Financial Transmission Rights (FTR)

PJM presented manual revisions to clarify how resources are defined as offline for the purpose of determining whether they are eligible for lost opportunity cost credits.

FERC rejected a rehearing request of its order approving SPP’s proposed one-time accelerated study of shovel-ready interconnection requests, sustaining its original 2025 decision.

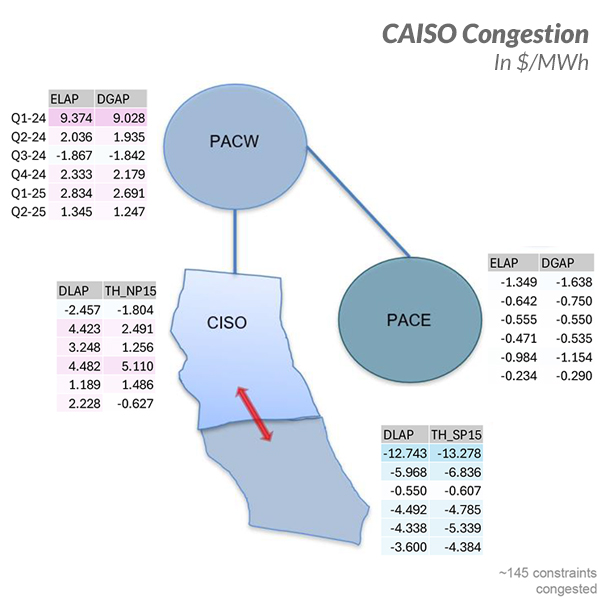

The California PUC wants CAISO to come up with a way to pause settlements of certain congestion revenue allocations in the ISO’s upcoming Extended Day-Ahead Market if participants begin to game the market through extensive self-scheduling.

CAISO continues to work to revise the rules around how congestion revenues will be allocated to participants in the ISO’s Extended Day-Ahead Market, which will be launched in spring 2026.

MISO said all four recommendations in the Independent Market Monitor’s 2024 State of the Market Report are likely viable.

SPP’s Board of Directors has awarded its eighth competitive project and third in 2025 under FERC Order 1000, a 345-kV upgrade in the Texas Panhandle.

Golden Spread Electric Cooperative will again appeal a stakeholder group’s rejection of a proposed tariff change that would pre-emptively determine the amount of load SPP's system can handle without requiring additional network upgrades.

FERC terminated a show-cause proceeding against SPP and accepted the RTO’s proposal to revise its collateral requirements for financial transmission rights by including an additional re-marking mechanism for seasonal products.

ERCOT says all systems are go — or more specifically, green — and early market trials have been successful as the Real-time Co-optimization plus Batteries project barrels to its Dec. 5 go-live date.

SPP stakeholders resoundingly rejected a proposed tariff change to integrate large loads, pushing back against what some say is a rushed process outside of the normal stakeholder structure.

Want more? Advanced Search