Capacity Market

The U.S. Department of Energy approved PJM's request to extend an order allowing Talen Energy to continue operating is oil-fired H.A. Wagner Unit 4 beyond the 438 hours it is permitted to operated each year.

MISO leadership shed more light on the RTO’s need for a pilot program to estimate load growth on a 20-year horizon after stakeholders asked for details.

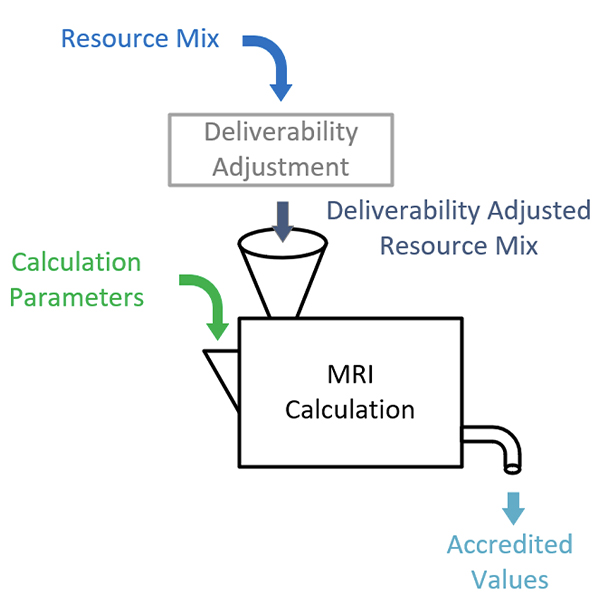

ISO-NE presented a high-level overview of how it plans to account for resource deliverability in its updated capacity accreditation framework.

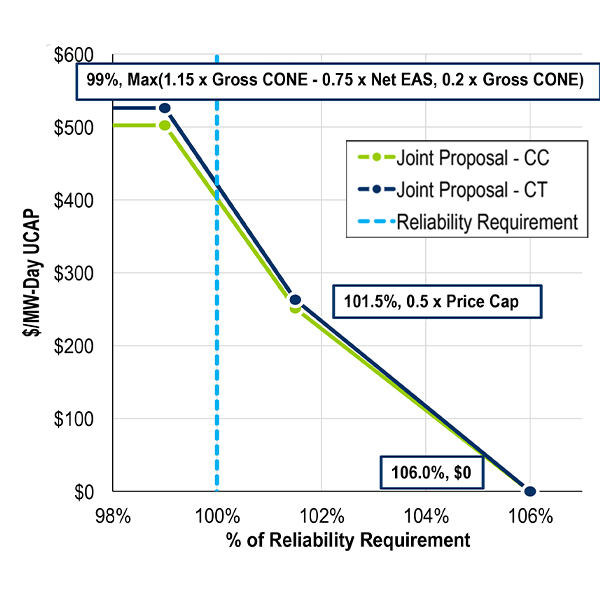

The PJM Board of Managers has directed staff to proceed with a Quadrennial Review design that reworks the capacity auction price curve and sets the reference resource as a combustion turbine for all zones.

NYISO’s consumer impact analysis for the Winter Reliability Capacity Enhancements project found that under the scenarios it considered, installed capacity procurement costs would drop by 15 to 45% depending on locality

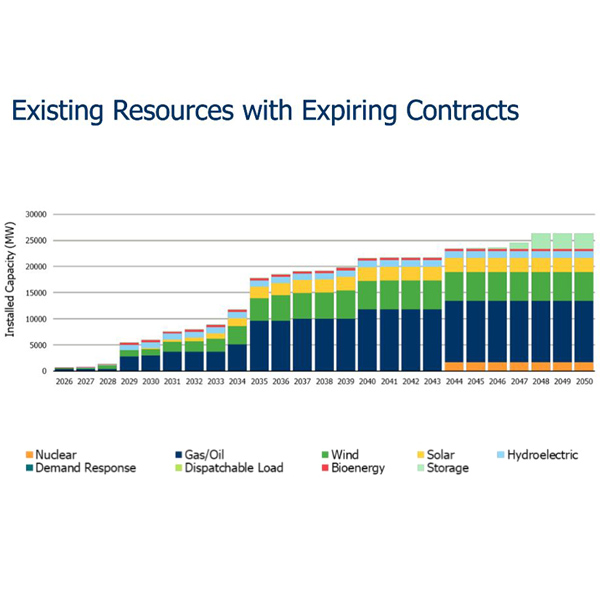

IESO is asking generation owners what it will take to extend the lives of their units at the end of their current contracts as Ontario seeks ways to meet a projected 75% load increase by 2050.

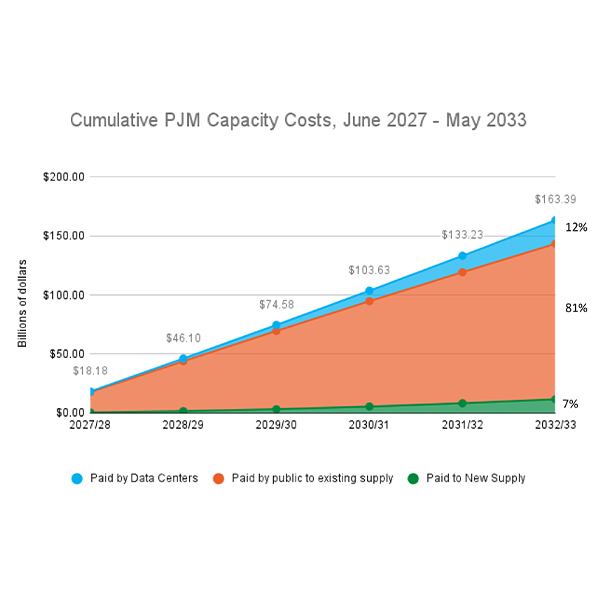

Several stakeholders presented proposals for how PJM could address accelerating load growth as the Critical Issue Fast Path process on large load growth wraps up its second phase.

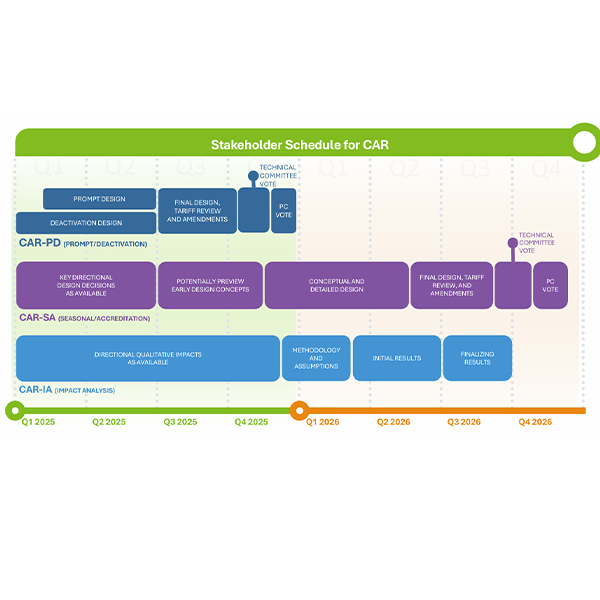

NEPOOL members proposed several amendments to the first phase of ISO-NE’s capacity market overhaul prior to the scheduled Markets Committee vote on ISO-NE’s proposal in November.

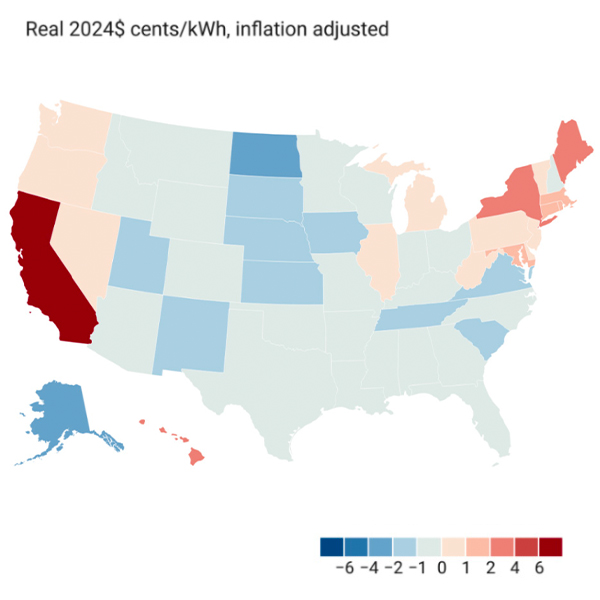

The Lawrence Berkeley National Laboratory released a paper recently examining why some states have seen retail power prices rise faster than inflation.

MISO convened a stakeholder workshop to go over new requirements for demand response resources heading into the 2026/27 planning year.

Want more? Advanced Search