FERC ordered a “paper” hearing Tuesday to determine whether it should require a 99% confidence level in setting collateral requirements for financial transmission rights traders or the 97% level that PJM and most of its stakeholders have sought.

The commission accepted and suspended PJM’s proposed tariff revisions subject to refund. It issued an eight-page list of questions to be answered, saying that the evidence provided thus far failed to address its concerns that PJM’s requirements may be insufficient to protect stakeholders against losses (ER22-2029, EL22-32).

On Feb. 28, FERC rejected PJM’s proposal to modify the FTR credit requirement with an initial margin calculation from a historical simulation model (HSIM) using the 97% confidence interval, saying the RTO failed to support its proposal because its independent auditors validated the model at a 99% confidence interval. It directed PJM to make a filing within 60 days to show cause why its existing FTR credit requirement remains just and reasonable or explain what tariff changes will remedy the commission’s concerns (ER22-703). (See FERC Rejects PJM’s FTR Credit Requirement Proposal.)

At the Members Committee meeting March 23, stakeholders endorsed a motion for PJM to refile the original proposal “accompanied by some new supporting rationale.” The motion received a sector-weighted vote of 3.9 out of 5 (78%). (See Stakeholders Encourage PJM to Defend FTR Filing.)

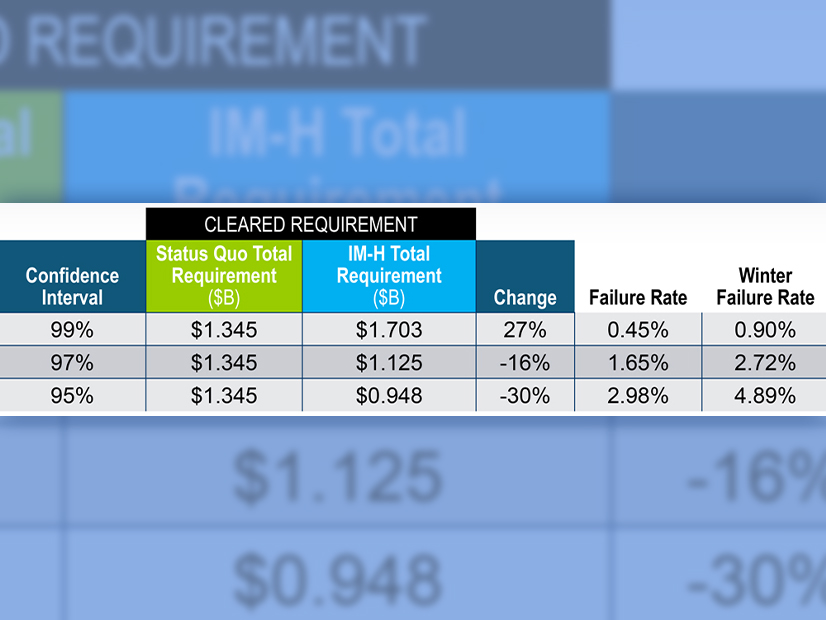

Supporters of the filing said PJM credit revisions had demonstrated a significant drop in the failure rate of FTR portfolios and a reduction in potential collateral shortfalls.

But the Organization of PJM States Inc. (OPSI) and the Independent Market Monitor said the 97% confidence interval was unsupported. The IMM said PJM failed to justify why it selected 97% when the International Swaps and Derivatives Association uses a 99% confidence interval in its HSIM.

Among the questions asked by the commission was whether, compared to the 99% confidence interval, 97% causes the PJM market and its customers to subsidize collateral for FTR market participants and exposes the entire PJM membership to potential default costs.

It also asked how structural differences between the PJM FTR market and exchanges regulated by the Commodity Futures Trading Commission might justify the use of a lower confidence interval.

In compliance with the order, PJM told stakeholders it would implement the new FTR credit requirement effective today, coinciding with the close of the 2023/26 FTR long-term auction bidding window that opened Monday.

The RTO said it will make any collateral calls required by the revised credit requirement Thursday, after the bidding window closes.