Offshore Wind (OSW)

An announcement by the U.S. Department of Interior said the Department of Defense had identified wind farms as national security risks and is pausing offshore wind leases.

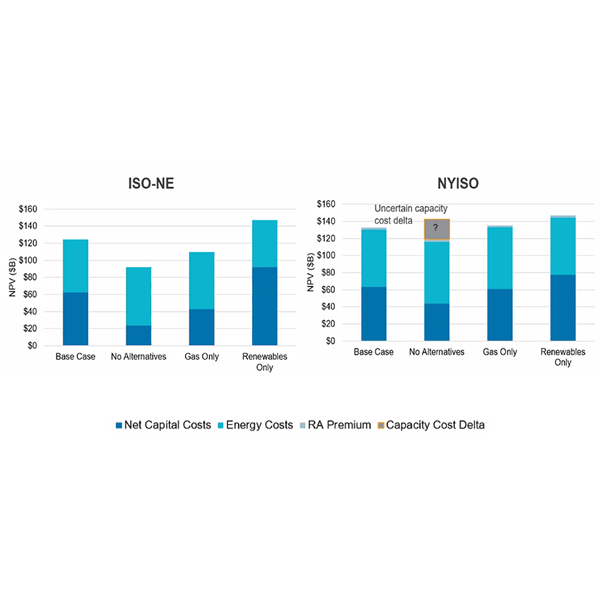

Northeastern power systems cannot afford to drop offshore wind if they are to maintain reliability, reduce emissions and lower electricity prices, according to a new analysis from Charles River Associates.

Ørsted reported a net loss for the third quarter, attributed to the continuing financial challenges for its U.S. offshore wind portfolio, but it also said those projects are progressing well toward completion.

The infrastructure that supports our ability to generate and move critically needed electrons relies heavily on a regulatory environment that offers some consistent level of predictability, says columnist Peter Kelly-Detwiler.

The California Energy Commission approved $42 million for five offshore wind projects at ports in the state, despite recent federal policy changes that have left the future of the renewable resource in limbo.

Ørsted will reduce its workforce roughly 25% through the end of 2027 as it wraps up construction of offshore wind farms and remakes itself as a more competitive company.

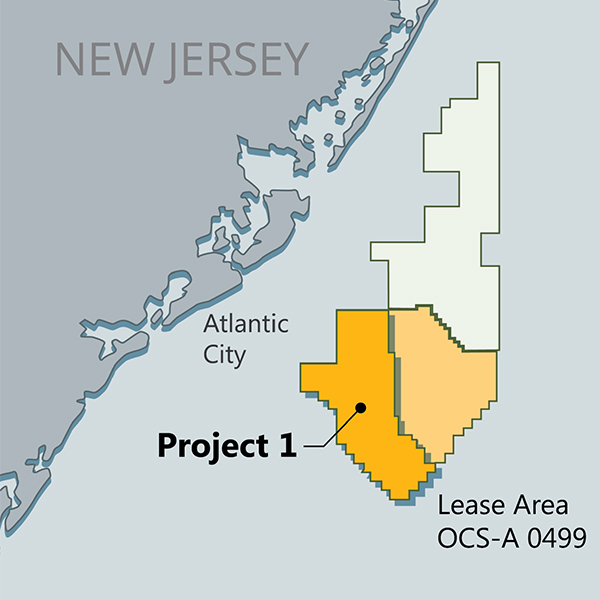

The Bureau of Ocean Energy Management is seeking to remand its earlier approval of the construction and operations plan for Atlantic Shores Offshore Wind.

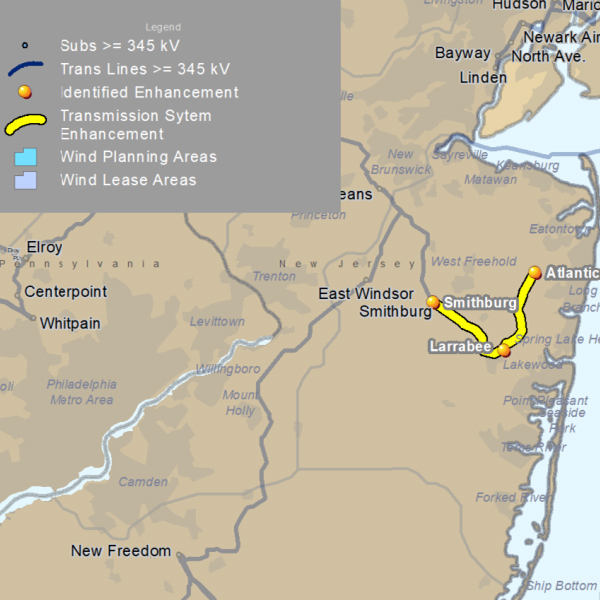

The Department of Energy has withdrawn a $716 million loan commitment that would have helped New Jersey upgrade the state transmission system to connect offshore wind to the grid.

Revolution Wind’s developers are seeking an emergency injunction against the federal stop-work order slapped on the offshore wind project.

The Trump administration is moving to close the door on U.S. offshore wind development by remanding approvals for all projects not already under construction.

Want more? Advanced Search