Energy Market

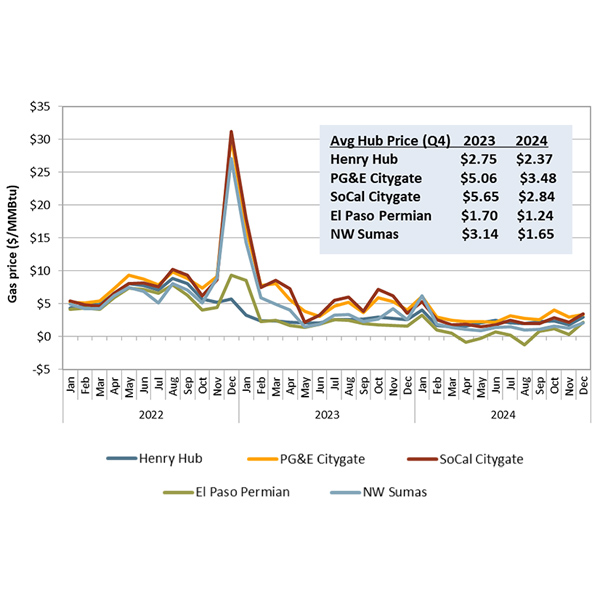

CAISO's Department of Market Monitoring found lower natural gas prices helped drive down energy prices in the WEIM in the fourth quarter of 2024.

MISO’s real-time energy prices in February 2025 nearly doubled from a year earlier as the footprint saw higher load and gas prices.

For the Balancing Authority of Northern California, a positive experience with CAISO’s Western Energy Imbalance Market was a key factor in the decision to also join the ISO’s Extended Day-Ahead Market.

FERC received several protests to Constellation's proposed purchase of Calpine, with PJM's Monitor arguing the companies need to make additional commitments to preserve competition in the RTO.

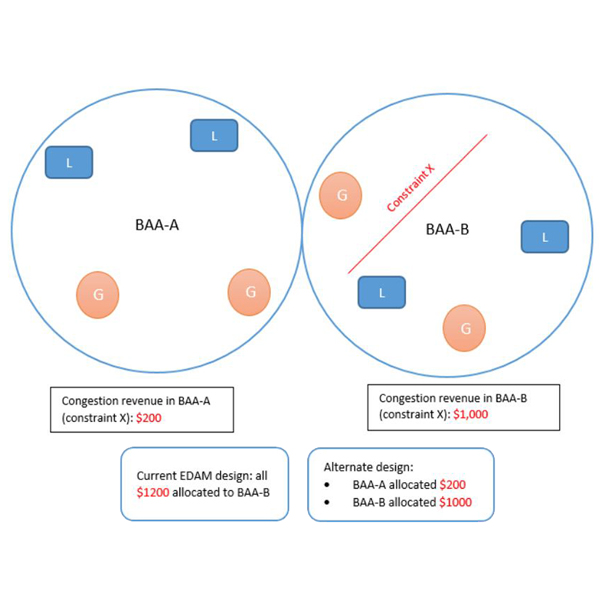

CAISO launched an “expedited” initiative to address stakeholder concerns about how EDAM will allocate congestion revenues when a transmission constraint in one balancing authority area causes congestion in a neighboring BAA.

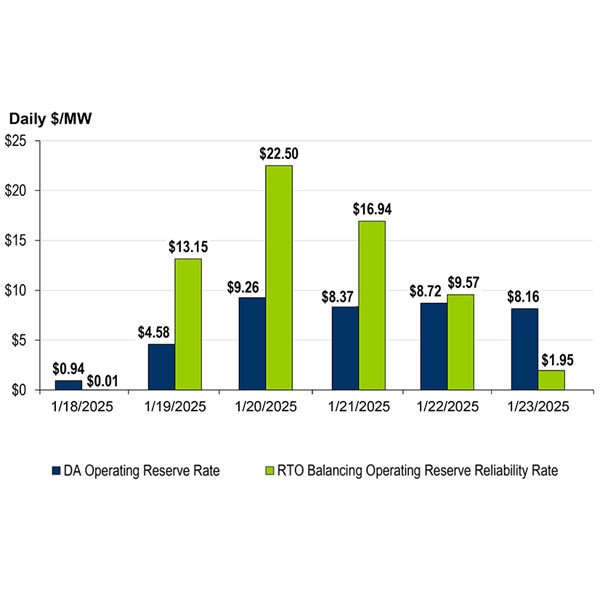

The Markets and Reliability Committee endorsed PJM's recommended installed reserve margin and forecast pool requirement values for the 2026/27 Base Residual Auction.

The Bonneville Power Administration’s first day-ahead markets workshop since issuing the draft policy stating its intention to join SPP’s Markets+ left little opportunity for critics to probe agency officials about the decision.

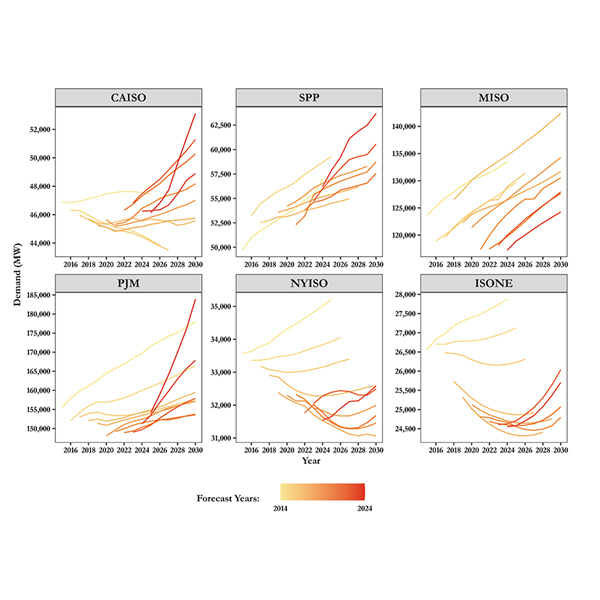

FERC's State of the Markets report showed lower wholesale energy prices but growing demand and higher capacity prices that signal a need to meet the coming load.

FERC approved a $528,000 settlement that ends a dispute between EDF Trading North America and CAISO over fuel cost recovery.

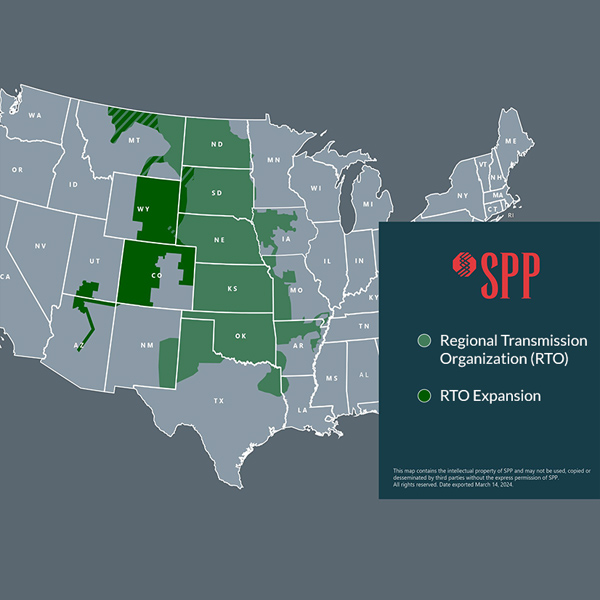

FERC accepted SPP's proposed tariff revisions that will incorporate seven Western Interconnection entities as transmission-owning members of the RTO.

Want more? Advanced Search