Ancillary Services

Having finally added real-time co-optimization to the market like every other U.S. grid operator with an effort that began in 2019, ERCOT can turn its attention to other pressing issues.

FERC told PJM to change its rules to allow for co-located load at generators, with new transmission services and other tweaks.

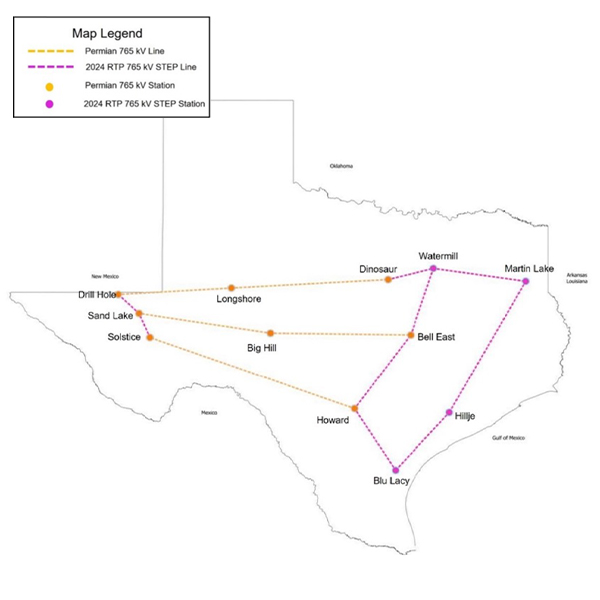

ERCOT’s Board of Directors has approved staff’s proposed 765-kV Eastern Backbone project and its $9.4 billion capital cost price tag, making it the most expensive project in the grid operator’s history.

MISO and its Monitor tracked a rise in energy consumption in fall 2025 and reviewed some operational rough patches, while the RTO explained why its machine-learning risk predictor remains a work in progress.

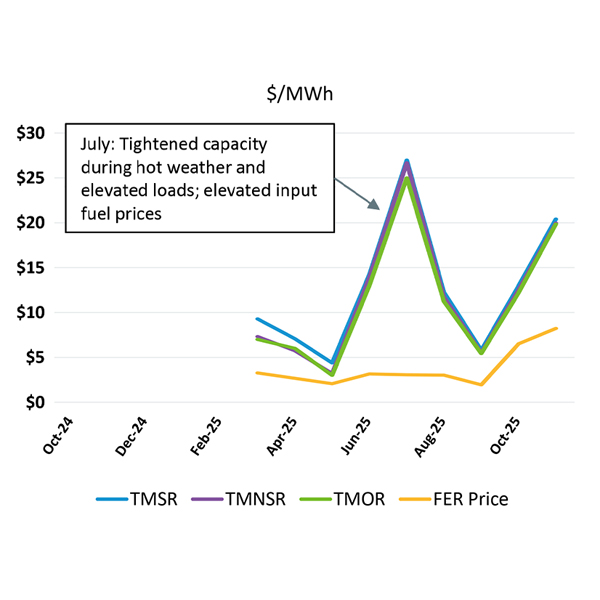

ISO-NE’s new day-ahead ancillary services market added about $258 million in incremental costs between March and August, equal to 7.6% of total energy market costs.

PJM’s forecasting of hourly peak loads continued to improve in November, with an error rate of just 1.17%, staff told the RTO’s Operating Committee.

ERCOT says it has successfully deployed Real-time Co-optimization + Batteries into the market, a mechanism used in most other RTOs and ISOs that procures energy and ancillary services in real time.

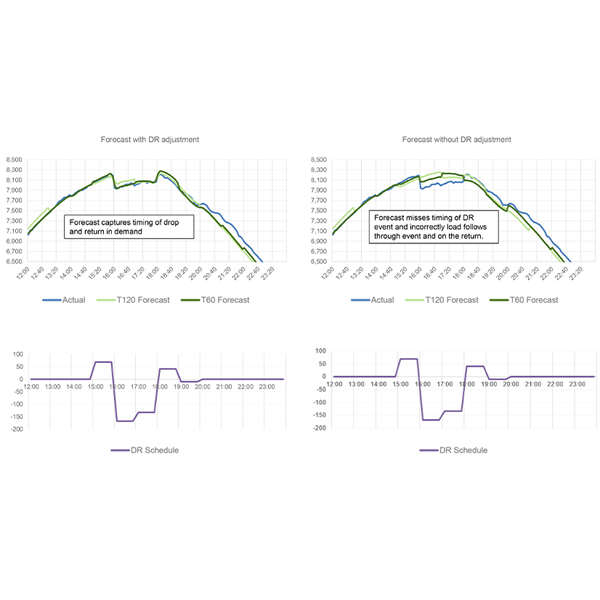

A new CAISO paper lays out a series of challenges around how to improve participation of demand response and distributed energy resources in the ISO's day-ahead and real-time markets.

ERCOT stakeholders endorsed a 1,109-mile, single-circuit 765-kV backbone project that is projected to cost nearly $9.4 billion in capital costs, making it the largest initiative in decades.

Texas regulators approved ERCOT’s methodologies for determining minimum ancillary services for 2026 while hinting at the same time that they are considering discontinuing the use of conservative operations.

Want more? Advanced Search