The Maryland Office of People’s Counsel has filed a complaint against PJM alleging the rules used in the 2025/26 Base Residual Auction would require consumers to pay twice for capacity provided by generators operating on reliability-must-run agreements.

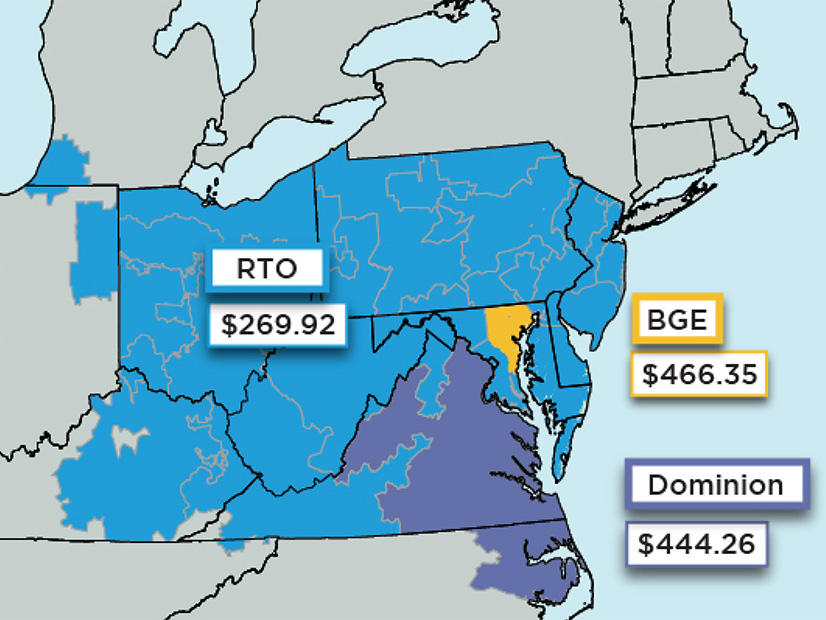

The auction conducted in July 2024 resulted in a nearly 10-fold increase in capacity prices. (See PJM Capacity Prices Spike 10-fold in 2025/26 Auction.)

“PJM ran a flawed auction resulting in prices that — unless corrected — will cost Maryland residential electric customers hundreds of dollars per year in unreasonable and unnecessary capacity costs,” People’s Counsel David Lapp said in an announcement of the complaint April 14. “We are asking FERC to undo those unjust results and direct PJM to reset the prices for the 2024 auction by correcting the same flawed rules that FERC has already accepted the need to fix for future auctions.”

Pointing to a Synapse Energy Economics report commissioned by the OPC, the complaint said excluding RMR units from the supply stack would inflate costs by more than $5 billion. That report found that the 2025/26 BRA design would increase monthly costs by as much as 24% for some Maryland ratepayers. (See Maryland Report Details PJM Cost Increases for Ratepayers.)

OPC also contends the auction allowed market manipulation, improperly exempted 1,600 MW of generation from being required to submit offers and produced prices incapable of incentivizing new entry because of the confluence of long development timelines and a compressed auction schedule. It notes the auction was conducted within a year of the start of the corresponding delivery year on June 1.

“The [FERC] and the courts have made clear that high prices are unjust and unreasonable if they do not reflect market fundamentals or cannot induce a market response. The 2025/2026 BRA results fall short on both grounds,” the complaint says.

The complaint argues that revising the auction results would not violate the filed rate doctrine as they are “intended to govern future performance” that has yet to begin. It pointed to a 2021 remand from the D.C. Circuit Court of Appeals directing FERC to reopen an investigation into MISO’s 2015/16 capacity auction, which set a $150/MW-day clearing price in its Zone 4. (See FERC to Take 2nd Look at 2015 MISO Capacity Auction.)

The complaint effectively would expedite implementation of a change the commission approved in February, granting a PJM request to model the output of RMR units as capacity as long as the resources could meet certain criteria, including being available to RTO dispatchers when called upon.

The proposal is set to go into effect for the 2026/27 and 2027/28 delivery years, with PJM intending to develop a long-term solution with stakeholders. Comments on the docket centered around two Talen Energy resources: the 1,289-MW Brandon Shores coal-fired generator and 843-MW H.A. Wagner oil-fired plant. Both facilities are located near Baltimore and are slated to deactivate after operating on RMR agreements through Dec. 31, 2028 (ER25-682, ER24-1787, ER24-1790). (See FERC OKs Changes to PJM Capacity Market to Cushion Consumer Impacts.)

“The 2024 auction results ignore the significant ratepayer-funded reliability contributions of the Brandon Shores and Wagner plants — with devastating consequences to customers from the resulting extraordinarily higher capacity market costs,” Lapp said. “The Federal Power Act prohibits requiring captive utility customers to pay twice for the same service.”