Bonneville Power Administration (BPA)

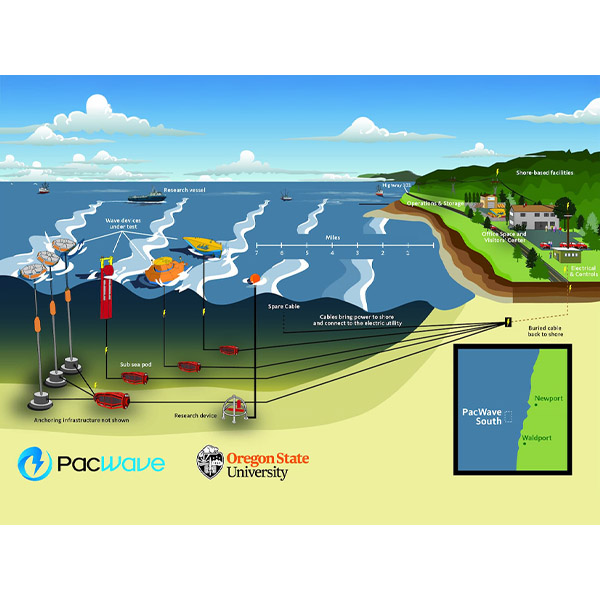

The Bonneville Power Administration has entered a five-year power purchase agreement to buy wave energy from a test facility managed by Oregon State University, the agency said in an announcement.

With California passing the bill designed to transition the governance of CAISO’s markets to an independent regional organization, new challenges await the West-Wide Governance Pathways Initiative as the coalition seeks to turn a once-elusive goal into reality.

The Pacific Northwest is on track to meet energy efficiency goals set in the Northwest Power and Conservation Council’s 2021 power plan after having saved 160 aMW through improvements in 2024, the council said in a news release.

California lawmakers have passed a landmark bill that will allow CAISO to transition the governance of its markets to the independent “regional organization” envisioned by the West-Wide Governance Pathways Initiative.

Utilities at a customer-led workshop voiced support for Bonneville Power Administration’s shift toward proactive transmission planning, though some expressed reservations about the agency’s proposed commercial readiness criteria.

The Bonneville Power Administration estimates it would take up to seven years and billions of dollars in upgrades for the agency to handle the 65 GW of transmission service requests in the queue.

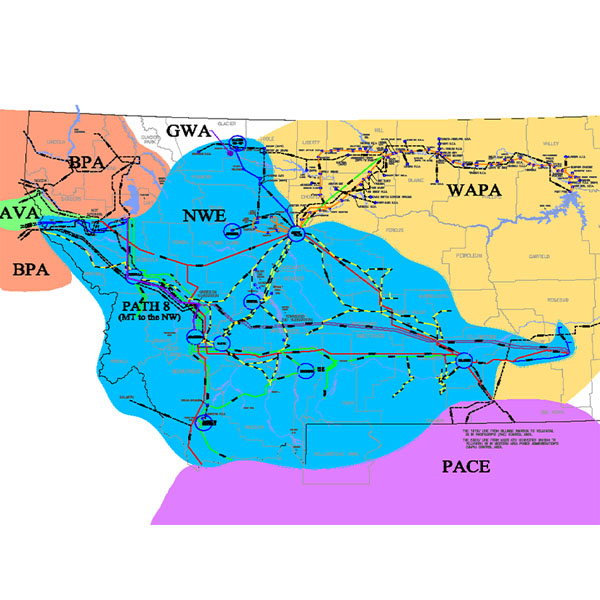

Four Western utility executives participating in an Energy Bar Association webinar presented their reasoning for why they ultimately chose either SPP’s Markets+ or CAISO’s EDAM, with some eyeing the creation of a full regional transmission organization in the future.

Oregon regulators have approved PacifiCorp's request for proposals for renewable resources, saying the utility must accept bids for resources with conditional firm transmission.

The proposed merger between Black Hills Corp. and NorthWestern Energy likely will reshape the map in the competition between CAISO’s Extended Day-Ahead Market and SPP’s Markets+ — but it’s still too early to know where new boundaries will be drawn.

BPA will begin to issue long-term contract offers under its Provider of Choice policy after finalizing the set of policies and decisions that will guide the 20-year contracts.

Want more? Advanced Search