The NEPOOL Markets Committee held a two-day meeting focused on ISO-NE’s capacity auction reform (CAR) project. (See related story, ISO-NE Outlines Market Power Mitigation Measures for CAR Project.)

Ambient Temperature Derates

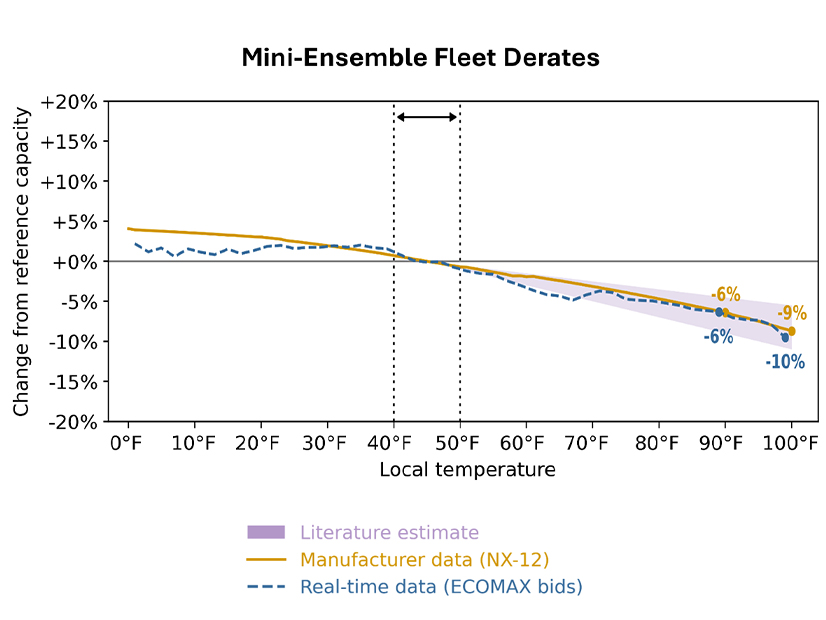

In other business, Hannah Johlas of ISO-NE presented an analysis of how ambient temperatures affect the performance of non-nuclear thermal resources, which the RTO developed in response to stakeholder requests. The analysis included an evaluation of third-party studies, capacity audit data and historical operational data.

All three components of the study showed a significant decline in the capacity of thermal resources as temperatures increased, equal to about a 3-4% decline in performance between 90 and 100 degrees Fahrenheit. The analysis did not evaluate the effects of ambient temperatures on fuel availability or resource outages.

While ISO-NE plans to calculate resource capacity accreditation at 90 F in the summer and 20 F in the winter, some stakeholders express concern that temperatures beyond this range could affect reliability.

ISO-NE does not plan to include modeling of ambient temperature effects in the CAR project because of the limited impacts and challenges of incorporating the additional modeling into the project. Johlas said it’s uncommon for the entire resource fleet to face temperatures above 90 F, even as climate change increases temperatures.

Some stakeholders pushed back on this conclusion, making the case that extreme heat often coincides with stress on the grid, and that a 3-4% reduction in the capacity of a 22,000-MW thermal fleet could cause a capacity reduction of up to 880 MW.

Demand Response Distributed Energy Resource Aggregations

Also at the MC, Dennis Cakert of ISO-NE presented conforming changes for FERC Order 2222, focused on demand response distributed energy resource aggregations (DRDERAs), which are aggregations of DERs that can reduce demand and inject energy into the grid.

Order 2222 requires transmission operators to eliminate barriers for distributed energy resource aggregations to participate in wholesale markets.

ISO-NE proposes to make DRDERAs eligible to participate in the day-ahead ancillary services market and to receive net commitment period compensation (NCPC). Including DRDERAs in NCPC would prevent “economic incentives to not offer true costs or follow dispatch instructions” in the energy market, Cakert said.

ISO-NE also proposes to reduce the minimum size requirement for resources participating in the regulation market from 5 MW to 100 kW “to align with the approved Order No. 2222 design.”

The changes would take effect in November 2026. ISO-NE will continue discussions on the conforming changes at the MC in May, targeting a vote on the proposal in June.

Tie Benefits

Matthew Ide, representing the Interconnection Rights Holders Management Committee, presented on the value of tie benefits and pushed back on the New England Power Generators Association’s arguments in March that including tie benefits in the installed capacity requirement (ICR) creates reliability risks. (See ISO-NE Gives Updates on Prompt, Seasonal Capacity Market Changes.)

The ICR determines the amount of capacity ISO-NE must procure in the capacity market, while tie benefits refer to the emergency support New England can expect to receive from neighboring regions during a capacity shortage.

At the MC in March, Bruce Anderson of NEPGA said the “current market design ‘assumes away’ approximately 2,000 MW of capacity demand based on the belief that system energy from neighboring control areas is equivalent to ‘firm capacity,’” creating risks of under-procurement and price suppression.

At the April MC meeting, Ide emphasized that tie benefits are not a market product, and instead are “the reasonably assumed reliability benefits that come from transmission infrastructure that enables emergency assistance between regions.”

Tie benefits “are a reasonable and appropriate input into the ICR calculation,” he added.

Ide said tie benefits are supported by contracts ensuring ISO-NE will receive tie benefits from neighboring regions if this support does not jeopardize reliability in the neighboring region. Even if weather conditions are similar across regions, it’s highly unlikely for regions to experience resource outages threatening reliability at the same time, he said.

“Network load customers pay for all the tie benefits that come from the [pool transmission facility] ties through regional transmission rates. In return, load receives the benefit of a lower ICR and less need to procure capacity to meet the ICR,” he added.

He noted that FERC has found including tie benefits in the ICR to be just and reasonable, and that a recent ISO-NE analysis found the “underlying methodology is robust and thorough in the capacity quantification of tie benefits.”

ICR in a Prompt Auction

Manasa Kotha of ISO-NE discussed how the transition to a prompt market will affect the RTO’s methodology for establishing the ICR. He said ISO-NE will begin the ICR process about a year prior to each capacity commitment period.

“The primary conforming change for the ICR setting process is mainly the time frame,” Kotha said, adding that reducing this timing from four years to one year will allow ISO-NE top use more up-to-date data, load assumptions and interface limits.

“Under CAR-Prompt, the data will all be provided closer in time to the commitment period, which is expected to enhance the accuracy of the ICR-related values,” Kotha said.