Dominion Energy reported net income of $953 million in the third quarter this year as it continued to see load growth from data centers, made progress on its offshore wind project and repaired damage from Hurricane Helene.

The storm caused significant destruction of the company’s infrastructure, knocking out power to nearly 450,000 customers, including nearly half of those Dominion serves in South Carolina, CEO Robert Blue told investors.

“The restoration involved replacing over 1,000 transformers, 2,300 poles and 7,000 spans of wire,” Blue said. “Although we’ve not completed our final accounting, our preliminary estimate of restoration costs, including capital expenditures, is in the range of $100 (million) to $200 million.”

Dominion’s Coastal Virginia Offshore Wind (CVOW) is 43% complete and remains on schedule and on budget, Blue said. The firm just completed a season of monopile installations, having installed 78 for the project’s turbines and an additional four pin piles for related transmission substations.

“Additionally, we’ve laid the first two of nine marine deep water export cables ahead of schedule,” Blue said. “I’m very pleased with our progress during this first season. Not only did we achieve our installations target, we also gained invaluable experience and process expertise that will make the next installation season even more productive.”

The rest of the monopiles are being produced and delivered to Portsmouth, Va., while Dominion expects nacelle and blade production to start in the first quarter of next year.

To help with offshore wind construction, Dominion is building a ship called Charybdis, which will be compliant with the Jones Act, a law that limits shipments inside U.S. waters to domestic vessels. The ship is 93% complete and should be operational by early 2025, Blue said.

“The project’s expected LCOE [levelized cost of energy] has improved to approximately $56 per megawatt hour,” Blue said. “The primary driver being forecasted REC [renewable energy certificate] prices, which have increased in value considerably.”

Dominion serves the largest data center market in the world, and so far this year, it has interconnected 14 of the facilities, with two more expected to come online before the end of 2024, Blue said.

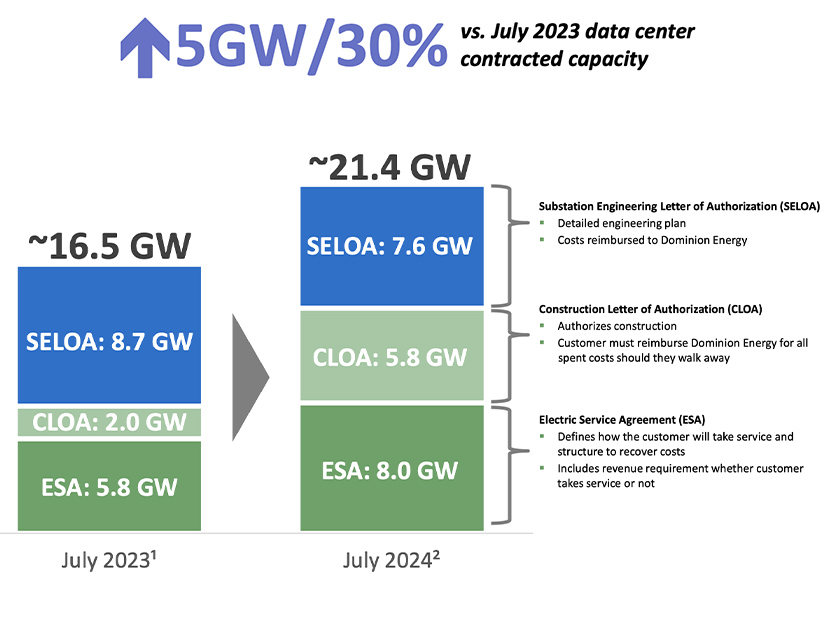

“We’re currently studying approximately 8 GW of data center demand within the substation engineering letters of authorization stage, which means a customer has requested the company to begin the necessary engineering for new distribution and substation infrastructure required to serve the customer,” Blue said. “There are also about 6 GW of data center demand that have executed construction letters of authorization, which are contracts that enable construction of the required distribution and substation electric infrastructure to begin.”

In total, the firm had about 21 GW of data centers in the more advanced stages of its planning process as of July, which was up from 16 GW a year earlier, he added.

“These contracted amounts do not contemplate the many data center projects that are in development phase and have not yet reached a point in the service connection process where a contract is executed,” Blue said.

Dominion owns the Millstone nuclear plant in Connecticut, which could benefit clean energy legislation in New England, as neighboring Massachusetts is considering legislation that would authorize long-term contracts with it. (See Mass. Clean Energy Permitting, Gas Reform Bill Back on Track.)

“We’ve continued to engage with multiple parties there to find the best value for Millstone. In addition to state-sponsored procurement, we’re exploring the idea of supporting incremental data center activity as well,” Blue said. “We feel strongly that any data center option needs to be pursued in a collaborative fashion with stakeholders in Connecticut. At this point, we don’t have a timeline for any potential announcements, but this remains top of mind for us.”