Speakers at the PJM Public Interest and Environmental Organizations User Group’s meeting Dec. 10 said the growth of local transmission projects is a major contributor to grid upgrades making up an increasing share of rates.

RMI’s Claire Wayner said transmission and distribution are making up an increasingly larger amount of consumers’ energy spending even as the number of line miles built is decreasing. Compared to regional projects that are reviewed at multiple levels to ensure reliability is delivered at least cost, local projects lack transparency and oversight, she argued.

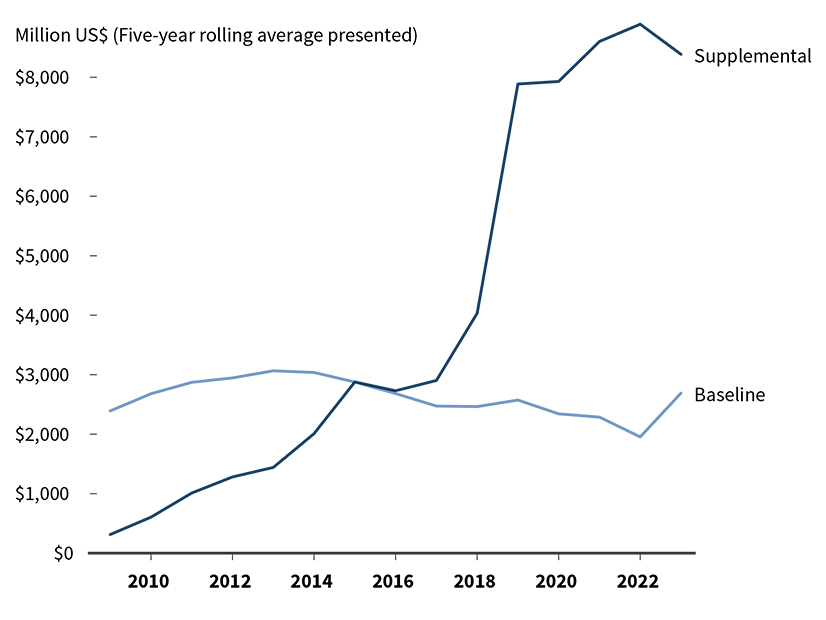

Wayner co-authored a report for RMI, released in November, that recommended several changes to the regulation of local projects. It showed that while transmission spending nationwide hit a new high in 2023 — accounting for 24% of consumers’ bills in 2020 compared to 10% in 2005 — the share of transmission spending that went to high-voltage projects has declined, falling from 72% in 2014 to 34% in 2021. In PJM, spending on local projects increased 26-fold between 2009 and 2023.

Many states don’t require certificates of public convenience and necessity (CPCNs) for local projects, which Wayner said effectively exempts them from review at public utility commissions. In addition to expanding CPCN requirements, she said states can also create electric transmission authorities and establish expedited cost recovery for projects that have undergone regional review.

Wayner recommended that FERC require independent transmission monitors, consider performance-based regulation, and rework its formula rate process to eliminate the presumption of prudence and RTO adder for local projects that do not undergo regional review.

She also argued that PJM could improve its processes by creating windows for utilities to submit local needs to be reviewed by the RTO as it plans regional solutions; standardizing definitions and tracking of local projects; and providing states with more opportunities for input on regional planning.

Greg Poulos, executive director of the Consumer Advocates of the PJM States (CAPS), said he has submitted cost-related questions on dozens of local, supplemental projects in PJM’s Planning Community portal and often received what he deemed inadequate or incomplete responses. In some cases, answers simply referred him back to the PJM website, which does not provide the detailed cost breakdowns he was seeking, he said.

“There is no ability to get more specific cost information than the sticker price of these projects,” he said.

Poulos also identified 31 instances in 2023 in which supplemental projects presented to PJM’s Transmission Expansion Advisory Committee were either already under construction or had been completed. He questioned what value there can be from stakeholder input on local projects that have already been completed.

CAPS has hired a consultant to further investigate how PJM’s tracking of supplemental projects can be improved, he said.

Advocates Lay out 2025 Priorities

Poulos also presented several issues that consumer advocates intend to focus on next year, including changes to PJM bylaws and governance, removing barriers to storage development, improving participation in demand response programs and a sub-annual capacity market design.

With rising capacity prices and the elimination of energy efficiency from PJM’s markets, Poulos said it is increasingly important for stakeholders to find opportunities for load to participate in the markets.

“It’s a part of the equation that has just been ignored for way too long,” he said.

Because consumer advocates make up one of five member sectors at PJM but only hold about 4% of non-sector-weighted votes at lower committees, he expressed skepticism that the stakeholder process could yield such changes directly.