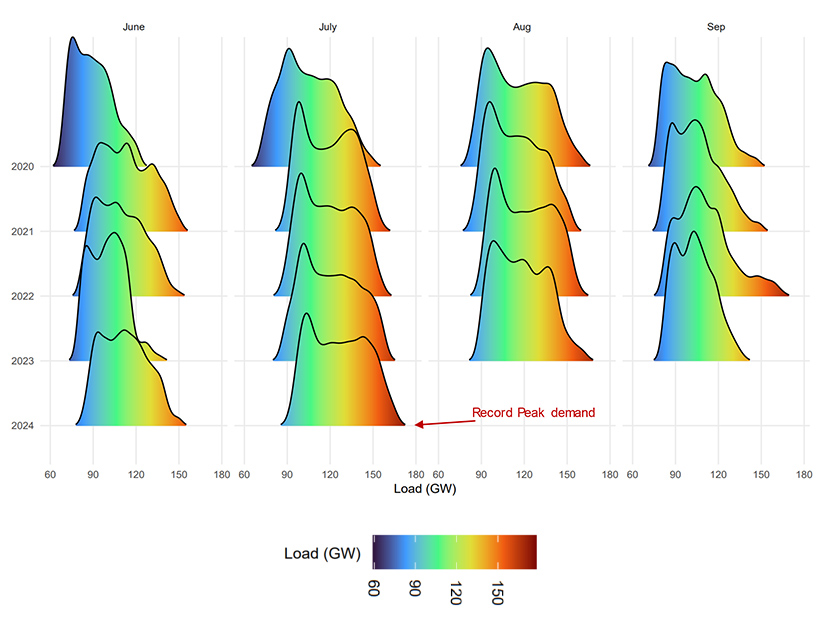

The Western Interconnection reached a record-breaking peak load July 10 despite relatively moderate demand in CAISO, the ISO said during a Sept. 18 meeting of its Market Performance and Planning Forum.

“When you look holistically across the West, it happens to be the warmest July on record, and that really drove the high loads in the Western Interconnection,” Guillermo Bautista Alderete, director of market analysis and forecasting at CAISO, said.

The Western grid’s peak reached 167,988 MW, slightly higher than the previous record in 2022. July saw many hours with high demand, Alderete said, and so the peak wasn’t necessarily an outlier for the month.

Despite record-breaking conditions across the West, temperatures in the CAISO system where the demand was concentrated were “not that extreme,” keeping ISO loads moderate, with a peak of about 45,000 MW — well below the historical peak of 52,000 MW.

“At the end of the day, it is not only how high the demand is, but also how well-equipped we are to handle that level of demand,” Alderete said.

‘Substantial Volumes of Exports’

Favorable resource adequacy conditions in CAISO helped support high loads in the West.

“We need to have enough resource adequacy capacity to be able to meet our actual load plus our reliability obligation. … When you put that obligation together and compare that against the resource adequacy capacity that we have available, you can see we were within a healthy margin,” Alderete said. “We were never even really close to hitting the resource adequacy showing level, and that means that the levels of demand that we have in the system were moderate enough that the resource adequacy capacity was sufficient to meet that obligation.”

CAISO experienced a marginal increase in RA capacity from 2023 to 2024, a trend the ISO expects will continue over time. Given the moderate levels of demand in the ISO’s balancing authority area in July, and even on the most critical days of July 23-25, RA capacity was enough to meet the load obligation.

CAISO’s prices increased as expected in July, reaching peaks on July 24. In June, average prices were typically below $50/MWh, while in July, they rose to $200/MWh for hours ending 7 and 8 p.m. Prices in the Pacific Northwest remained low compared with California and the Desert Southwest.

“Practically speaking, even those prices are moderate given all the conditions that we have when we look at the real-time,” Alderete said.

Import and export levels were close to historical norms as well. Most imports with self-schedules or bids at or below $0/MWh were cleared in both the day-ahead and real-time markets, though up to 640 MW of bid-in RA couldn’t clear given path derates on the Malin intertie because of the impact of the Park Fire.

CAISO cleared “substantial volumes of exports” in July due to conditions driven by record loads across the Western Interconnection, resulting in several days of net exports.

While the ISO had to reduce exports on very few days, its hour-ahead scheduling process on July 24 reduced up to 900 MW of exports.

The Western Energy Imbalance Market (WEIM) provided operational benefits and offset risk for members by facilitating assistance energy transfers (AETs), which allow a participating BA to receive energy when it does not meet the market’s resource sufficiency requirements ahead of a trading interval. Ten WEIM balancing areas opted into the AET program in July, the largest rate of participation since the program’s inception, Alderete said.

The ISO in July also identified three issues related to the Residual Unit Commitment (RUC) process and incorrect reporting of exports.

“I would say, in the grand scheme of things, they are relatively minor items, but we want to provide the transparency,” Alderete said.

On July 4, the RUC process triggered undersupply infeasibility — which indicates a potential supply shortage — without attempting to reduce low-priority exports to maintain supply, but the issue was fixed the following day.

The month also saw an incorrect reporting of export reductions in the customer portal that was fixed July 9, as well as an incorrect loss of high-priority status for certain exports. In particular, under different permutations of bidding in day-ahead and real-time markets, different bid validation rules triggered the unintended loss.

CAISO is assessing whether to revise the validation rules and has resolved all other issues, Alderete said.