New York Independent System Operator (NYISO)

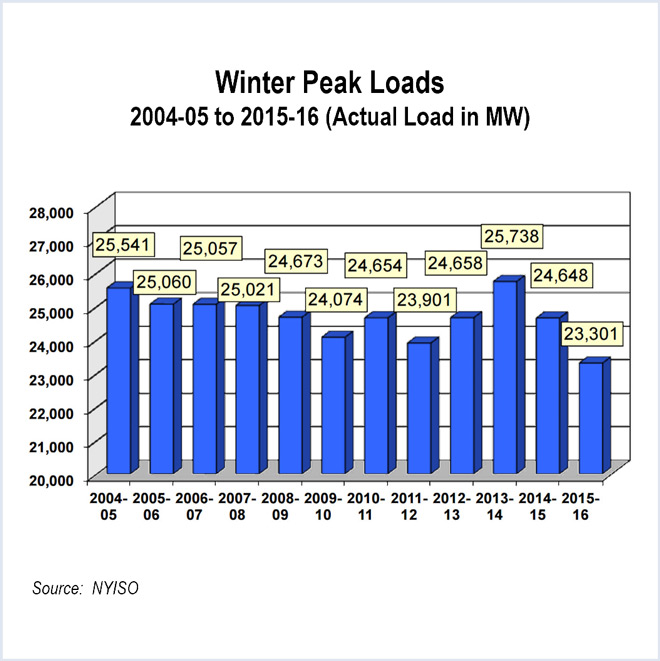

The NYISO Management Committee discussed the record-breaking demand for natural gas last winter, as well as a new method for setting the ISO's demand curve.

FERC denied a rehearing request from LIPA in a dispute with a power plant developer over interconnection requirements.

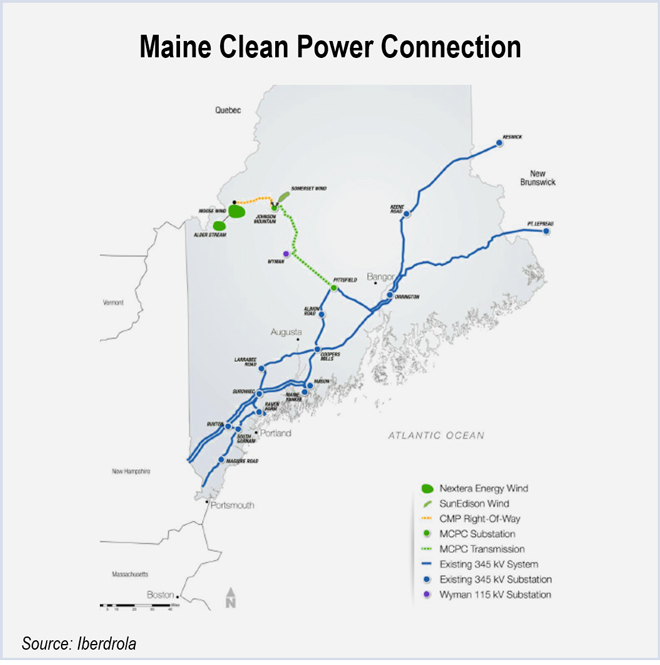

Requests for proposals for the next rounds of multi-state clean energy, efficiency and storage energy procurement were released.

FERC approved the plan to keep the Ginna nuclear power plant operating but objected to elements that it said encroached on its jurisdiction.

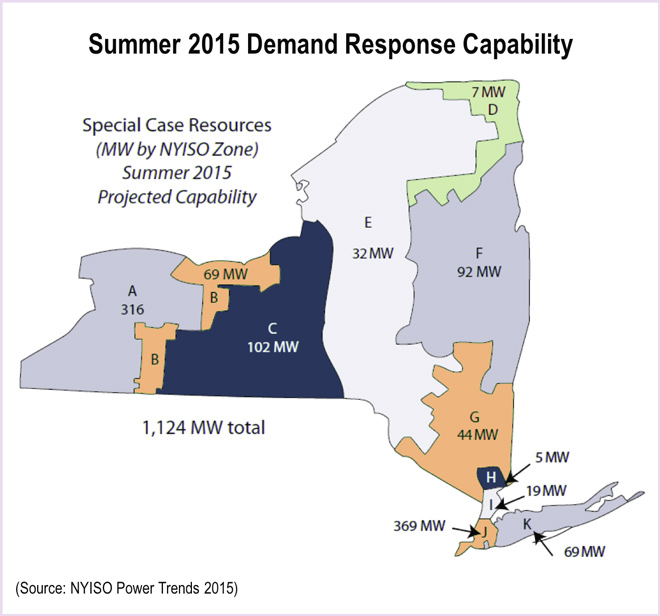

FERC approved changes to NYISO’s scarcity pricing logic to better reflect the real-time value of demand response.

New York regulators OK'd a contract to keep the struggling R.E. Ginna nuclear power plant operating through March 2017.

Closure of the FitzPatrick nuclear plant will leave New York at least 325 MW short of its generation requirement by 2019, NYISO says.

A summary of responses by RTOs and state officials to the Supreme Court's stay to the Clean Power Plan.

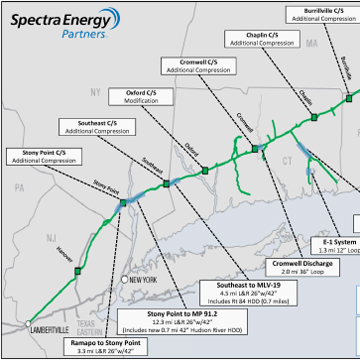

FERC turned aside attempts to block Spectra Energy’s Algonquin pipeline expansion, allowing construction to continue on the 37-mile span.

NYISO and the New York PSC have a begun a joint study to determine how a changing generation resource mix will affect the bulk power system over the next 15 years.

Want more? Advanced Search