Production Tax Credit (PTC)

New tax incentives for standalone storage in the Inflation Reduction Act will accelerate the pace and urgency of the energy transformation ahead.

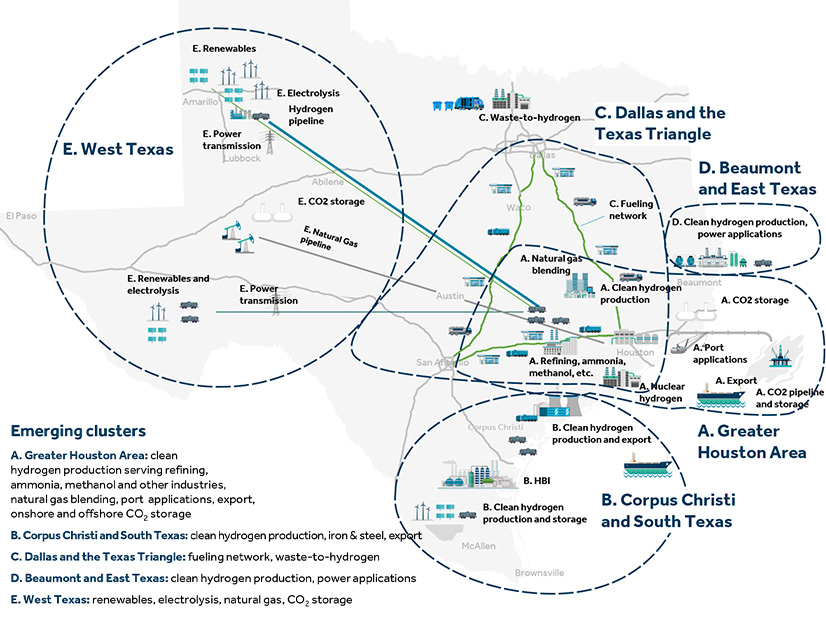

$8 billion in funding for hydrogen hubs is "a start" but won't solve all the challenges the industry faces, panelists said at Infocast’s Hydrogen Hubs Summit.

Infocast’s Hydrogen Hubs Summit was intended to focus on the $8 billion in federal funding for clean hydrogen hubs authorized in the IIJA.

Exelon said the proposed 15% minimum corporate income tax in the Democrats’ energy and climate bill could impinge its cash flow, slow infrastructure investment.

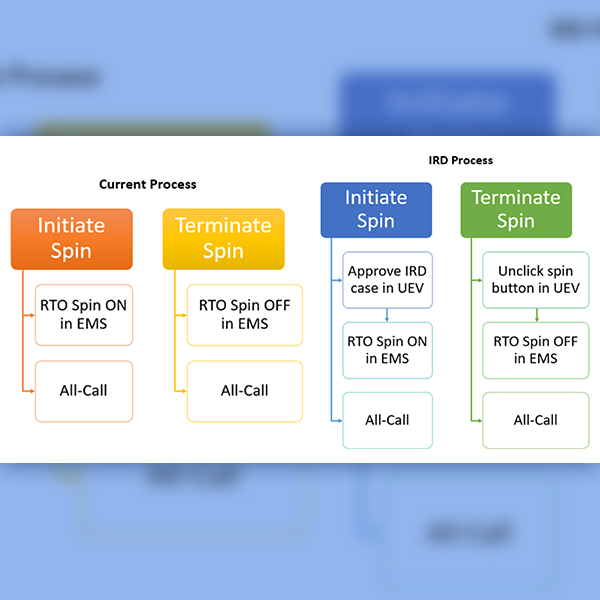

PJM's MIC OK'd rules on accounting for PTC/REC revenue and dealing with long-term market suspensions and discussed a loophole allowing CTs to ignore dispatch.

Stakeholders at a PJM Market Implementation Committee meeting peppered RTO staff with questions about a proposal on cost-based energy offers.

In its yearly Wall Street briefing, the Edison Electric Institute stressed the importance of extending federal tax credits for renewable resources.

Developers still face challenges to finance offshore wind projects, but lenders are eager to get involved, speakers told the ACPA's OSW conference.

Citing the coronavirus pandemic, the IRS extended the time that wind and solar developers have to complete their projects and qualify for tax credits.

Legislators see long-term, full-value tax credits as one tool among many that are needed to expand renewables at the requisite pace and scale.

Want more? Advanced Search