The California Energy Commission has updated its energy demand forecast for data centers after receiving revised figures from Pacific Gas and Electric about data center growth.

PG&E submitted data center information to the CEC in September. But an update the utility provided this month “shows substantially more requested capacity since their [September] submission,” according to a Dec. 23 presentation to the CEC’s Demand Analysis Working Group.

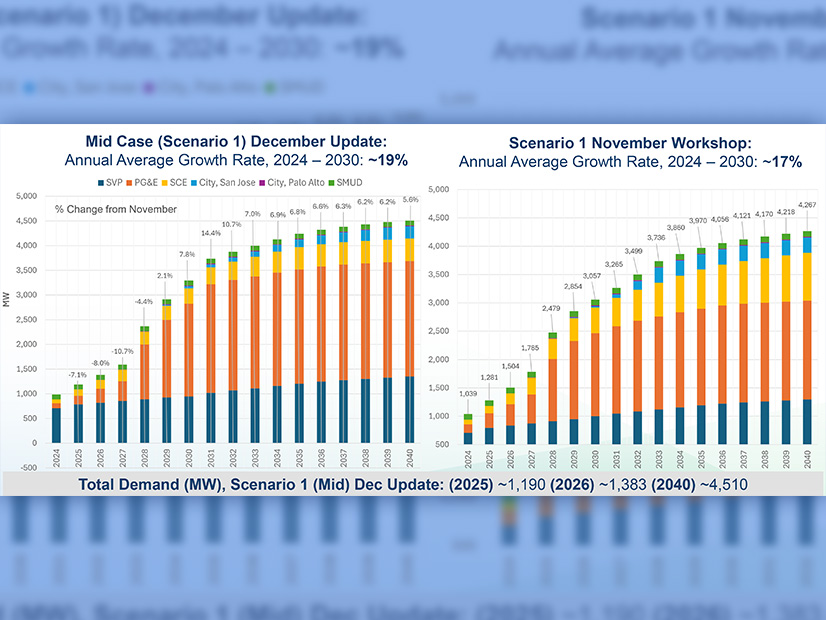

Compared to projections discussed by the working group in November, PG&E’s peak data center demand in 2040 has increased by about 600 MW, to roughly 2,300 MW, under a “mid” demand scenario.

The forecast hasn’t been finalized, and the CEC is still accepting comments.

The CEC is wrapping up its 2024 California Energy Demand Forecast, of which data center demand is one component. The commission is expected to adopt the forecast at its Jan. 21 business meeting.

Once completed, the forecast is used in statewide energy planning, such as CAISO’s transmission planning process and the California Public Utilities Commission’s resource adequacy and integrated resource planning.

Heidi Javanbakht, program manager in the CEC’s Demand Analysis Branch, said CEC staff have been talking to leadership at CAISO and the California Public Utilities Commission about implications of data center demand growth.

“Planning for this potential magnitude of load growth … in the Bay Area over the next five to six years is going to require really close coordination between the agencies and the utilities,” Javanbakht said.

She also said “it’s a priority across the agencies and the ISO” to support the data center industry.

Revised Forecast Methods

In addition to incorporating new data from PG&E, the CEC’s updated data center demand forecast uses a different methodology compared with the previous forecast.

Previously, the CEC assumed all proposed data center projects would be completed. The rationale was that if one project fell through, another one would likely come along to replace it.

“However, considering the number of new applications reported by PG&E, we decided to revise the previous methodology and assume that not all projects will be completed,” said Jenny Chen, supervisor in CEC’s sector modeling unit.

Under the new methodology, which applies to PG&E and Southern California Edison (SCE), the likelihood of a data center project being completed is judged based on where it is in the planning process. The likelihood of completion is higher if engineering studies for the project are in progress or completed; lower if there’s an active application but no engineering studies; and even lower in the case of an inquiry without an application.

The change also helps address concerns that data center developers may be contacting more than one utility about a single project, which could lead to double counting.

With the new methodology, PG&E’s projected peak data center demand decreased from 2024 to 2027 compared with the CEC’s projections from November. But from 2028 to 2040, peak demand was up compared with the previous projections in both a “mid” and “high” demand scenario.

For SCE, projected data center peak demand is lower in most years with the new methodology. In 2040, peak demand is projected at just under 500 MW for the “mid” scenario, a drop of about 394 MW compared with the forecast using the previous methodology.