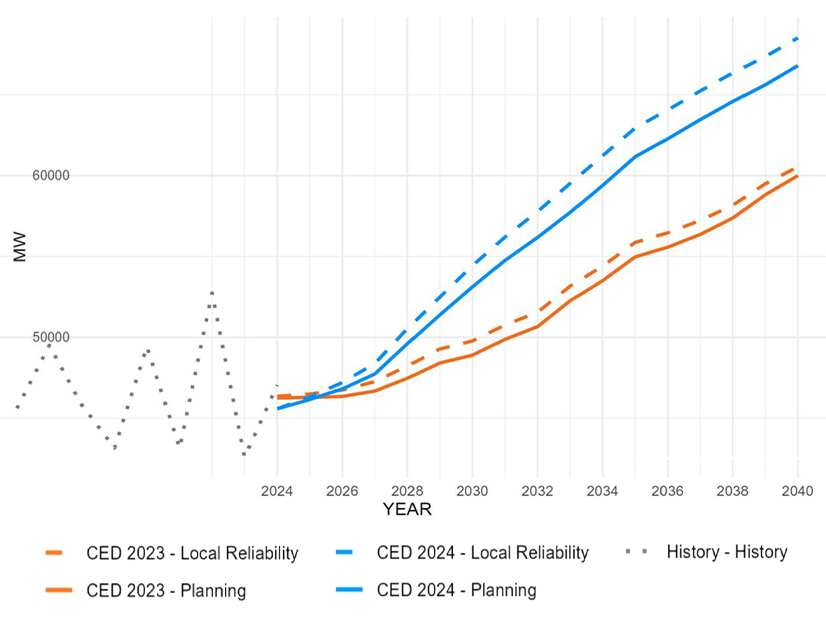

CAISO peak demand will grow from 48.3 GW in 2024 to about 68 GW in 2040, according to a new forecast that attributes much of the increase to data center load.

The figure is part of the California Energy Commission’s annual update to the California Energy Demand forecast. The forecast, which is part of the Integrated Energy Policy Report (IEPR), is considered a cornerstone of the state’s energy planning process.

The commission approved the 2024 update Jan. 21.

At the same meeting, the commission welcomed its newest member: Nancy Skinner, who served in the state Senate from 2016 to 2024. Skinner replaces Commissioner Patty Monahan.

The CEC’s peak demand projections for 2040 are 66.8 GW in what’s known as the planning forecast and 68.5 GW in the local reliability forecast.

That compares to a peak demand recorded in 2023 of 44.53 GW, followed by 48.32 GW in 2024. CAISO’s all-time peak demand was 52,061 MW on Sept. 6, 2022, amid a record-breaking heat wave.

The new projections are substantially higher than those made in 2023, when estimated peak demand in 2040 was around 60 GW.

One difference is that the 2024 forecast “improved [the] characterization of the expected growth of data centers,” the CEC said in its draft IEPR update released in November.

“A significant amount of the peak growth is coming from the additional data center load that we have added this cycle,” Nick Fugate, lead forecaster in the CEC’s Energy Assessments Division, told commissioners.

Data centers typically run around the clock, including during peak hours, and therefore contribute to peak demand, Fugate said.

The CEC updated its forecasts in December after receiving new information from Pacific Gas and Electric about data center trends. The PG&E update indicated substantially more requested data center capacity compared to figures the utility submitted in September. (See CEC Ups Data Center Demand Forecast After PG&E Revisions.)

Sales Forecast

The annual peak demand growth rate in the CEC forecast through 2040 is 2.3% and 2.4% in the planning and local reliability forecasts, respectively.

The growth is even steeper for statewide electricity sales, which see a 3.2% and a 3.3% annual increase through 2040 in the planning and local reliability forecasts, respectively.

Fugate noted that peak load doesn’t grow as quickly as electricity sales in the forecast because much of the EV charging that contributes to electricity sales is expected to take place in off-peak hours.

Electricity sales will increase from about 245 TWh in 2024 to 420 TWh in 2040, under the local reliability forecast. In comparison, the CEC’s 2023 forecast predicted only about 350 TWh of electricity sales in 2040.

The CEC’s planning forecast makes “mid-range” assumptions and is used for system-level planning, such as resource adequacy.

The local reliability forecast may be used for utility distribution system planning or local area reliability studies in CAISO’s transmission planning.

Compared with the planning forecast, it assumes less behind-the-meter solar and storage, less energy efficiency and more electrification, resulting in higher predicted demand. That makes up for some of the uncertainty in forecasting for smaller areas, the CEC said.

Behind-the-meter Solar

Another change to the 2024 energy demand forecast was improved projections of behind-the-meter solar and storage. Historical data was updated based on better interconnection data from several utilities.

The CEC estimated there was 17.2 GW of behind-the-meter solar capacity in California at the end of 2023, including a record-setting 2.5 GW that was interconnected that year.

And behind-the-meter solar capacity factors were updated based on “a large real-world sample,” the CEC report said. Capacity factors are the ratio of electricity actually generated by a system to the system’s maximum capacity.

The new, lower capacity factors used in the 2024 forecast translated to lower estimates of electricity generation compared to the 2023 forecast.

On the energy storage side, the CEC found roughly 1.5 GW of behind-the-meter storage in the state through 2023, and about 84% of that was interconnected in the last five years.

In other changes made in the 2024 forecast, the CEC used the latest information about zero-emission appliance regulations to update building electrification projections. The forecast also accounted for growth in transportation electrification.