New York will be short 1 GW of resources by 2034, driven by increased demand, large load growth and lack of natural gas, according to the preliminary results of NYISO’s biennial Reliability Needs Assessment.

“Preliminary results show criteria violations that will result in reliability needs,” Ross Altman, senior manager of reliability planning for NYISO, told the Electric System Planning Working Group and Transmission Planning Advisory Subcommittee on July 25. “However, we are not defining those needs today. These are still preliminary results.”

New York City will experience a security margin baseline deficiency beginning as early as 2031, driven by the retirement of the New York Power Authority’s small gas plants. Altman said this could be expected to grow to 275 MW by 2034 because of demand growth.

“This is driven both by New York City load growth and also the assumption of the retirement of several small gas plants that NYPA is required by law to retire or replace,” Altman said.

Altman said that the final results of the RNA, to be presented in August, would identify some needs but that there would be more detail in the solicitations for next year.

Assumptions

The preliminary RNA assumes that many large generation projects will be online and contributing to the grid, including both the Empire Wind 1 and Sunrise Wind 2 offshore wind projects.

“This is a fairly small list, but we are tracking a much wider pool of projects,” said Altman. “This is a fairly conservative assumption. These are only the projects that we have high confidence on because they’ve met their milestones.”

Approximately 6,400 MW of generation fueled by non-firm gas was modeled as unavailable. Altman said this modeling change was consistent with recently adopted changes to New York State Reliability Council rules. Dual-fuel sources with non-firm gas were modeled running on their alternate fuels.

“We wanted to highlight dual-fuel units that have non-firm gas contracts; we do not assume those out,” said Altman. “We just model what their capability is when they’re operating on their alternate fuel source.”

Additionally, roughly 2,100 MW of additional large loads were added to the system. Electrical imports from Chateauguay, Quebec, were set to 0 MW during winter months.

“We are setting those imports to zero in winter peak months consistent with our coordination with Hydro-Quebec and what we’re seeing in operations,” said Altman.

Preliminary Results

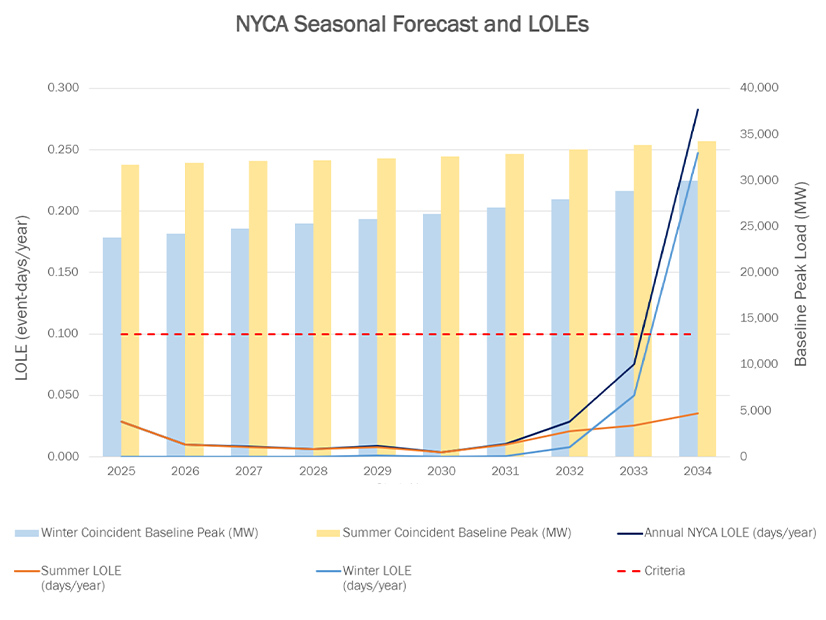

Ten years from now, NYISO estimates a loss-of-load expectation as high as 0.283.

“We need resources at that point to bring the LOLE to 0.1,” said Laura Popa, a manager of resource planning for NYISO.

Popa walked stakeholders through alternate 2034 scenarios in which additional risk factors and potential solutions were modeled, including the inclusion of 9,000 MW of offshore wind, construction delays on the Champlain Hudson Power Express transmission project and the removal of certain large loads. Delaying the CHPE project would significantly impact the LOLE, bumping it up to 0.327 by 2034. Adding extra wind power or removing 1,900 MW of large load would bring the state below the 0.1 LOLE threshold.

Most questions from stakeholders centered on the math and assumptions of the model. Some wondered whether gas was being appropriately modeled as unavailable. Altman pointed out that New England was particularly dependent on natural gas and that it would continue to be used for heat, even if new construction was electrified.

“I don’t think anyone should take these results as ‘the sky is falling,’” Altman said. NYISO would prefer market-based solutions to the problem and believes it could identify an appropriate solution if it went through a solicitation process, he said.