Capacity Market

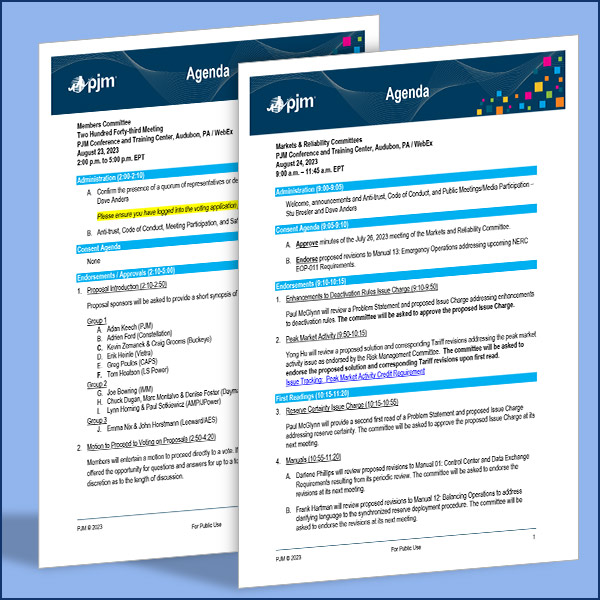

PJM's Markets and Reliability Committee endorsed issue charges, opening stakeholder discussions on generator deactivation timelines and a potential overhaul of the reserve markets during its Sept. 20 meeting.

PJM members recommended various avenues for the RTO's Board of Managers to consider as it weighs a possible FERC filing incorporating components of proposals made during the critical issue fast path process.

NYISO secured Business Issues Committee approval of the ISO’s proposal to create separate capacity demand curves for summer and winter beginning with the 2025/2026 capability year.

The NYPSC has filed a third petition seeking federal judicial review of FERC orders related to NYISO's proposed 17-year amortization period for its demand curves in capacity market auctions.

Voltus withdrew a demand response resource issue charge, while AEP and Dominion proposed a capacity obligation issue charge.

Stakeholders remain frustrated with MISO’s plan to enact a marginal capacity accreditation as staff insist that the approach will measure the true value of capacity.

State regulators of MISO South are withholding support for MISO’s plan to implement a sloped demand curve in its capacity auctions based on a proposed option for states to shield themselves from the effects.

None of the 20 proposals PJM and stakeholders drafted through the critical issue fast path to rework the capacity market garnered sector-weighted support from the Members Committee.

PJM and stakeholders presented their final CIFP proposals and posted executive summaries explaining how their packages would redesign the RTO's capacity market.

The PJM Members Committee will convene a special meeting to vote on 20 proposals to revise the workings of the RTO's capacity market through the critical issue fast path process.

Want more? Advanced Search