The U.S. Energy Information Administration expects consumers will spend roughly the same on winter heating this year as they did last year, according to its Winter Fuels Outlook.

“Overall, we expect that there’s going to be, generally speaking, lower fuel prices that are going to be offset by higher consumption this winter,” EIA Administrator Joseph DeCarolis said in an Oct. 9 webinar.

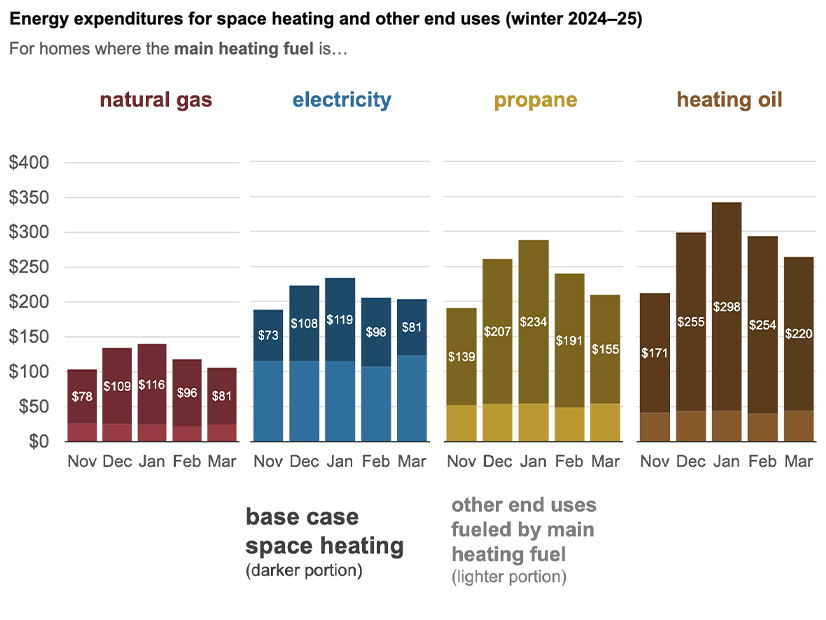

The two biggest sources of space heating across the country are natural gas and electricity, at 45 and 43% of all households. On average, bills for both sources should go up slightly this winter.

The Midwest is expected to see higher bills than last year, as consumers there are expected to spend 11% more on natural gas, compared to the 1% national average, and 6% more on electricity, compared to the 2% national average. The Midwest had an exceptionally mild winter last year, so the return to more normal temperatures in the region is expected to lead to a bigger jump in demand for heating, the outlook said.

While wholesale prices have fallen this year, weather forecasts call for more cold, with EIA expecting heating degree days to tick up 5% compared to last year. But it still is expected to be a generally mild winter, with the forecast calling for heating degree days to be 2% below the average of the previous decade, DeCarolis said.

For the first time, EIA broke out the share of the average bill for each fuel that goes toward space heating. While customers spend more on electric bills overall, the space heating portion of EIA’s estimates are almost the same as those for natural gas, though the South has the biggest share of electric heating.

Temperatures can have a big effect on winter prices, though when it comes to electricity and natural gas, the effect is felt more in the wholesale markets. The impact lags on retail prices because, for the most part, they are overseen by state regulators, EIA analysts said in the webinar.

The prices for propane, which is used by 5% of households concentrated in the Midwest, and heating oil, used by 3% of total households almost entirely in the Northeast, vary more significantly with temperature because wholesale prices are more closely linked to residential prices.

Some five major storms have led to major effects on natural gas and power systems over the past 15 years, but those are difficult for EIA to predict. (See Déjà Vu as FERC, NERC Issue Recommendations over Holiday Outages.)

“Something like a major winter storm or an acute weather event is difficult to build into our forecast because the impact on price is of something like that would be highly dependent on where the storm hits,” EIA’s Corrina Ricker said. “For example, if it were to impact production, or if it’s close to large demand centers, those types of factors would really play into how the natural gas price would be impacted.”

Winter storms can cause major price spikes, but those are short-lived, and their effect on residential prices usually is felt later when regulators allow utilities to recover costs from such events, she added.

A major trend in home heating is the adoption of heat pumps. But given how many other factors beyond the equipment can affect a home heating bill, EIA wasn’t able to tease out any differences between that technology and traditional electric heating. EIA said it was working on how to isolate the effect of different heating equipment on consumer utility bills.

“The consumption and expenditures associated with these technologies depend to a large extent on household characteristics and the climate in which they are located,” the winter outlook said. “For example, an electric resistance heater used in a small, well-insulated home in the South could result in lower expenditures than an air source heat pump placed in a larger, drafty home in the Northeast.”