A new report suggests that Houston should become the “epicenter” of a federally funded hydrogen hub stretching from the Gulf Coast of Texas into Louisiana, potentially transforming the region into “global leader” in the production, application and export of clean hydrogen.

Released Monday by the Center for Houston’s Future and the Greater Houston Partnership, the report signals that the city is preparing a push to win a portion of the $8 billion in funding that the U.S. Department of Energy plans to award to four to eight sites across the country to accelerate the production and distribution of “clean” hydrogen for use in transportation, industrial processes and electric generation.

“This report gives additional weight to the already strong case that Houston is uniquely positioned to lead a transformational clean hydrogen hub with global impact,” Mayor Sylvester Turner said in a press release accompanying the report. “We can also deliver economic growth, create jobs and cut emissions across Houston and the Gulf Coast, including in underserved communities.”

While the authors say they are “technology-agnostic” on how hydrogen will be produced in the region, the report focuses on the production of “green” hydrogen through electrolysis (powered by renewable energy sources) and “blue” hydrogen produced by steam methane reforming of natural gas, accompanied by carbon capture.

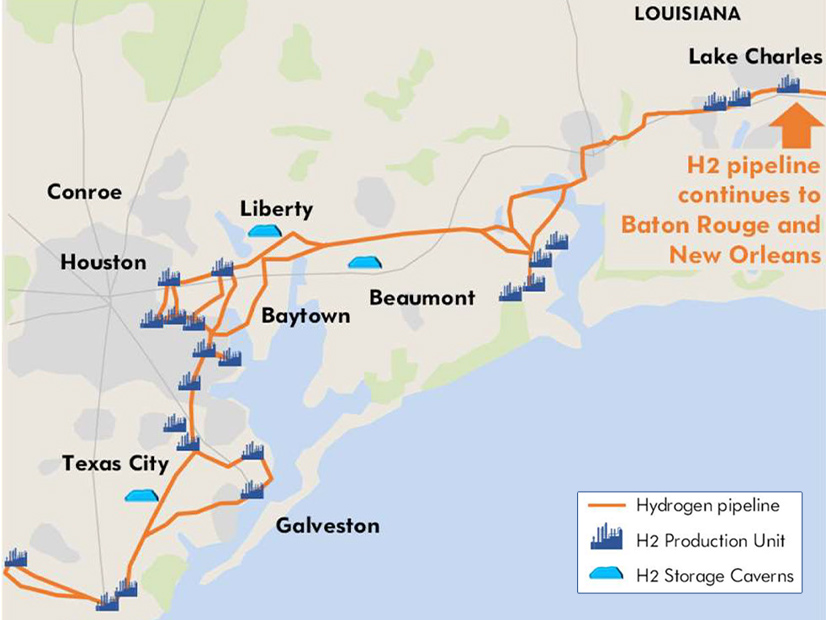

The report attempts to emphasize that a Houston hub could be uniquely positioned to help DOE meet its ambitious target of producing $1/kg clean hydrogen by 2030. It notes that, as a global center for the production and transportation of oil and gas, Houston boasts “natural advantages” for developing the cost-effective production and distribution of clean hydrogen. Among those advantages, the Texas Gulf Coast has access to more than 900 miles of dedicated hydrogen pipelines extending into Louisiana, which represent more than half of all hydrogen pipelines in the U.S. and one-third of such pipelines in the world.

“Unlike natural gas pipelines, which allow open access, hydrogen pipelines are not regulated by the Federal Energy Regulatory Commission and provide only ‘bundled’ sales and transportation via bilateral contracts between the pipeline owners/operators (primarily large, industrial gas companies) and their industrial clients,” the report says. “This existing infrastructure points to a competitive advantage in the form of knowledge and expertise with respect to hydrogen pipelines.”

The report also notes that Texas’ extensive network of natural gas pipelines could “potentially be repurposed” to transport natural gas. (A 2013 study by the National Renewable Energy Laboratory raised concerns that high concentrations of hydrogen within natural gas pipelines can cause embrittlement and increase the possibility of leaks.)

Houston could also benefit from its proximity to geographic formations that can accommodate the storage of hydrogen and CO2, the report notes. Texas possesses three of the four salt caverns in the world currently used to store hydrogen, with a combined working storage capacity of 485 GWh.

Top Producer

According to the report, Texas also enjoys the advantage of presently being the largest supplier of hydrogen in the U.S., producing 3.6 million tons (MT) of hydrogen per year, about one-third of the country’s annual output. On the flip side, the region’s extensive petrochemical and refining industries provide a strong, existing base of demand for the fuel.

“Texas is likely to be a demand hub for hydrogen given its high share of U.S. industrial activities and population growth, as seen in potential demand clusters such as Greater Houston, Corpus Christi and the Texas Triangle. Proximity to demand could help hydrogen producers in the region drive early adoption,” the report says.

Yet another advantage for Texas, according to the report, is the abundance of low-cost wind generation in the western part of the state, a key component for powering the electrolyzers needed to produce a fuel that can qualify as zero-carbon green hydrogen.

Pointing out that electricity represents the single greatest cost in the production of electrolysis-based hydrogen, the report’s authors estimate that the average cost of wind generation in Texas without the federal production tax credit could fall from $28/MWh at present to $21/MWh by 2030. Assuming that West Texas wind capacity factors increase from 46% to 51% by 2030, and that the region’s electrolyzer capacity grows to about 20 MW by 2025 and 85 MW between 2030 and 2050, the authors estimate that state’s electrolysis-based hydrogen could price at $1.50/kg by 2030 and $1/kg by 2050.

“The estimated cost of producing natural-gas-based hydrogen with carbon capture and storage (CCS) in 2030 could meet the DOE’s goal of $1/kg of clean hydrogen; however, electrolysis-based hydrogen is unlikely to achieve this target without government interventions in the form of research and development funding or direct incentives for hydrogen production and supporting technologies, such as renewables and CCS,” the report said.

Export Potential

The report also envisions a Houston-centered hub becoming a powerhouse of hydrogen exports.

The authors estimate that demand for Texas’ clean hydrogen could reach 21 MT by 2050, with industrial applications accounting for 6 MT, followed by ground transportation (2.3 MT), utilities (1.6 MT), and marine and aviation (1.5 MT). The lion’s share of that demand — 10 MT — would be international exports, putting the Houston hub in competition with other likely low-cost clean hydrogen producers such as Australia, Chile and Saudi Arabia.

Beyond cost advantages in production and transportation, the report states, Houston may offer beneficial “non-cost strategic considerations” for export markets, including “geopolitical and national security considerations (such as Europe’s move to diversify its fuel supplies away from Russian and accelerate its use of green hydrogen); a potentially quicker deployment of capital and capital build than competitors; and the possibility for long-term offtake agreements.“In many ways, the market for hydrogen exports could resemble the evolution of the liquified natural gas market. Similar to LNG, supply-based hydrogen hubs such as in the Middle East, Australia and North America could compete to serve demand in East Asia (e.g., Japan and South Korea). Given the cost assumptions, Texas is likely to leverage its cost and strategic advantages to export hydrogen and its derivative products,” the report said.