The PJM Independent Market Monitor released the second iteration of its report on the 2025/26 Base Residual Auction, digging deeper into the impact of excluding reliability-must-run (RMR) resources from the capacity market.

The report ran a sensitivity modeling the Brandon Shores and H.A. Wagner generators as offering capacity into PJM’s supply stack, along with including capacity offers from all intermittent and storage resources categorically exempt from the capacity must-offer requirement.

The report found that combining the two led to a 53.9% increase in total capacity costs, amounting to about $5.14 billion. The two generators, owned by Talen Energy, were not required to offer into the 2025/26 auction as they will be operating on an RMR contract. (See PJM Requests 2nd Talen Generator Delay Retirement.)

The second sensitivity analyzed the effect of limiting combustion turbines and combined cycle generators to their summer ratings when PJM’s risk modeling is concentrating risk in the winter, paired with modeling the expected output of the two RMR generators. The analysis estimated that the two led to a 77.6% increase in capacity costs, or about $6.42 billion.

Combining the three components — excluding the two RMR units, and categorically exempt resources from the capacity market and capping gas generation at summer ratings — corresponded with auction prices being 108.1% higher, or a $7.63 billion increase.

The Monitor argued that exempting resource classes from participating in the capacity market and not modeling RMR units allows generation owners to limit access to transmission that could be used by other resources to deliver capacity and create significant differences in the supply stack year-to-year. It argued that the risk of an intermittent capacity resource being subject to capacity performance (CP) penalties for being offline during an emergency at a time when it could not respond could be countered by accounting for availability when assessing performance.

“The inclusion of a must-offer obligation for categorically exempt intermittent and capacity storage resources should be coupled with the removal of (performance assessment interval) penalty liability for such resources when it is not physically possible to perform,” the Monitor wrote. “The capacity market has included balanced must-buy and must-sell obligations from its inception. The current rules can and should be changed to restore that balance.”

During the Organization of PJM States Inc. (OPSI) annual meeting Oct. 21, Monitor Joe Bowring said capacity interconnection rights (CIRs) are a scarce resource that control access to the grid for generators. He argued that those holding CIRs should be required to exercise them.

PJM Executive Vice President of Market Services and Strategy Stu Bresler responded that it would not make sense to count on resources that cannot perform when there’s an auction with an annual commitment to perform. Exempting intermittents from the CP construct would be trading one set of exemptions for another, he said. Instead, PJM is committed in the long term to designing a more granular, seasonal capacity market structure.

The Monitor’s report also recommended expanding the granularity of PJM’s effective load carrying capability (ELCC) accreditation to include hourly data, so that unit-specific accreditation can be implemented, replacing class accreditation with a system of paying resources to be available on an hourly basis, and untying accreditation and summer ratings to allow winter CIRs to determine capability when risk is concentrated in the winter.

“The need for the energy from capacity is not limited to one peak hour or five peak hours. Customers require energy from capacity resources all 8,760 hours per year,” the Monitor wrote. “Rather than develop a complicated seasonal capacity market based on an arbitrary definition of seasons, the hourly value of the energy from capacity should be explicitly recognized in the capacity market.”

The total impact the changes PJM made on the auction led prices to be around double what they would be based on supply and demand fundamentals alone, Bowring said.

PJM Defends Capacity Market Design in Response to Part A of IMM Report

In its Oct. 11 response to the initial portion of the Monitor’s report, PJM argued that while the underlying analysis in the report appeared to be largely correct, the Monitor drew incorrect conclusions and omitted necessary context in its recommendations.

“PJM also does not take exception to the results of the simulations the IMM conducted as they are summarized in the report. They are directionally consistent with those that would be expected given the inputs used,” PJM wrote. “However, the IMM presents an incomplete set of sensitivities, provides insufficient context, and draws several conclusions that either lack support or are incorrect.”

The Monitor’s analysis, released Sept. 20, modeled four sensitivities looking at the impacts of PJM’s marginal ELCC accreditation methodology, exempting generators operating on RMR agreements from being required to offer into the auction, capping accreditation at resources’ summer ratings, and not subjecting intermittent and storage resources to the must-offer requirement.

The Monitor wrote that shifting generation accreditation from equivalent demand forced outage rate (EFORd) to marginal ELCC led to a 49.1% increase in total capacity costs, a finding PJM said conflates the changes made to accreditation and risk modeling. PJM said its revised risk modeling approach accounted for the bulk of the increased capacity costs associated with a market redesign approved by FERC in January 2024 following the Critical Issue Fast Path (CIFP) process conducted last year. (See FERC Approves 1st PJM Proposal out of CIFP.)

“The IMM does not estimate sensitivities capable of differentiating the impacts of these distinct market rule changes, but nevertheless attributes the impact to ‘PJM’s ELCC approach’ and ‘the ELCC availability metric,’” PJM wrote.

PJM went on to defend the marginal ELCC approach, stating that the probabilistic modeling at its core is becoming industry standard, with variants approved by FERC for implementation in MISO and NYISO, with ISO-NE considering similar changes. It argued the EFORd approach of using average availability to determine accreditation predominantly incentivizes performance throughout the year without sufficient focus on high-risk periods.

“Under the tight supply-demand conditions that materialized for the 2025/26 BRA, even relatively small impacts to the supply-demand balance can have outsized impacts on clearing prices because of the inelasticity of both supply and demand,” PJM wrote. “PJM believes that the nearly 2.7 GW impact of the enhanced risk modeling and concordant accreditation changes were appropriate and necessary to reflect emerging patterns of risk and lower-than-expected generator performance during such risk events.”

While the Monitor argued that PJM’s practice of modeling the expected output of RMR units when determining capacity transfer between zones is inconsistent with not including those resources in the supply stack, PJM stated that it views the issue as secondary to recognizing the disparities between capacity resource obligations and RMR agreements. Those contracts require units to operate during limited operational events and carry different obligations from capacity that are incomparable to capacity obligations, PJM said.

The response said more analysis is needed to determine the impact of using winter ratings for gas resources. Adding capacity to high-risk winter hours could shift ELCC weighting toward the summer, where high loads are a greater driver than forced outage rates. That could have the effect of pushing the reliability requirement higher.

PJM said the Monitor’s allegation that intermittent resources could be engaged in market manipulation by withholding their capacity is unsupported and misses valid reasons generation owners may not exercise the must-offer exception.

“The report fails to consider legitimate reasons why exempt resources may not have been offered into the capacity market. … Specifically, PJM believes that the IMM must assess the portfolio profitability impacts of the purported ‘withholding’ in order to determine whether the action could plausibly be connected to the exertion of market power. Additionally, the IMM should request information from market sellers in cases where the IMM suspects exercise of market power to consider whether there were other factors that explain the market sellers’ decisions,” PJM wrote.

PJM said the Monitor had not included an additional sensitivity the RTO had required be included in the report: the cumulative impact four recommendations the Monitor had made in its report on the 2024/25 BRA would have had if implemented in the 2025/26 auction. Those recommendations were establishing a sharper variable resource rate (VRR) curve, extending the must-offer requirement to intermittent resources, and excluding capacity offers from demand response (DR) and external resources.

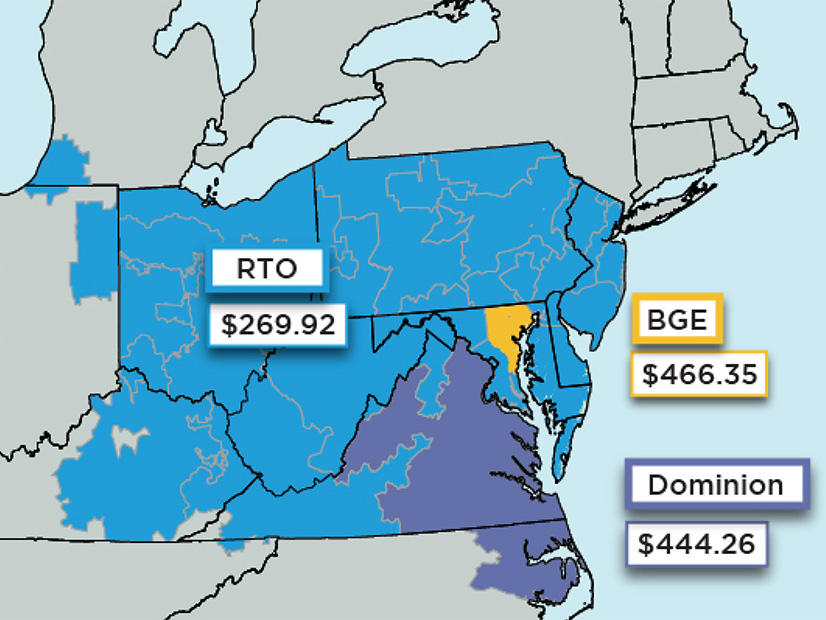

Excluding DR from the auction would have reduced the excess unforced capacity (UCAP) by 8,769 MW, while doing so for external generation would have removed an additional 1,410 MW of excess UCAP. Combining the two would have left the RTO 6,983 MW short of the reliability requirement, pushing the clearing price to the $375.91/MW-day cap and resulting in a total capacity cost 42% higher than the actual results.

PJM said that gap would not have been made up for by other recommendations the Monitor made to increase available supply, such as requiring intermittent and storage resources to offer. That would have added 2,800 MW of available capacity, leaving a shortfall of 4,183 MW.