Major regional and interregional transmission lines might be big investments, but they tend to produce more benefits than expected, RMI said in a report published Feb. 28.

“High Voltage, High Reward Transmission” looked into seven case studies from around the country — in all of the ISOs and RTOs — to look into how they actually benefited residential, commercial and industrial customers.

“There’s … huge momentum towards regional planning with [FERC] Order 1920, and we really want regulators and planners to feel confidence in this type of high-voltage, long-distance transmission to meet the energy challenges of today and tomorrow and really provide lasting value for consumers and businesses, especially when we’re kind of facing an affordability crisis in this country,” RMI’s Tyler Farrell, a co-author of the report, said in an interview.

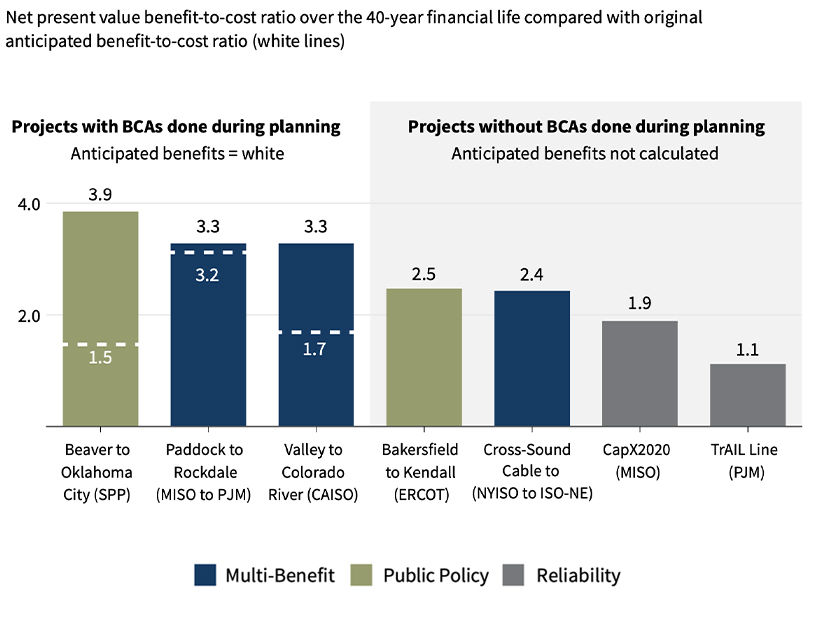

The seven projects were built for different reasons — reliability, economics and meeting public policy — and all of them had benefits that exceeded their costs, even using conservative assessments. They include the Cross-Sound Cable between New York and New England; PJM’s TrAIL project; the Paddock-to-Rockdale line between MISO and PJM; MISO’s CapX2020 line; SPP’s Beaver-to-Oklahoma City line; ERCOT’s Bakersfield-to-Kendall project; and CAISO’s Valley-to-Colorado River line.

Five of the seven lines were built with economic benefits in mind, and they all had positive cost-benefit ratios. The three projects in which cost-benefit analyses were performed in the planning process all wound up beating those predictions in real-world operations. FERC has a standard that such lines exceed the ratio of 1:1.25; all five beat that easily.

The other two lines were reliability projects, and in addition to keeping the lights on, they led to unexpected economic benefits, RMI said.

Transmission investments typically are meant to last 40 years, but the lines in the study all were paid off in eight to 34 years. Farrell said projects sometimes can keep running much longer than four decades. One example from outside the study is the Pacific DC Intertie, which links the Pacific Northwest and Southern California and has been in operation for more than 50 years.

“When they were built, the administrator for [the Bonneville Power Administration] said that these lines pay for the construction costs of these lines every single year, for their entire lifetime,” Farrell said. “And now we’re in 2025 and yes, they made investments into those lines since then, but those lines are still in operation and delivering huge savings to people across the Pacific Northwest and in California.”

The report looks at three main ways transmission saves money: reduced congestion, access to cheaper generation, and access to renewable sources of generation that meet public policy goals. Some lines also have unique benefits.

“Transmission infrastructure, beyond its initial driver, is designed to adapt to unforeseen changes or events,” the report said. “Several projects have enabled the significant integration of renewable resources like solar, wind and storage, far exceeding original expectations because of substantial decreases in technology costs. This has lowered generation costs for ratepayers. Additionally, many projects have played critical roles in maintaining grid reliability during unforeseen extreme events, such as winter storms and heat waves, ensuring that the lights remain on for consumers.”

Texas spent billions on the Competitive Renewable Energy Zone lines to connect wind resources to the state’s major cities, but an unexpected benefit was that they enabled the electrification of oil and gas drilling in the Permian Basin, the report said.

Across all seven of the projects studied, congestion relief savings made up most of the benefits to ratepayers, and the report said it was the most straightforward benefit new transmission offers because it cuts fuel and variable costs, ensuring the grid operates as efficiently as possible.

Another recent RMI report, “Mind the Regulatory Gap,” highlighted how most transmission dollars lately were flowing to local projects, which often lack the same oversight as regional and interregional planning processes. It was cited in a complaint consumer groups filed last year asking FERC to address that gap, the comments for which are due March 20. (See Consumer Groups Seek Independent Oversight of Local Tx Planning.)

With most transmission costs going into those local projects, the industry is not at risk of gold-plating the grid by shifting more of its focus to regional and interregional projects, Farrell said.

“I actually think that regional planning is the opposite of that, which is really cost-effective planning versus local planning, which is non-cost-effective planning,” Farrell said. “It’s literally just reliability planning and building the system from the ground up, versus the top down, which is what regional planning looks like.”