PJM capacity prices increased nearly tenfold in the 2025/26 Base Residual Auction as a trifecta of load growth, generation deactivations and changes to risk modeling shrank reserve margins.

PJM capacity prices increased nearly tenfold in the 2025/26 Base Residual Auction (BRA) as a trifecta of load growth, generation deactivations and changes to risk modeling shrank reserve margins.

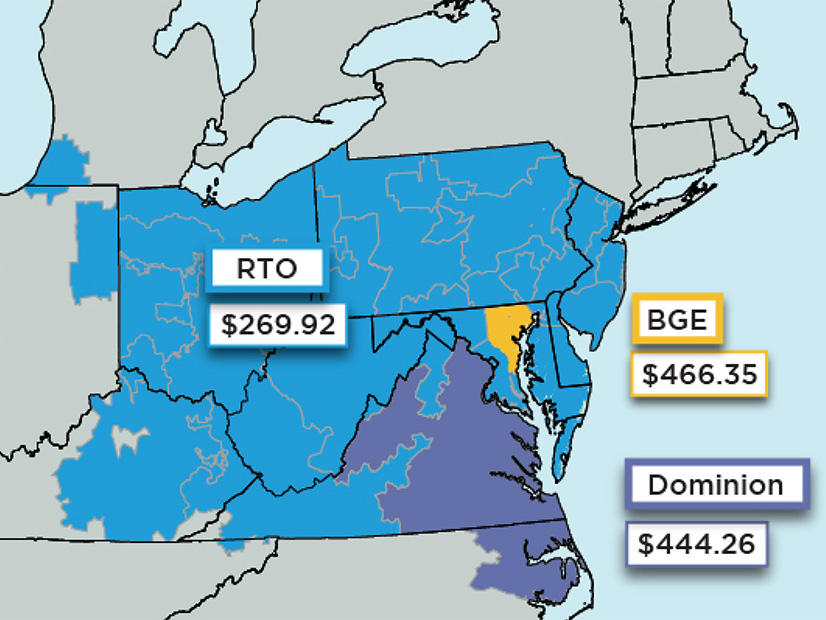

The clearing price for most of the RTO jumped to $269.92/MW-day, far above the $28.92/MW-day for the 2024/25 auction. Two regions surged to their price caps, reaching $466.35/MW-day in the Baltimore Gas and Electric (BGE) zone and $444.26/MW-day in the Dominion zone. (See PJM Capacity Prices Jump in 5 Regions.)

“The significantly higher prices in this auction confirm our concerns that the supply/demand balance is tightening across the RTO. The market is sending a price signal that should incent investment in resources,” PJM CEO Manu Asthana said in a July 30 announcement of the BRA results.

PJM forecasts a peak load of 153,883 MW for the 2025/26 delivery year, up 3,243 MW from the previous year. The auction procured 135,684 MW of capacity at a record $14.7 billion to serve that load, with an additional 10,886 MW supplied through fixed resource requirement (FRR) plans.

The total installed capacity was around 182 GW, resulting in an 18.5% reserve margin, just over the 17.8% installed reserve margin (IRM) target. The Dominion and BGE zones landed just under their reserve requirement and are transmission-constrained, causing prices to jump to the zonal cap.

PJM Executive Vice President of Market Services and Strategy Stu Bresler said the auction procured adequate supply and sent a signal that investments in capacity are needed for future delivery years. He cautioned that capacity costs remain just one component of consumers’ bills and the results should not be read as causing a multifold increase in retail rates.

“Auction prices were significantly higher in this auction and those steep increases, we believe, do signal the need for investments,” he said during a press conference July 30.

The auction followed a yearslong trend of declining supply, with around 6.6 GW retiring or being approved for a must-offer exemption, which signals their intent to deactivate. Bresler said the tension between supply and demand demonstrates the reliability concerns the RTO highlighted in a February 2023 Energy Transition in PJM white paper. (See “PJM White Paper Expounds Reliability Concerns,” PJM Board Initiates Fast-track Process to Address Reliability.)

Bresler said PJM is searching for solutions to speed the generation interconnection process to facilitate new resource development; however, 38 GW of resources have cleared the generation interconnection process but have yet to enter commercial operation.

“Interconnection process reform is proceeding, but hurdles remain for many projects outside of our process,” Bresler said in the announcement accompanying the auction results. “We are considering ways to accelerate those who can successfully overcome those challenges and build.”

In addition to tighter supply and demand, Bresler said the cost increase was driven by a shift in how PJM models reliability risks and matches them with resources accreditation (ER24-99). (See FERC Approves 1st PJM Proposal out of CIFP.)

The changes use PJM’s marginal effective load-carrying capability (ELCC) framework to accredit all resources, except energy efficiency, and rely on its hourly probabilistic modeling to calculate capacity needs through the reserve requirement study. The new approach concentrated reliability risk into the winter and led to several resource classes seeing reduced accreditation. (See “Revised Reserve Requirement Study Values Endorsed,” PJM MRC/MC Briefs: March 20, 2024.)

Auction Conducted After Several Delays

The timing of the auction has been repeatedly delayed from the original May 2022 schedule to implement several market changes, including reversing an order establishing a forward-looking energy and ancillary services (EAS) offset, followed by the Critical Issue Fast Path changes. (See FERC Approves PJM Capacity Auction Date Changes.)

An additional delay approved in February pushed the opening of the auction from June 12 to July 17 to grant market participants more time to understand how the RTO will calculate effective load-carrying capability (ELCC) ratings to accredit the capacity resources can provide. (See FERC Approves PJM Capacity Auction Delay.)

EPSA Says Increased Prices Reflect Increased Risks, Manufacturers Skeptical

Electric Power Supply Association (EPSA) CEO Todd Snitchler said the increased capacity prices are an encouraging first step in meeting the mounting reliability risks PJM has identified.

“While there is still work to be done, these price signals recognize the situation PJM faces and should begin to incentivize the investment needed to deliver a reliable system in PJM and in other U.S. markets,” Snitchler said in a statement. “Reliability watchdogs, regulators, policymakers and PJM itself have been sounding the alarm that the misalignment of power resource retirements and additions poses a serious reliability risk to the grid — especially in the face of rising demand spurred by data center and manufacturing growth among other factors like electrification, extreme weather and policy choices.”

Ryan Augsburger, president of the Ohio Manufacturers’ Association, said in a statement that auction delays will translate to higher capacity costs for consumers.

“Markets work — but after years of delay of PJM’s critical capacity auction, prices are rising to attract generation in a hurry. PJM’s capacity auction will yield billions more for generators that locate in its territory to serve healthy customer electric load, but customers will bear the brunt of PJM’s costly auction delays,” he said.