Pattern CEO Armistead Says Transmission is Being Overlooked

HOUSTON — CERAWeek 2025 by S&P Global, held March 10 to 15, examined the changing energy landscape through 14 themes, from policy and regulation to climate and sustainability.

None seemed to draw more focus from the more than 10,000 attendees (a record) representing 89 countries than the rapid expansion of artificial intelligence technologies and their potential to transform the industry.

Almost four dozen presentations — some that conflicted with each other — included AI in their titles during the conference, including “democratizing AI” or “accelerating AI.” It was no surprise given the projected electricity demand of AI data centers and their potential for producing and managing and consuming power — as well as for helping energy systems become more efficient and sustainable.

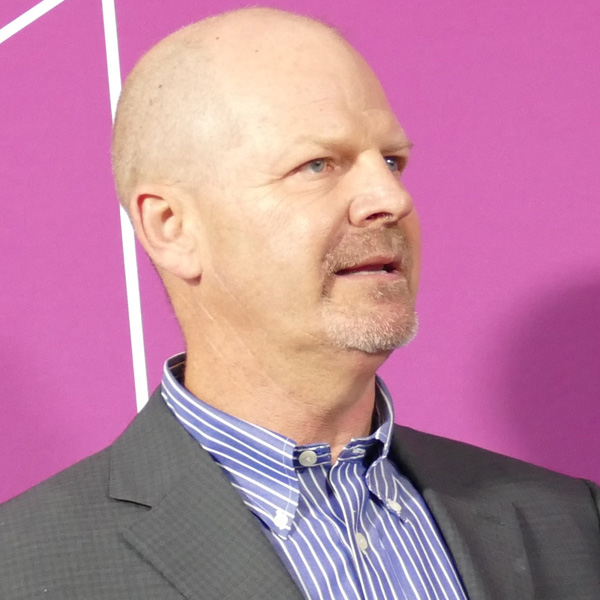

“Every time we come to CERA, you kind of think about themes that are going on in the conference,” Pattern Energy CEO Hunter Armistead said. “My next slide will be, of course, a mandatory slide talking about AI driving the flow of goods. I think everyone has to have that slide.”

Armistead was joking. But while AI may be reshaping the future of energy production, someone still must get the power from the source to where it’s needed.

“I’m a little surprised so far that when we talk about responding to [AI], there hasn’t been enough discussion about the critical role that transmission can play in delivering resiliency and actual capacity for this new load that’s coming,” he said. “We need to think bigger and faster, just like we talked about ‘all-of-the above,’ as far as energy resources that can deliver and meet this amazing challenge.”

Armistead’s company, which he co-founded, is in the business of building HVDC transmission lines to deliver those resources. Pattern has a development pipeline of over 25 GW of renewable energy and transmission projects, but Armistead is most proud of the company’s SunZia Wind and Transmission Project — a 550-mile, 525-kV line capable of moving 3.5 GW of renewable energy between New Mexico and Arizona.

“Spoiler alert: We’re crushing it. … It’s on-time and on-budget,” he said. “I’ve always said, when you’re building an $11 billion project, you better do it well because everyone’s watching.”

Construction began on SunZia in 2023. Armistead said it will begin commercial operations in 2026.

“For the last 20 years, we really had almost flat to no load growth. It’s been super hard to have a discussion with either rate-based entities or ISOs about the absolute need for increased transmission,” he said. “That’s all changing, and that’s super exciting. There’s actually now a catalyst that basically says we need to expand our grid and we need to expand our energy resources. And the part that I think the transmission provides for this is it allows efficient utilization.”

Pattern’s other U.S. HVDC project is the Southern Spirit Transmission, a 320-mile, 525-kV line able to transmit 3 GW of renewable energy to Mississippi and the Southeastern Regional Transmission Planning region. Pattern filed an application with FERC more than a decade ago and has cleared regulatory hurdles in Texas. Construction is targeted to begin in 2028, but Pattern must still negotiate with landowners and gain approval in Mississippi. (See ERCOT, PUC Adamant: Southern Spirit Doesn’t Interconnect Texas.)

Armistead said the developers have found a way around a Louisiana law that would have hindered the use of expropriation to secure private land for the line’s right of way.

“It’s embarrassing to say both these deals have taken 12 years to get to this point where they’re ready to go, but that’s where we are,” Armistead said. “The bigger challenge is getting the utilities of the Southeast to see why this helps them serve their customers that are coming in now. What we’re seeing is the huge load growth within the Southeast has the utilities and those customers saying, ‘Please, get Southern Spirit online.’ So, we see a lot of traction to actually deliver this.”

The Need for Speed

Armistead and Pattern have support in high places, including FERC Commissioner Judy Chang. Speaking on a panel discussing how to meet the power surge (The U.S. Energy Information Administration projects 4.6% demand growth in 2025, the highest in decades.), Chang said there is a need for speed.

“From a regulator’s perspective, we want to move fast,” she said. “We encourage the utilities and any folks that can serve the new demand to move fast at the same time to protect existing customers, or all customers, and to make sure that we do this with an efficiency in mind and reliability in mind, and with a long-term view of where this whole industry, where the whole demand growth is going.”

“What do we need?” said fellow panelist Amanda Peterson Corio, Google’s head of data center energy, clean energy and power. “We need everything. … We need more grids. We have to find a way to be fast. Speed is the name of the game.”

Ever the optimist, Chang said the “unprecedented growth” in demand is creating an opportunity for the industry.

“It’s not an option to serve or not to serve this customer, whether it’s AI or manufacturing. We built a sector to serve customers,” she said.

Chang said she looks at the situation through “the lens of opportunities” around how the entire supply chain of the power industry — from generation to distribution — can serve these customers.

“From a regulator’s perspective, we have to make sure … we have secure energy and reliable energy and efficient use of energy. We want to make sure there’s equity and fairness in the way the cost of the network, the cost of the resources, are being paid for,” she said.

Christie: CC Gas Units the Key

Stressing the need for dispatchable resources to maintain grid reliability, FERC Chair Mark Christie relied on a statement that he’s made before: “We have a rendezvous with reality.”

“We’re simply not ready to run a grid where we don’t have dispatchable resources,” Christie said. “That’s just the reality. We need to deal with it. We need to act accordingly.”

“I would say that’s not just a rendezvous with reality; it’s a rendezvous with a stark reality,” CERAWeek Chair Daniel Yergin said.

Christie bolstered his case by referring to PJM’s performance during the week of Jan. 20, when the RTO set a new winter peak at just over 145 GW. He ticked off the resources that made up the fuel mix at the pre-dawn peak: natural gas at 44%, and nuclear and coal at 22% each. (See PJM Sets Record Winter Peak Load.)

“What those numbers tell us is not that wind and solar don’t ever have an important role to play at different times, but when PJM, the largest grid operator in America, hit their winter peak, the resources that were keeping the lights on and the heat pumps running so people didn’t freeze were 88% dispatchable,” he said.

Christie acknowledged the lengthy time it can take to build combined cycle gas units but said they are vital sources of baseload power.

“The [PJM] combined cycle gas units were running like a top,” he said. “It doesn’t take long to get the combined cycle gas as your baseload generating resource of choice. It’s going to have to be, and if it takes seven years [to build], it takes seven years. It’s not an argument not to proceed with building combined cycle gas.”

After all, “I think it was Churchill who said, nothing concentrates the mind like being told you’re going to be shot at dawn,” Christie said. (He was actually paraphrasing Samuel Johnson: “When a man knows he is to be hanged in a fortnight, it concentrates his mind wonderfully.”)

Nuclear Hub in Texas?

Texas is taking quick action on its drive to become a “global nuclear energy hub,” as posited by a 2024 report.

Bills have been filed in the Texas Legislature that would set up a Texas Advanced Nuclear Energy Authority and create a $2 billion fund to offset construction costs, provide grants for reactors and fund research into nuclear power development. (See Texas Now Wants to be No. 1 in Nuclear Power.)

But even that may not be quick enough.

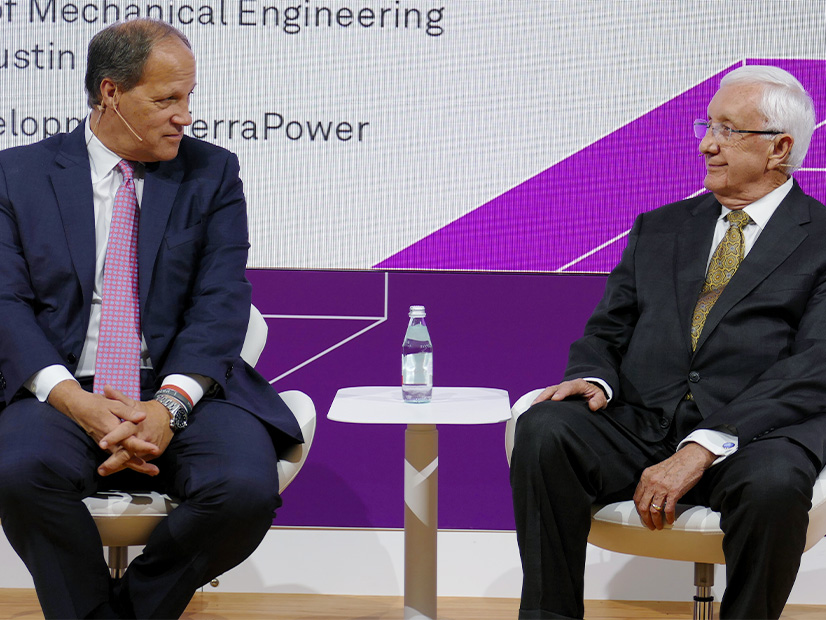

During a panel on the state’s Texas-sized ambitions, Dale Klein, former Nuclear Regulatory Commission chair and now a mechanical engineering professor at the University of Texas at Austin, said Gov. Greg Abbott has been proactive and recently hosted a reception for an industry group.

“When he heard it might be 2030 before new nuclear [could] be in Texas, he said, ‘That’s too late,’” Klein said. “He wants it earlier, but the federal government licenses reactors.”

In the meantime, Texas A&M University has asked the NRC for an early site permit that would allow up to five 10- to 200-MW reactors to be built on its campus. The commission approved Abilene Christian University’s request in 2024 to build and test a 1-MW advanced nuclear reactor (ANR) that will be cooled by molten salt. Along the Gulf Coast, Dow Chemical and X-energy plan to develop four gas-cooled ANRs at a large chemical plant.

“We do everything big in Texas,” said former Texas Public Utility Commissioner Jimmy Glotfelty, who oversaw the report. “We don’t believe that the report is success. Success is steel in the ground, concrete in the ground, people working and building a plant. That is the end goal.”

Texas has two nuclear sites, Comanche Peak and the South Texas Project. Each generates about 2,500 MW of power and has room for two additional reactors.

“We want enough new nuclear megawatts in the state to help the economy continue to hum as it has been for a long time, but we also want to have a role in the production of all of the nuclear plants around the United States and around the world,” Glotfelty said.

“The momentum in the legislature is tremendous,” said Jeff Miller, vice president of business development at Bill Gates’ nuclear energy startup TerraPower. The company has partnered with the U.S. Department of Energy to build a reactor in Wyoming, using its sodium-cooled fast-reactor technology. “We are very bullish on Texas.”

Think Local Supply Chains

The U.S. Economic Policy Uncertainty Index may be one of the best measures of uncertainty for investors. With the Trump administration’s use of tariffs potentially starting a global trade war, the index has reached levels not seen since the COVID-19 pandemic and the global financial crisis in 2008.

Not to worry, said NextEra Energy CEO John Ketchum.

“We’ve been dealing with tariffs in our industry for a number of years. Tariffs are not a new thing for our industry,” Ketchum said, noting that the Biden administration kept some of the first Trump administration’s tariffs on solar panels. “Our supply chains have all adjusted to respond accordingly. But one thing that has changed is that our supply chains are largely American today.”

Ketchum said 90% of wind turbines being installed in the U.S. are made domestically, and the industry has been able to pivot to a nearly 100% domestic supply chain for batteries.

“When you turn this to solar, we’re buying more and more here in the U.S.,” he said. “We have been able to really diversify the supply chain. This is an industry that is an American industry. It’s a trillion-dollar American industry.”

“One thing which is important for us as big investors, since we build generation capacity on this side and the other side of the Atlantic, is the current geopolitically more tense environment,” said Markus Krebber, CEO of global renewables provider RWE. “It is very important to keep an eye on your supply chain, not only where the capacity is available, but also where it comes from, with risk around tariffs, trade wars and so on. Building a local supply chain is much easier and safer to build local than to rely on imports.”

“Anything that you import increases the amount of uncertainty that you have,” said GAF Energy President Martin DeBono, whose solar firm sells solar shingles.

Stacy Ettinger, a senior vice president with the Solar Energy Industries Association, said her organization has been working with its members to help them understand “what actually is happening.”

When it comes to tariffs, members are asking about the content of the measures, when they apply and what they apply to, so they can use the information when considering their own supply chain and procurement needs, Ettinger said.