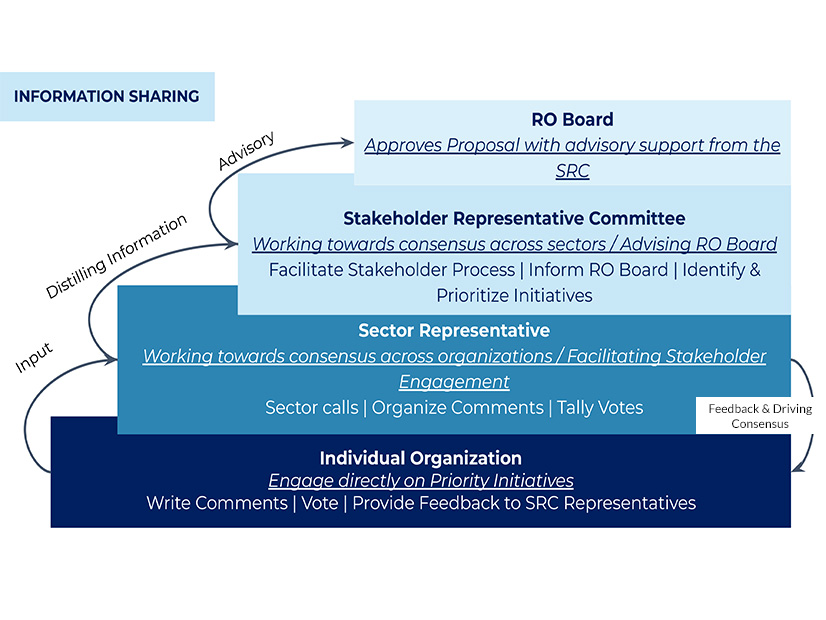

The West-Wide Governance Pathways Initiative has revised its “regional organization” stakeholder process proposal to expand the size of a key stakeholder committee and boost representation for some groups.

The revision also provides more detail about the makeup and functioning of the Stakeholder Representatives Committee (SRC), among other changes.

The changes recommended by the Pathways Initiative Launch Committee in its Oct. 14 “Revised Sector Proposal” came in response to extensive stakeholder comments on the initial proposal released in August. (See Comments on Western RO Stakeholder Plan Show Complexity of Effort.)

“The Launch Committee’s recommendations regarding sectors and sector representatives are intended to promote the goals of the SRC and recognize the uniquely diverse stakeholder community that has a vested interest in the RO,” the committee wrote in the revised proposal. “It is also intended to ensure robust dialogue and guard against changes to the market that would decrease efficiency, result in any market manipulation practices and negatively impact benefits to customers.”

The revised plan would increase the number of seats on the RO’s proposed SRC from 16 to 19. More specifically, it bumps up the number of SRC representatives from the Extended Day-Ahead Market (EDAM) Entities sector (from one to two), the Western Energy Imbalance Market (WEIM) Entities sector (from two to three) and the sector representing non-investor-owned utilities serving load from the EDAM or WEIM (three to four).

The Launch Committee said it proposed to increase the number of seats for the WEIM Entities sector to reflect the size of the WEIM, which has 20 participants.

“The three SRC representatives are intended to provide the flexibility to ensure that both public power and IOUs have representation, as well as enable geographically diverse representation from the Northwest, [the] Desert Southwest and California,” the committee wrote.

The committee’s proposal to increase the number of non-IOU seats on the SRC was intended “to ensure the unique voices of public power, municipal utilities, cooperatives and community choice aggregations are represented. However, if an entity participates collectively through an EDAM entity (e.g. BANC members), they cannot also participate in a different sector as individual entities (i.e., generators or [municipal utilities]).”

The revised proposal also clarifies definitions of the nine SRC sectors set out in the original proposal.

For example, it draws from CAISO’s tariff to clarify the definition of an EDAM entity as being a balancing authority “that represents one or more EDAM Transmission Service Providers and that enters into an EDAM Entity Agreement with the CAISO to enable the operation of the Day-Ahead and Real-Time Markets in its Balancing Authority Area.”

Similarly, a WEIM entity is described as a BA “that represents one or more WEIM Transmission Service Providers and that enters into an WEIM Entity Agreement.”

According to the proposal, EDAM and WEIM entities can be investor-owned utilities, federal power marketing agencies or publicly owned utilities.

The revised plan also removes the reservation of SRC seats for independent power producers (IPPs) and marketers in the sector shared among IPPs, marketers and independent transmission developers — which continues to hold three seats.

Other Changes

The revised proposal additionally recommends creating the roles of an SRC chair and vice-chair to “serve as the primary point of contact with the RO staff and provide administrative leadership for organizing the SRC” but “not have any decision making or enhanced authority.” The stakeholders filling each role must be from different sectors.

The positions would rotate yearly and be selected by the SRC, with each sector casting a single vote.

The proposal also calls for limiting SRC membership to “market participants” (those with a direct stake in the EDAM or WEIM) but recommends creating another stakeholder category of “other load-serving non-market participants” who would sit outside the SRC. That arrangement would allow “people or organizations who do not participate in the WEIM or EDAM and therefore do not fit within one of the designated sectors” to register with the RO to offer a nonbinding vote on issues before the SRC.

“The votes will not count toward an SRC recommendation [to the RO board] or remand threshold but will be shared with the RO staff and Board for information only. This group of individuals or organizations may participate in the stakeholder process and submit comments that will be included in the package of information that goes to the RO staff and/or board when appropriate,” the proposal said.

The Launch Committee also calls for a reevaluation of the SRC sectors and structure at two points in the future: during implementation of the RO and two years later.

“Reevaluation could include both consolidation of sectors and reorganization of sectors to reflect necessary changes based on meeting the goals. It should also consider whether it successfully prevents sector shopping and astro-turfing, and whether it creates the right balance across sectors for achieving the market goals,” the proposal said.

The revised proposal also recommends removing a provision in the original plan that would trigger an “automatic remand” of an RO initiative back to the stakeholder process if voting on the proposal shows “significant opposition” among stakeholders. That’s defined as a lack of support from a simple majority of sectors or one-third of SRC sectors registering at least 70% of their members voting in opposition.

“We recommend removing the automatic remand but still using the ‘significant opposition’ thresholds to trigger additional discussion at the SRC about whether remanding back to the stakeholders would be beneficial to the process and the initiative,” the Launch Committee wrote.

The committee is seeking comments on the sector proposal until Oct. 25.