Public Service Enterprise Group saw an “over-12-fold” increase in mature leads and inquiries from customers exploring “large load and data center projects” over the past year, CEO Ralph LaRossa said in the utility’s fourth-quarter earnings call Feb. 25.

The suggestion of a potentially expensive surge in demand comes after several quarters in which LaRossa has touted the utility’s South Jersey nuclear generators — Hope Creek and Salem — as primed to accommodate the needs of data centers and artificial intelligence developers. Company officials have suggested they are an important part of the utility’s future expansion and of helping the state boost its economy. (See Data Center Opportunity is Strong, Expanding, PSEG CEO Says.)

The volume of inquiries totaled 4,700 MW in the last year, compared to about 400 MW in 2023, LaRossa said. The average size of the leads in 2024 was 100 MW, and the customer inquiries even included some “large electric vehicle interconnections,” he said.

“Approximately 25% of the 4,700 MW of new business leads have been incorporated into PJM’s 2025 system peak load forecast,” he noted.

NJ Wind Port

Responding to an analyst’s question, utility executives rebuffed suggestions that the utility’s ability to develop such projects would be affected by recent FERC rulings.

The commission Feb. 20 voted to launch a review of issues associated with the co-location of large loads such as AI-enabled data center at generating centers in PJM. (See FERC Launches Rulemaking on Thorny Issues Involving Data Center Co-location.) The inquiry was triggered in part by the number of such proceedings that emerged in the RTO’s territory. (See Constellation Complaint Seeks Formal Data Center Co-location Rules.)

The ruling gave PJM and its transmission owners 30 days to answer a series of questions about whether the RTO’s tariff needs updating to accommodate co-location arrangements.

“We continue to have discussions with multiple parties for various elements of what we’re talking about, and that interest remains strong,” CFO Daniel Cregg said.

“It would have been great to have complete answers throughout everything from what FERC said,” Cregg added. “I don’t know that we necessarily expected that, and we’ve got to wait for some [details]. But I think directionally, what they said was favorable for the flexibility to do what you want to do, and those details have yet to be written, so we’ll continue to see what happens there.”

LaRossa said he hoped for more “clarity” from FERC on the issue in the future but added that “it’s not stopping anything.”

New Jersey has spent more than $500 million to develop the New Jersey Wind Port adjacent to PSEG’s nuclear plants, off the Delaware River, with a goal of serving the state’s nascent offshore wind sector. However, state wind projects have largely stalled amid economic and supply chain difficulties, as well as opposition from the Trump administration. (See NJ Abandons 4th OSW Solicitation.)

LaRossa noted that the New Jersey Economic Development Authority announced recently that it is looking for alternative uses for the port.

“That’s one thing that we just want to point out,” he said. “And we know that there’s some interest, from the governor’s standpoint and from New Jersey’s standpoint, to continue for us to look to pursue these opportunities.”

The sheer volume of inquiries shows that “there’s interest from the industry in New Jersey” and that the state’s effort to market itself to large load clients “has been working,” LaRossa said.

Fall in Earnings

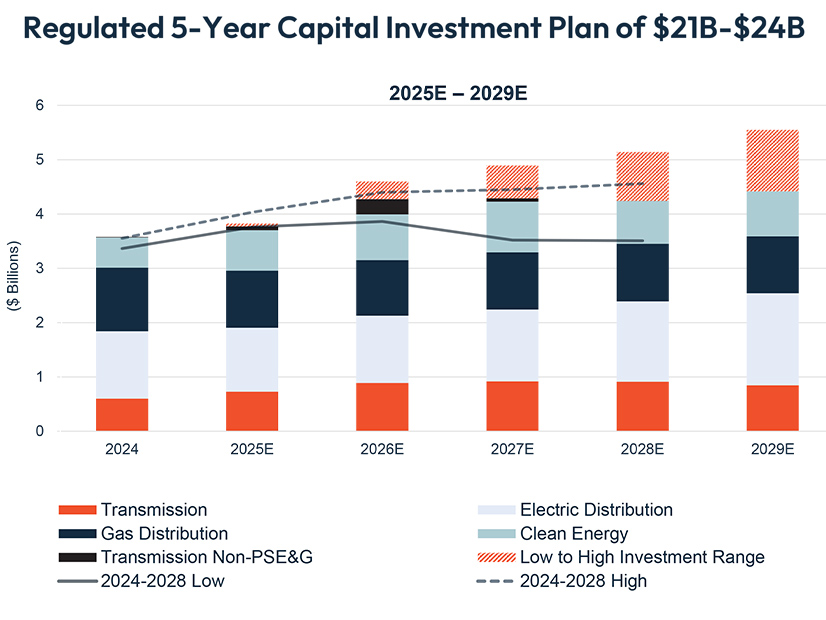

Cregg said the utility plans to invest $3.8 billion in 2025 in regulated investments on “infrastructure modernization, energy efficiency and meeting growing demand and electrification initiatives.”

That expenditure is part of an expanded five-year regulated capital investment plan of $21 billion to $24 billion between 2025 and 2029, an increase from the previous planned $18 billion to $21 billion, he said.

PSEG’s fourth-quarter results for 2024 fell from $546 million ($1.10/share) in 2023 to $286 million ($0.57/share). Non-GAAP operating earnings for the quarter were $421 million ($0.84/share), compared with $271 million ($0.54/share) in the same period last year.

Full-year 2024 earnings were also lower than those of 2023. The company reported net income of $1.772 billion ($3.54/share), compared with $2.563 billion ($5.13/share). Non-GAAP operating earnings were $1.839 billion ($3.68/share), compared with $1.742 billion ($3.48/share).