PJM Conducts Voltage-reduction Test

VALLEY FORGE, Pa. — The first biennial test of voltage-reduction capability was a success, PJM told the Operating Committee during its Sept. 12 meeting.

Senior Dispatch Manager Kevin Hatch said the Mid-Atlantic region saw a 280-MW load reduction during its Aug. 14 test, coming out to about a 0.7% reduction in real-time load. PJM’s expectation was about 635 MW (1.6%).

The western and southern regions were tested the following day, together achieving a 360-MW (0.85%) load reduction against a 920-MW (2.2%) expectation. Hatch called the test a “good, coordinated drill.”

Conducting regular voltage-reduction testing was one of the recommendations following the December 2022 winter storm, during which an alert was issued stating that a reduction could be imminent. Following the storm, PJM told stakeholders that had a handful of additional generators tripped offline, a voltage-reduction action may have been necessary. The last time that happened was in January 2014, during the polar vortex event. (See PJM Recounts Emergency Conditions, Actions in Elliott Report.)

A PJM news release regarding the test stated that no impact to consumers was reported, and the test provided the RTO and transmission owners valuable insight into how voltage actions are conducted.

“Overall, the tests allowed PJM and its transmission owners to benefit from increased communication and understanding about the time to implement the voltage-reduction test, coordination with field personnel and evaluating the impact on the overall system,” PJM wrote. “The test also provided an opportunity to validate the operation of transmission and distribution equipment and verify equipment operating characteristics and parameters.”

Generators experienced a 1.5% drop in reactive power capability during the test, which PJM said demonstrates a need for increasing reactive reserves to ensure transfer capability remains available. The loss amounted to 3,150 MVAr in the Mid-Atlantic and 1,300 MVAr in the west and south.

Exelon’s Alex Stern said the operational performance data presented at the OC this month supported that PJM’s grid is delivering reliability, but stakeholders need to be proactive in ensuring that can be maintained.

“To me this data corroborates some of what we heard [PJM CEO Manu Asthana] talk about, which is we have a really reliable grid; we just need the generation to be there, and we need to make sure we send the signals that will get the generation built … but the grid itself is functioning well,” Stern said.

Monthly Operations Metrics

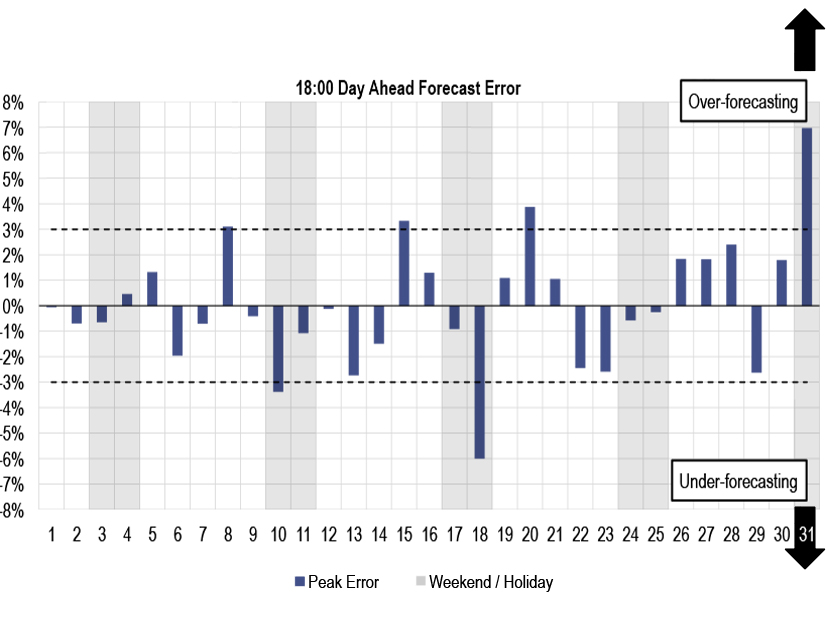

PJM’s Marcus Smith said load forecasts remained accurate through heat waves at the start of August, including a 149-GW peak on Aug. 1, though unexpectedly low temperatures during the Labor Day holiday weekend contributed to a 7% overforecast on the last day of the month.

Most of PJM’s forecast error is driven by weather, particularly temperature, cloud cover and thunderstorms. In response to stakeholder inquiries, Smith said the RTO will look at also presenting its backcasts of how significant of a factor weather has played.

August also saw three spin events, one of which exceeded the 10-minute mark that triggers penalties for underperforming resources. The Aug. 18 event began at 4:04 p.m. and went through 4:20 — 15 minutes and 51 seconds. A total of 1,417 MW of generation and 529 MW of demand response was committed to respond to the event, with respective response rates of 59 and 90%. A total of 630 MW of reserves face penalties for underperformance during the event.

PJM also declared a nine-minute, 39-second spin event Aug. 12, with 1,386 MW committed and a response rate of 75%; and a four-minute, 13-second event Aug. 26, with 2,650 MW committed and a 92% response rate.

PJM’s David Kimmel said the response rate has been low recently, which can be attributed to generation start times, as well as some resources having difficulty maintaining their committed output for the duration of the event.

A maximum generation alert was also issued Aug. 27 because of a 9.7% generation outage rate, peaking at 17,611 MW offline, and a high load forecast. Hatch said the alert was meant to put neighboring regions on notice that interchange may have to be curtailed to serve internal load. He said both MISO and SPP were operating tightly ahead of the notice and implemented load-management procedures that reduced the need for interchange.

Cybersecurity Briefing

Presenting the monthly security briefing, PJM Director of Enterprise Information Security Jim Gluck recommended that members ensure they have a plan for alerting the RTO to any cybersecurity breaches so staff are aware of any disruptions to expect and precautions that may be necessary to protect the grid.

The concern stemmed from a breach at Halliburton in which customers were notified of disruptions to oilfield operations through news reports, rather than by the company. Gluck said PJM has procedures in the manuals to notify members of any breaches on its end, and sensitive information that may need to be shared can be done so through the Electricity Information Sharing and Analysis Center.

2025 Preliminary Project Budget

PJM’s Jim Snow presented the preliminary 2025 project budget, which calls for $50 million in capital expenditures, including “historic” investments in technology.

The forecast budget for 2024 is $44 million, while $40 million was spent in 2023 and $38 million the year prior.

The largest share of the budget is $21 million for application replacements and retrofits, the largest of which are the energy management system (EMS) and model management software. Part of the increased funding request is the result of PJM identifying an off-the-shelf product that can accomplish much of the second phase of replacing its EMS software, leading expenditures to be concentrated in 2025 rather than spread out as planned.

The second-largest funding area is current applications and system reliability at $18 million, including upgrades to PJM’s Dispatcher Application and Reporting Tool (DART), data analytics, credit and risk enhancements, and cybersecurity measures. The budget proposal also calls for $8 million in funding for facilities and technology infrastructure, $2 million for new products and services, and $1 million on interregional coordination.

Snow said several items were considered for inclusion in the budget, but staff feel comfortable deferring action to avoid a larger spending increase in 2025. That includes spending approximately half a million on developing energy market incentives supporting reserve certainty and about $400,000 on expanding credit surveillance of market participants.

The Finance Committee is scheduled to deliver a recommendation letter to the Board of Managers on Sept. 23, with board action on the budget expected in October.