MISO’s proposal to use a temporary “fast lane” in its interconnection queue to speed up necessary resource additions would give utility-owned generation preferential treatment, according to protesters’ comments filed with FERC on April 7, with a group of former commissioners saying it should be a nonstarter.

The RTO on March 17 filed its proposal to install the fast lane by the beginning of summer with FERC. (See MISO Says Queue Fast Track Design Settled, Ready for FERC.) The plan would have projects designated as essential by regulators traversing a separate queue equipped with dedicated, individual studies instead of the cluster-style studies MISO uses in its ordinary queue (ER25-1674).

MISO staff have said its current interconnection procedures are not up to the task of processing new projects expeditiously because of a buildup of projects with study delays. The grid operator has proposed using the special process for the next four years to overcome capacity deficits.

The plan drew a letter from eight former FERC commissioners — Democrats and Republicans alike — to express “deep concern.” The group, which includes past Chairs Richard Glick, Neil Chatterjee, Joseph T. Kelliher and Pat Wood III, said creating a special, expedited interconnection study treatment in the queue “presents the opportunity for self-dealing by utilities to advance their affiliated generation.”

The former commissioners said the fast lane’s process, in which a proposed generating facility must either be owned by a load-serving entity or have a power purchase or similar agreement with proof of load, appears unworkable. The group pointed out that independent competitive generation projects historically have been unable to finalize offtake terms and arrangements in contracts until they are assigned network upgrade costs in the queue. They called the plan a threat to FERC’s policy of open-access transmission.

They also questioned whether regulators would use an independent process or seek to avoid undue discrimination when selecting projects for special study treatment. They said PJM and CAISO’s recent adoption of queue expressways differ from MISO’s, which is “not narrowly tailored and allows affiliated generation to receive preferential treatment.”

“It has been nearly 30 years since FERC first planted the flag of open access when the commission issued Order No. 888. We have come too far to reverse course now, especially when, as other regions have demonstrated, more narrowly tailored options to expedite the generator interconnection process for resource adequacy purposes are available,” warned the former commissioners, which also include James Hoecker, Donald Santa, Nora Mead Brownell and John Norris.

States Divided

Support for the proposal among MISO’s states fell along retail choice lines.

The Illinois Commerce Commission said it believed the fast lane would discriminate against retail choice jurisdictions and give preferential treatment to vertically integrated states. While state identification of need would work for those that use integrated resource plans, it wouldn’t work for Illinois, which relies on competitive markets to ensure resource adequacy, the ICC said.

Illinois is MISO’s only true retail choice state; Michigan allows up to 10% of a utility’s retail electric sales to be purchased from alternative suppliers.

“Unless the proposal is amended, the projects in Illinois will be at a disadvantage,” the ICC argued. MISO’s proposal as is does not contain “workable language” to include Illinois or Michigan in short-term reliability considerations, it said.

Rolling out the special queue lane in a staggered manner wouldn’t be a solution, either, the ICC said, because by the time MISO established specialized rules for Illinois, the state would have suffered “irreparable economic harm” from the delay.

Vistra, which operates resources in downstate Illinois’ Zone 4, agreed. The company said the fast lane would bestow undue preference for generation in vertically integrated states, violating the Federal Power Act, and give LSEs a leg up over independent power producers.

Vistra said MISO is failing to ensure the fast lane would be limited to interconnection requests needed to meet resource adequacy or reliability requirements. The company argued that a request from a regulatory authority to study a resource does not mean it will meaningfully contribute to resource sufficiency.

“If MISO is going to take the exceptional step of allowing select resources to bypass the queue in the name of meeting near-term reliability needs, then there must be a reasonable basis for concluding that these resources can meet the specific reliability needs identified by MISO,” Vistra said.

The Michigan Public Service Commission expressed concern the plan could worsen “inherent inequities” unless applicants for expedited treatment show they have analyzed whether existing projects in the queue could solve the resource adequacy problem they seek to address. Absent that step, MISO could facilitate discriminatory practices and “do grave harm to fundamental principles of open-access transmission that have been core tenants of FERC’s regulatory framework since the issuance of Order 888 in 1996,” the PSC said.

It also said it doubted MISO’s commitment to bringing projects online as soon as possible because its plan includes a three-year grace period beyond its proposed three-year-out commercial operation date for expedited projects.

Earthrise Energy, which also owns generation in southern Illinois, said FERC should direct MISO to amend its filing so it includes a separate plan for Illinois and Michigan.

But the proposal drew plenty of support from vertically integrated states, including two governors.

Missouri Gov. Mike Kehoe, whose state turned up a capacity deficit in MISO’s 2023/24 Planning Resource Auction, said it is “committed to swift action to meet the needs of this moment.” He said the express lane can help the industry meet unprecedented load growth reliably.

Indiana Gov. Mike Braun also supported the fast lane, saying it’s “essential for energy development” in his state.

“We are committed to providing reliable, affordable energy to all Hoosiers, but we cannot move as swiftly as necessary without MISO being equally as swift,” Braun wrote. MISO is right to recognize it needs urgency and a unique means to manage a confluence of accelerated load growth, a rash of resource retirements and lagging resource additions, he said.

The Organization of MISO States framed the plan as a “necessary but limited mechanism” to maintain reliability across the footprint. OMS said most of its members support “enabling an alternative pathway other than the standard queue to meet immediate resource adequacy needs.”

The Arkansas, Louisiana, Mississippi and Texas commissions supported the proposal. Entergy operating companies, which make up the lion’s share of MISO South, were similarly on board.

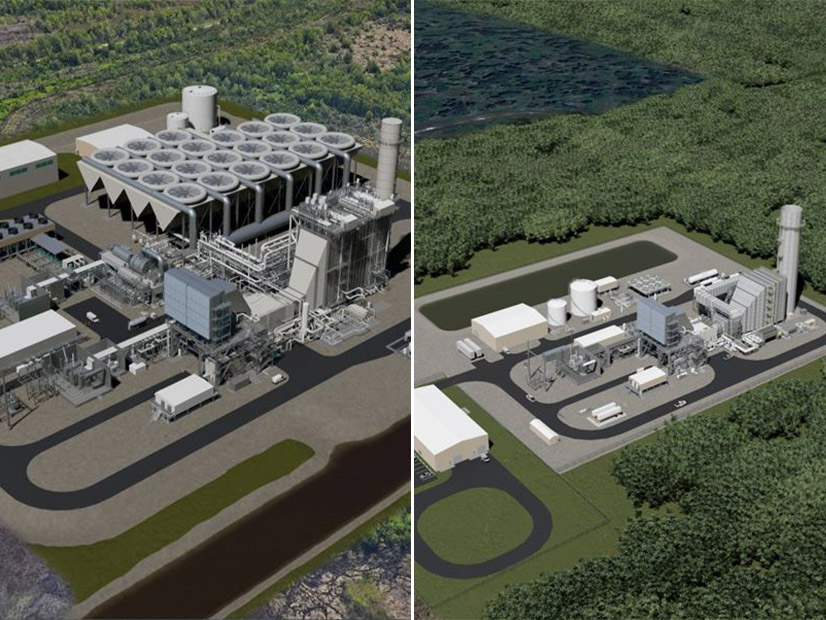

Entergy Texas noted that it needs to bring its Legend and Lone Star gas plants — worth 1.2 GW collectively — online by 2028 to serve growing demand. Entergy Louisiana said it needs three new gas plants of its own at 2.26 GW to serve a new Meta data center. Entergy Arkansas said MISO’s queue backlogs “unreasonably impede” new generation coming online.

Questions over Fairness for IPPs

IPPs predicted that the fast lane, which wouldn’t use a megawatt cap to limit entries, soon would form a “second, unmanageable queue that would paralyze the MISO interconnection process.”

They also echoed Vistra’s concerns that regulators could make errors deciding which projects are essential and questioned “MISO’s decision to delegate many of the key terms and conditions of interconnection service to state and local regulatory authorities outside of FERC’s jurisdiction and leave those processes ripe for arbitrary and unduly discriminatory outcomes in violation of the FPA.”

They echoed the former FERC commissioners’ discrimination arguments and said the plan would put those developing competitive generation at a disadvantage while creating opportunities for LSEs to engage in self-dealing.

Public interest organizations, including the Sierra Club, Natural Resources Defense Council and Union of Concerned Scientists, called the proposal a “queue-jumping mechanism for preferred projects.”

“In MISO’s own telling, such a proposal is necessitated by MISO’s failure to maintain a process that timely processes interconnection requests from new generation. And as a result of this failure, MISO now claims that it needs to create a separate interconnection process to ensure that these preferred projects are able to come online by the time they are needed for grid reliability,” the groups said. They added that MISO was missing a “technical quantification” of its RA need in its proposal.

NextEra Energy said the “gravity of harm that will be caused … cannot be overstated” and predicted the proposal would give vertically integrated utilities free rein to “self-build their own generation solutions, bypassing gigawatts of independent generation stranded in MISO’s legacy interconnection queue.”

The Coalition of Midwest Power Producers (COMPP) lambasted the filing as well. It said MISO didn’t quantify its resource inadequacy and wrongly omitted Michigan’s Zone 7 and Illinois’ Zone 4 from the plan. COMPP said together, those two zones contain about 31 GW of load, just 3 GW less than the whole of MISO South. It asked FERC to reject the filing.

The Clean Grid Alliance (CGA) said the expedited proposal is redundant because MISO already has efforts underway to speed up its queue, including study automation help from tech startup Pearl Street, higher fees and the capping of annual entrants at 50% peak load.

CGA said expedited generation would be allowed to claim transmission capacity that otherwise could be available for projects in the traditional queue, causing harm to developers. It also said MISO didn’t seem to be considering that some of its 56 GW with signed generator interconnection agreements would overcome delays to come online and handily manage a projected shortfall of a few gigawatts. (See MISO Members Grapple with 54 GW in Incomplete Gen, Predict Storage Expansion.)

“Rather than meaningfully parsing out data from its queue and even attempting to match queued generation to sub-region resource adequacy shortfalls, MISO merely makes conclusory statements and cites to its reports that claim there is a resource adequacy shortfall,” CGA argued.

LSEs: RA Needs Above All

Michigan-based Consumers Energy said that even though the 1,603-project, 296-GW interconnection queue appears to be able to deliver on resource adequacy, more than 70% of projects drop out of the queue.

Consumers said the high withdrawal rate, coupled with supply chain, permitting and study delays, translates into waiting times for projects that regularly exceed three years. On the other hand, a fast lane is a “tool that can help identify necessary projects and provide a path for a limited number of these resource adequacy projects to get connected in time to meet customer needs.”

Duke Indiana said the fast track would be a solid plan, pointing out that NERC’s 2024 Long-Term Reliability Assessment indicated that MISO may experience a 4.7-GW shortfall in 2028 “if the current expected generator retirements occur without the addition of significantly more generation.”

DTE Energy, Alliant Energy, Ameren and WEC Energy Group likewise filed in support, all stressing MISO’s resource adequacy needs.

Transmission owners said the proposal is “tailored” to avert conflicts between expedited projects and those in the queue’s usual definitive planning phase by allowing both to be processed in tandem. TOs also said the plan is “intentionally targeted and time-bound with a built-in sunset date, at the latest, by the end of 2028.”

MISO has acknowledged its stakeholders are concerned over the potential for discrimination between generation projects and whether a need really exists to create a dedicated fast track in the queue. But staff maintain the proposal is necessary and won’t be unduly preferential.

“We have a significant resource adequacy need we’ve been projecting for a few years,” MISO’s Andy Witmeier said at a Dec. 6, 2024, workshop. He pointed to the warnings MISO delivers on a quarterly basis in front of its Board of Directors.

Witmeier said MISO is confident that it has enough “inherent barriers” in place to the fast lane that there won’t be a “mad rush” where developers enter projects “willy nilly.” He said projects must be recognized and accepted by a state to meet a known need before they are able to gain entry.

“MISO has always been open to queue reform and trying to make the process better … and more efficient for all users,” Witmeier said, noting that in the five years he has worked on the queue, the RTO has continually made improvements.

He said it is prepared to hire additional consultants, contractors or temporary personnel to take on the additional work of the fast lane, resulting in higher processing fees for interconnection customers, though it should be straightforward. MISO won’t create special studies; it will just conduct its usual interconnection studies on a condensed timeline by focusing on a single generating unit, he said. “We know how to study interconnection requests.”