

Voltage instability is expected to emerge by 2030, with widespread violations expected in 2031-2045 from a lack of reactive support in the ComEd area and increased imports into Illinois to serve load.

“If not resolved with system upgrades, [the voltage stability problems] could lead to blackouts driven by voltage collapse,” the report said. “This is indicative of the need for additional transmission system expansion — reinforcements to existing lines or construction of new lines — on East-West transmission paths between ComEd and AEP.”

ComEd and NIPSCO proposed static volt-ampere reactive compensators to address the voltage instability concerns and synchronous condensers to replace the megavolt-amperes reactive (MVARs) capabilities lost with the plant retirements, estimating costs at $525 million and $193 million, respectively.

“Voltage issues generally need to be fixed near where” the generation is removed, said Egan.

PJM’s Sami Abdulsalam said renewables’ ability to provide voltage support is limited. “A megaVAR is a megaVAR once it reaches the grid,” he said. But solar and wind cannot provide MVARs when they are not generating power, unless they also have storage, he said.

Impact on Individual TO Zones

PJM reported the need for the following upgrades on individual TOs:

-

-

- ComEd: $100 million through 2030 to address thermal overloads, most for a new 138-kV line from Haumesser to West Dekalb to Glidden. ComEd expects an additional $160 million in thermal upgrades after 2030.

- AEP: $63.5 million to solve thermal overloads through 2030, almost 80% to rebuild the 138-kV AltaVista-Otter-Johnson Mountain-New London line. After 2030: $178 million to solve thermal overloads, about 85% for a new 345-kV Segreto-Cook line and a rebuild of the 138-kV West End Fostoria-Woodville line.

- FirstEnergy: $320 million to address thermal violations caused by an increase in East-to-West power flow by 2030, and about 60% for reconductoring five 138-kV circuits: two between Leroy Center and Mayfield, and three from Charleroi to Union Junction, Westraver and Yukon. After 2030, FirstEnergy estimates $180 million in upgrades to address thermal violations, more than 80% to reconductor the following 138-kV lines: Mitchell-Shepler Hill Junction, Peters-Union Junction, Yukon-Smithton, Leroy Center-Mayfield and Richland-Lockwood (AEP).

- Duquesne: $180 million, most for new 138-kV facilities, including a new Elrama substation, two new ties and one new line. About 35 circuit miles of 138-kV reconductor is also needed.

- NIPSCO: $125 million in upgrades over the study periods to address thermal-based reliability criteria violations.

-