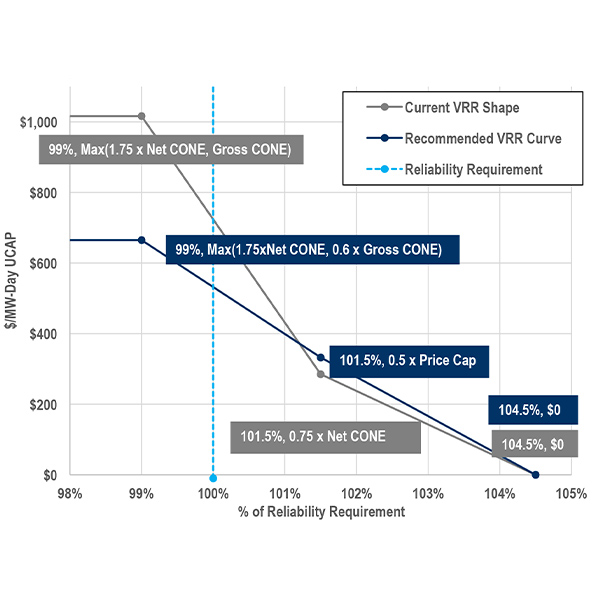

variable resource requirement (VRR) curve

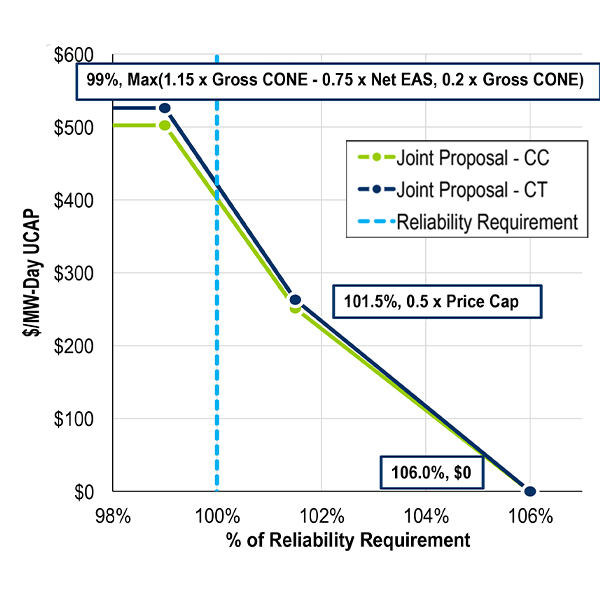

The PJM Board of Managers has directed staff to proceed with a Quadrennial Review design that reworks the capacity auction price curve and sets the reference resource as a combustion turbine for all zones.

The PJM Market Implementation Committee voted to endorse two packages of revisions to key parameters of the capacity market out of six offered by PJM and stakeholders that resulted from the Quadrennial Review.

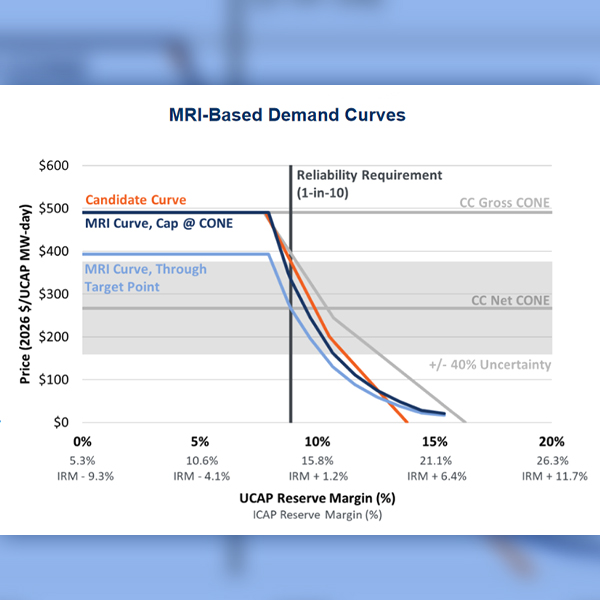

Key challenges in the review are tightening supply and demand, the uncertain cost of new capacity and accounting for changes PJM has made to how it identifies reliability risks and determines the capacity value for different resource types.

PJM heads into 2025 with several proposals before FERC seeking to rework its capacity market and generator interconnection queue, while stakeholders work on an expedited Quadrennial Review of the market and changes to resource accreditation.

Pennsylvania Gov. Josh Shapiro filed a complaint with FERC on behalf of the state asking the commission to revise how the maximum clearing price in PJM's capacity auction is determined.

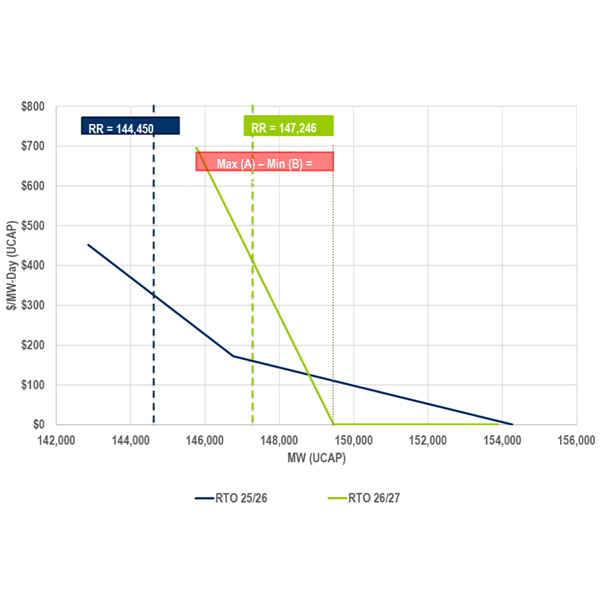

PJM presented how the planning parameters for the 2026/27 Base Residual Auction affected the variable resource rate curve, which intersects with supply and demand to determine auction clearing prices.

PJM updated its Critical Issue Fast Path proposal, while several additional stakeholder presentations are scheduled for the remaining two meetings before they vote on packages.

FERC accepted revisions to PJM’s tariff that the RTO proposed via its Quadrennial Review of the parameters underlying its Reliability Pricing Model auctions.

PJM defended the proposed capacity auction parameters in its quadrennial review before FERC against two protests from the generation sector.

The 2023/24 Base Residual Auction held by PJM in June yielded competitive results, the RTO’s IMM announced in a report released last month.

Want more? Advanced Search