Energy Storage

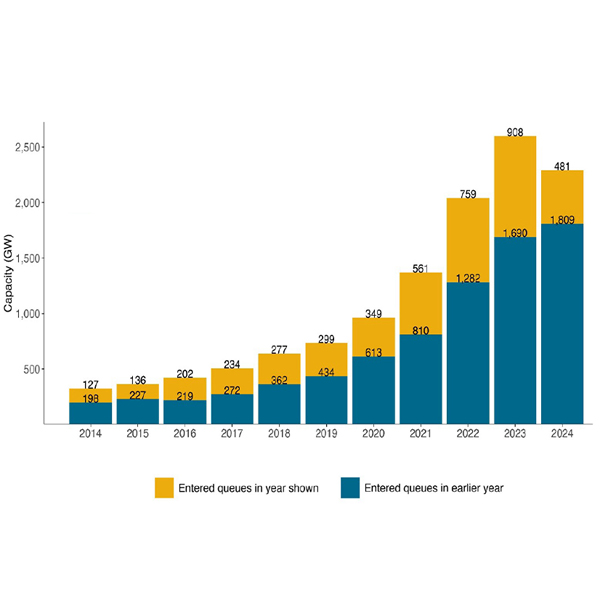

Two new data sets show the industry has started to cut back on record high interconnection queue levels from last year as reforms have started to take hold.

Investment bank Jefferies’ latest analysis finds the levelized cost of paired solar-plus-battery storage is cheaper than that of gas, saying slow turbine deliveries and inflationary equipment pricing makes the renewable alternative an “attractive” opportunity as data centers drive demand.

New Jersey's latest draft investment plan for its Regional Greenhouse Gas Initiative funds would broaden the state's portfolio to include electrifying multifamily housing and accelerating investment in wind and solar infrastructure.

Two laws signed by New Jersey Gov. Phil Murphy aim to dramatically expand the state’s community solar and storage incentive programs as the state searches for new generation sources to help meet a predicted energy shortfall.

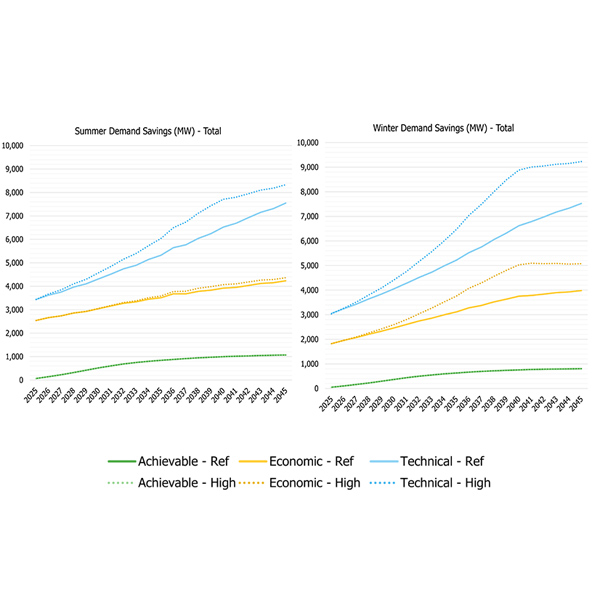

IESO officials say they will release more information on how the ISO constructed its study of the potential for incremental energy savings in Toronto after stakeholders complained they lack enough details to comment meaningfully.

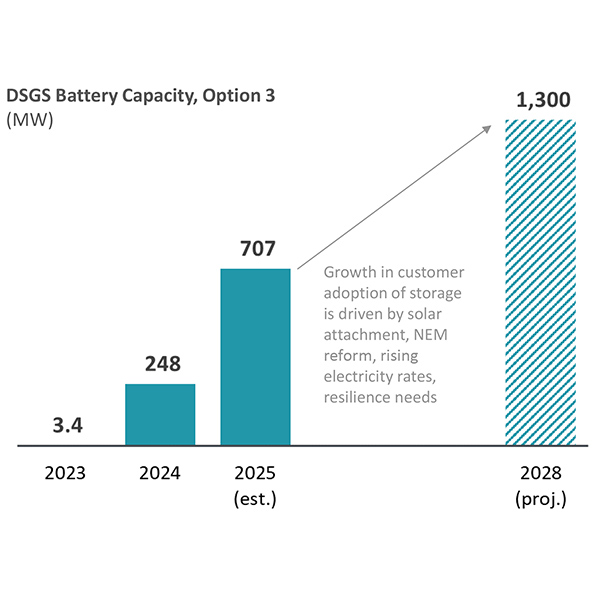

Clean energy advocates are urging California lawmakers to restore funding to a fast-growing distributed energy program that has shown its ability to support the grid during a test run.

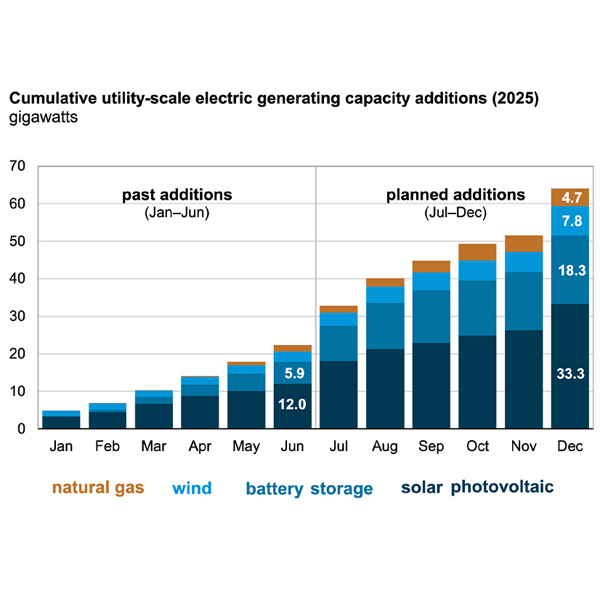

The United States is on track for a record increase in power generation capacity in 2025, the U.S. Energy Information Administration reports.

CAISO’s Market Monitor is concerned about potential gaming practices and inefficient bidding behavior in the ISO’s bid cost recovery process for battery storage resources.

A new report urges SPP to accelerate its interconnection process and reform market rules to allow greater buildout of energy storage.

The Massachusetts Department of Energy Resources and the state’s investor-owned electric utilities have issued a request for proposals to procure up to 1,500 MW of mid-duration energy storage.

Want more? Advanced Search