VALLEY FORGE, Pa. — PJM Senior Dispatch Manager Kevin Hatch presented more detail on the RTO’s plan to scale back a 30% adder it added on the synchronized and primary reserve requirement in May 2023. (See “Stakeholders Discuss Synchronized Reserves,” PJM MRC/MC Briefs: Feb. 20, 2025.)

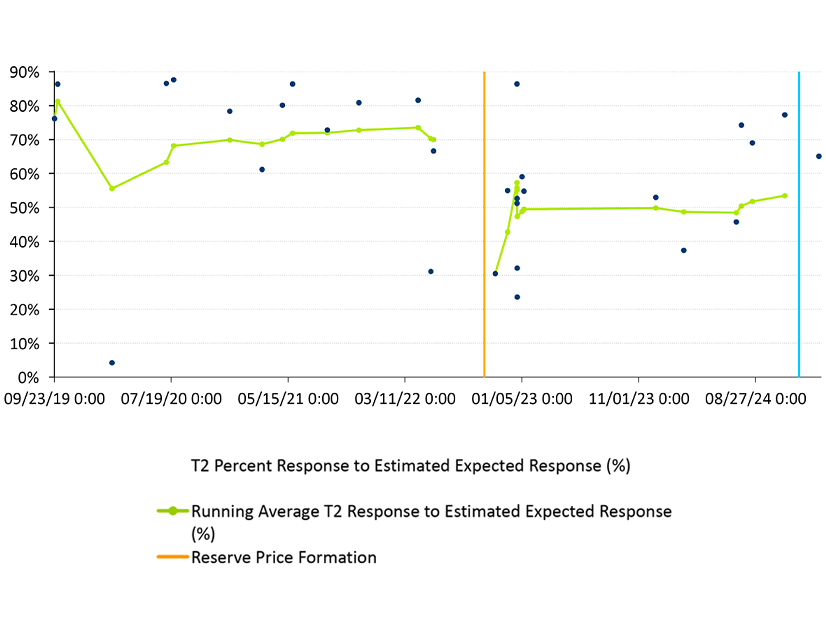

The adder would be scaled back incrementally if average reserve performance increases across three consecutive events. If performance is above 75% for three events, the adder would be reduced to 20%; if performance increases to 85%, the adder would be set at 10%; and if performance gets above 95%, the adder would be removed. The plan also includes a fallback if average performance across three consecutive events declines below 75%, in which case the adder would increase by 10%.

The adder would be capped between 0 and 30%, meaning that the reserve requirement could not fall below 100% of its tariff-defined value nor increase above 130%. Once the adder has been changed in either direction, the three-consecutive-event counter would be reset. Only events exceeding 10 minutes would count toward the average.

Hatch said PJM’s hope is that the implementation of changes to automatic generator control (AGC) for reserve resources in December 2024 will improve the ability for generation owners to understand when and how they are being deployed. It updates resources’ basepoints with reserve instructions and allows for units to be deployed at less than their full output. (See “Stakeholders Endorse Reserve Rework, Reject Procurement Flexibility,” PJM MRC Briefs: July 24, 2024.)

Hatch said PJM went with the 10-minute threshold because that is the amount of time synchronized and primary reserves are expected to perform for.

Hatch said the AGC proposal was the first step in the right direction and PJM is open to making further changes to make sure there are adequate incentives for units to respond. While PJM wants to start backing off the requirement increase, it has to be performance driven.

Stakeholders Resume Discussions on SATA

Stakeholders resumed talks on a proposal to define rules for storage as a transmission asset (SATA) years after the Markets and Reliability Committee (MRC) deferred voting on the package.

The proposal was endorsed by the PC in December 2020, but the MRC delayed action the following February until after rules governing how storage acts in PJM’s markets had been developed. PJM brought a problem statement and issue charge before the PC to reopen the subject in September 2024. The committee delayed action in October due to the number of pressing issues before stakeholders. The motion to defer precluded action on the issue charge before February 2024 and called for education to be conducted first at the OC. (See “Vote on Issue Charge to Establish SATA Rules Deferred,” PJM MRC Briefs: Oct. 30, 2024.)

PJM’s Jeff Goldberg said there would be several distinctions between SATA and other transmission assets, including downtime during charging periods limiting its ability to resolve some types of violations.

To maintain RTO independence, SATA owners would be responsible for maintaining state of charge on single- or multi-peak days by submitting schedules for charging and discharging times. The batteries would need to be configured in an automatic operation to allow them to respond instantly to frequency or local load security needs. Installations would not be able to be moved between sites under normal operations. Any change in location would require a new baseline reliability study.

Granular load curves would be used to determine how much storage must be in place to resolve a violation; if those curves were not available, then four hours of storage of sufficient scale would be required.

The proposal would apply only to storage acting solely as transmission, with the possibility for dual use between transmission and markets put off to possible future discussions if transmission rules are finalized. Goldberg said dual use being the third phase of storage rules, following markets and transmission, was PJM’s intent when the SATA rules were first drafted, and that remains the possible road map. But a key consideration is that batteries would need to retain enough charge to resolve transmission needs while also participating in the markets.

Several stakeholders questioned how PJM would determine when to deploy SATA assets to resolve a transmission need instead of dispatching market-based resources.

PJM Director of Transmission Planning Sami Abdulsalam said operators would have to monitor and take SATA deployment into account. It would be used for reliability and not arbitrage to play in the market. Director of Stakeholder Affairs Dave Anders said that will be part of the education and subsequent package development, adding that some areas of the proposal developed in 2020 may need revisiting.

Exelon Director of RTO Relations and Strategy Alex Stern said the reliability issues PJM is experiencing have grown since SATA last was discussed and states increasingly have pushed for its deployment. When the package was drafted, the intention was to allow PJM and TOs to evaluate if SATA could be used as a solution to both regional and local transmission needs; the challenge for stakeholders is how to do that in a way that isn’t making storage a market asset while allowing it to participate on the transmission side. If that cannot be accomplished, there should be a record created to explain the barriers to member states.

February Operating Metrics

Presenting monthly operating metrics, PJM’s Joe Mulhern said the RTO saw three days in February where load forecast error exceeded staff’s 3% benchmark, mainly due to unexpected weather conditions. The overall hourly error rate was 1.81%.

The peak for Feb. 2 was 4.04% under forecast due to a storm that brought unexpectedly cold temperatures and snow, increasing load throughout the middle of the day and the evening peak. On Feb. 6, another storm system led to an unusual load shape where the forecast peak occurred two hours later in the evening than expected, though the scale of the peak was the same as forecast. On Feb. 16, cold temperatures and a storm that brought rain contributed to a 4.13% hourly and 3.18% peak under forecast.

PJM’s David Kimmel said there were three shared reserve events, three spin events, one pre-emergency load management load reduction and two cold weather alerts in February. Two shortage cases were issued Feb. 5 due to unit trips and a third was issued Feb. 11 due to a sharp increase in load paired with smaller generation trips.

Feb. 5 saw a spin event lasting 10 minutes and 3 seconds, with 1,827 MW of generation expected to respond and 1,155 MW received, while all 98 MW of demand response (DR) performed. Penalties were assessed against 672 MW of generation that did not respond. Another event the following day lasted 4 minutes and 59 seconds with 1,800 MW of generation expected and 1,149 MW received, while 53 MW of DR was committed and 32 MW responded. A 5 minute, 19 second spin event Feb. 11 expected 933 MW of generation and 1,021 MW received, while 104 MW of DR was expected and 40 MW received.

SOS Updates

Presenting an update on System Operations Subcommittee discussions, Hatch said an 85 MW pre-emergency load management deployment was issued in the Ashburn area of Dominion on Feb. 19 to when a transmission line needed to be taken out of service due to issues with a potential transformer. An existing outage caused by a tree falling on a nearby line earlier in the week also contributed to the need for the deployment.

The load reduction mitigated the need for a pre-contingency load shed, which may have been needed to avoid a cascading failure identified under N-5 analysis. The deployment began at 4:20 p.m. and mandatory participation ended at 9 p.m.

PJM conducted its second voltage reduction test Feb. 5, which reduced system voltages by 5% between 7 and 7:30 a.m.

The test was expected to lower loads by 1.9%, or 1,439 MW, but a 0.7% reduction, amounting to 520 MW, was observed. Hatch said there also was a large impact on MVAR capability, with about 2,560 MVARs of generator capability lost, illustrating a need to increase MVAR reserves.