California wildfires

Concern about Pacific Gas and Electric’s financial meltdown has spread as CAISO addressed worries about the utility’s potential to default on its payments.

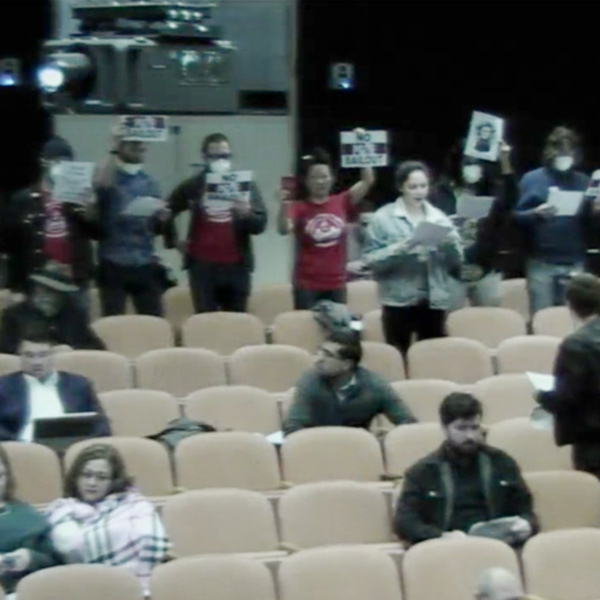

The California PUC began implementing wildfire cost recovery provisions, as protesters argued against any effort to bailout PG&E for the deadly wildfires.

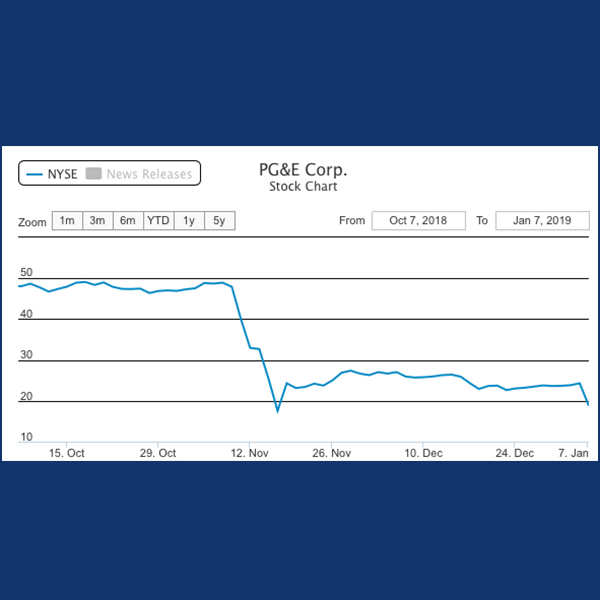

PG&E’s stock price sank lower Monday and Tuesday, dropping by more than 30% due to fears the company could go bankrupt or be broken up by the state.

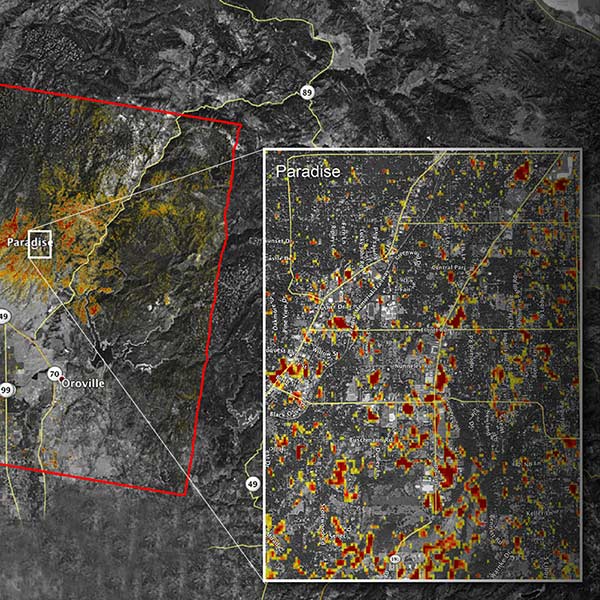

After the deadliest wildfire in California history, PG&E is facing intense scrutiny from lawmakers, regulators and a federal judge.

CAISO will tackle its new role as reliability coordinator in 2019, and California lawmakers will struggle with preventing wildfires sparked by power lines.

PG&E reported additional problems with its transmission lines prior to the Camp Fire and asked state regulators to approve a more than $1 billion rate hike.

The California Public Utilities Commission voted to examine its rules allowing utilities to de-energize power lines in cases of wildfire conditions.

California legislators will struggle with wildfire liability, while lawmakers in Washington and Nevada could debate clean energy.

The California PUC will open a new phase of investigation into PG&E’s practices as the utility faces allegations that its equipment ignited the Camp Fire.

California’s deadliest and most destructive wildfire has set off a new round of turmoil for Pacific Gas and Electric.

Want more? Advanced Search